Benzinga's options scanner just detected over 9 options trades for CVS Health (NYSE:CVS) summing a total amount of $615,632.

At the same time, our algo caught 2 for a total amount of 550,000.

Predicted Price Range

Analyzing the Volume and Open Interest in these contracts, it seems that the big players have been eyeing a price window from $55.0 to $65.0 for CVS Health during the past quarter.

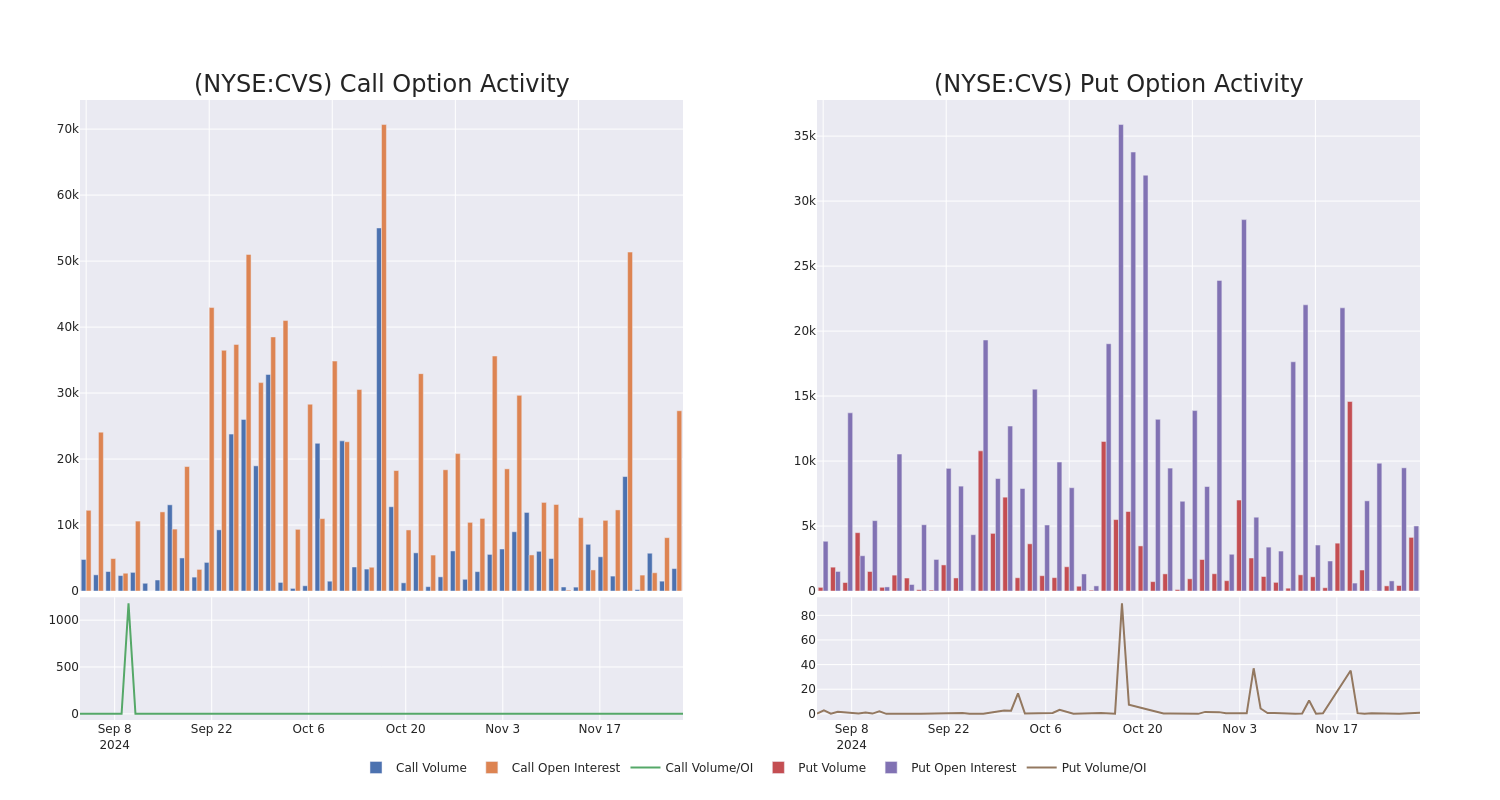

Volume & Open Interest Development

Looking at the volume and open interest is an insightful way to conduct due diligence on a stock.

This data can help you track the liquidity and interest for CVS Health's options for a given strike price.

Below, we can observe the evolution of the volume and open interest of calls and puts, respectively, for all of CVS Health's whale activity within a strike price range from $55.0 to $65.0 in the last 30 days.

CVS Health Call and Put Volume: 30-Day Overview

Largest Options Trades Observed:

| Symbol | PUT/CALL | Trade Type | Sentiment | Exp. Date | Ask | Bid | Price | Strike Price | Total Trade Price | Open Interest | Volume |

|---|---|---|---|---|---|---|---|---|---|---|---|

| CVS | PUT | TRADE | BULLISH | 01/16/26 | $5.5 | $4.85 | $5.0 | $55.00 | $300.0K | 5.0K | 2.9K |

| CVS | PUT | TRADE | BEARISH | 01/16/26 | $5.0 | $4.8 | $5.0 | $55.00 | $250.0K | 5.0K | 1.1K |

| CVS | CALL | SWEEP | BULLISH | 02/21/25 | $1.62 | $1.6 | $1.62 | $65.00 | $114.6K | 23.8K | 734 |

| CVS | CALL | SWEEP | BULLISH | 02/21/25 | $3.6 | $3.5 | $3.56 | $60.00 | $35.7K | 2.0K | 351 |

| CVS | CALL | SWEEP | BULLISH | 02/21/25 | $3.6 | $3.5 | $3.56 | $60.00 | $35.7K | 2.0K | 451 |

About CVS Health

CVS Health offers a diverse set of healthcare services. Its roots are in its retail pharmacy operations, where it operates over 9,000 stores primarily in the us. CVS is also a large pharmacy benefit manager (acquired through Caremark), processing about 2 billion adjusted claims annually. It also operates a top-tier health insurer (acquired through Aetna) where it serves about 26 million medical members. The company's recent acquisition of Oak Street adds primary care services to the mix, which could have significant synergies with all its existing business lines.

CVS Health's Current Market Status

- Trading volume stands at 2,253,456, with CVS's price down by -0.01%, positioned at $59.95.

- RSI indicators show the stock to be may be approaching overbought.

- Earnings announcement expected in 68 days.

What The Experts Say On CVS Health

In the last month, 5 experts released ratings on this stock with an average target price of $64.8.

Turn $1000 into $1270 in just 20 days?

20-year pro options trader reveals his one-line chart technique that shows when to buy and sell. Copy his trades, which have had averaged a 27% profit every 20 days. Click here for access. * An analyst from Truist Securities downgraded its action to Buy with a price target of $67. * Consistent in their evaluation, an analyst from Piper Sandler keeps a Overweight rating on CVS Health with a target price of $64. * An analyst from Barclays has decided to maintain their Overweight rating on CVS Health, which currently sits at a price target of $71. * An analyst from UBS has decided to maintain their Neutral rating on CVS Health, which currently sits at a price target of $62. * Consistent in their evaluation, an analyst from Wells Fargo keeps a Equal-Weight rating on CVS Health with a target price of $60.

Options are a riskier asset compared to just trading the stock, but they have higher profit potential. Serious options traders manage this risk by educating themselves daily, scaling in and out of trades, following more than one indicator, and following the markets closely.

If you want to stay updated on the latest options trades for CVS Health, Benzinga Pro gives you real-time options trades alerts.