Two-income couples could see their Social Security benefits slashed by up to $16,500 annually starting in 2033; for high-income couples, that number could top $21,000. A recent report from the non-partisan Committee for a Responsible Federal Budget (CRFB) calculates that if Congress doesn't act soon to reform the system, retirees will only receive 79% of their benefits. By the first year of underfunding in 2033, today’s 58-year-olds will reach their full retirement age of 67.

America's aging population is stressing the system. About 10,000 retirees enter the Social Security program each day. With this in mind, it's important to determine if your benefits will be cut and, if so, how you can prepare for the inevitable.

Will my benefits be cut?

Let's be clear: your benefits won't go away or zero out in 2033; they will simply be lower. Without legislative action, the trust fund is expected to become insolvent by 2033, resulting in a 21% cut to beneficiaries' monthly Social Security checks, regardless of marital status or income, according to the CRFB analysis. That could wreak financial havoc for both current and future retirees.

This projection is especially worrisome for the four out of ten seniors who live solely on an average Social Security monthly benefit of $1,907. That amount will certainly increase over the next nine years to keep up with inflation, but Social Security cost of living increases (COLAs) tend to be conservative.

Living on a fixed income is challenging enough, but much more so if your benefits are cut.

"The result would likely lead to a spike in poverty rates for older Americans," Shannon Benton, executive director of the advocacy group Senior Citizens League, told CBS MoneyWatch. "Given that low-paid workers are less likely to save for retirement compared to higher-income Americans, they are often more reliant on Social Security in their later years."

The longer lawmakers postpone fixing the program, the worse the underfunding problem will become, according to Chris Towner, policy director at the CRFB. "There is a cost of waiting to fix the program," he said. "It could be fixed right now with a 27% tax increase or a 21% benefit cut to all beneficiaries, while waiting would make the tax increase grow to 32% and the cut to 25%," he told CBS MoneyWatch.

How much will my benefits be cut?

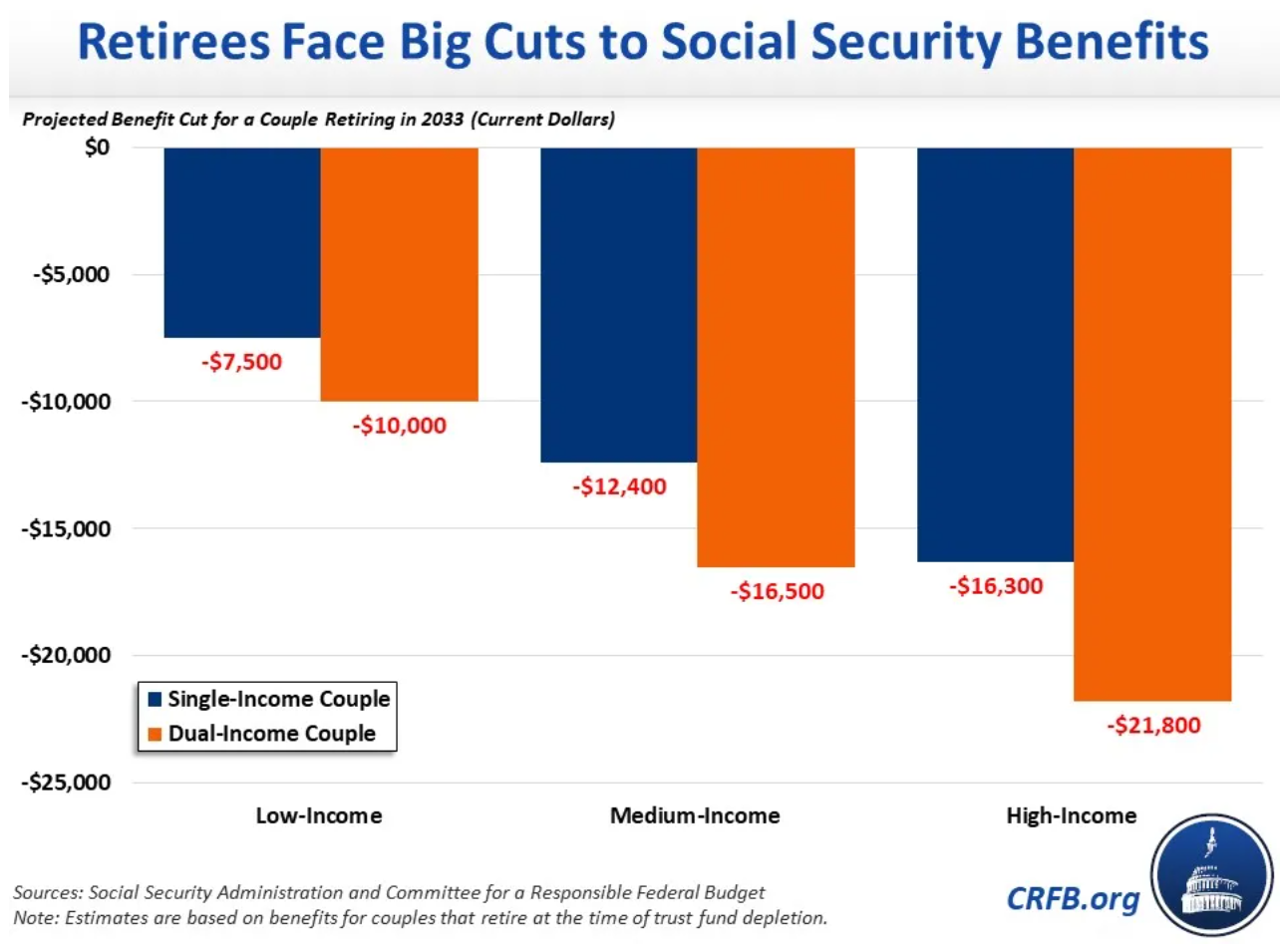

The actual size of the cut of retirees benefits would vary depending on age, work history, and lifetime income. The report offered this example: a low-income, dual-income couple retiring in 2033 — as defined by the Social Security Trustees — would see a $10,000 cut to their benefits. Whereas, high-income, dual-income couples would see a cut of $21,800, according to the CRFB, a nonpartisan advocacy organization focused on fiscal issues.

Although the cut for a low-income couple would be smaller and reflect a 21% reduction in their annual benefits, it would be a larger share of their income. And, while retirees will see a 21% across-the-board cut to their benefits in 2033, this automatic cut will grow over time, to 31% by 2098.

How likely is it that Social Security will not be fixed by 2033?

The Social Security program is currently paying out more in benefits than it collects in payroll tax and other forms of revenue, and it’s drawing down its reserves to cover the remaining cost of benefits. Once the reserves are depleted, the law limits benefits to incoming revenue, which mandates a 21% across-the-board benefit cut for Social Securities’ more than 72 million beneficiaries.

While both Vice President Harris and former President Trump have promised to protect Social Security, Harris has promised to “strengthen Social Security and Medicare for the long haul by making millionaires and billionaires pay their fair share in taxes.” Former President Trump has also pledged to “fight for and protect Social Security,” yet neither candidate has offered a comprehensive plan to address the impending solvency challenge. Moreover, Trump's proposal to stop taxing Social Security benefits may sound like a good deal for retirees, but it would further underfund the program.

When will Social Security run out of money?

The good news is that the Social Security benefits program will never completely run out of money and stop paying benefits, no matter when the trust fund runs dry. Rather, at least a portion of promised benefits will be paid by new tax levies. According to the Center on Budget and Policy Priorities, a 1983 bipartisan Social Security financing deal enabled Social Security to run a surplus each year until 2021. Then, in 2021, Social Security’s total cost exceeded its income and began to pull funds from reserves.

Benefits will not cease if Social Security’s trust funds run out of Treasury bonds to cash in. Money from income taxes would enable Social Security to continue paying about 79% of benefits.

How can I prepare for Social Security cuts?

In less than a decade, Social Security is expected to become insolvent if no legislative action is taken. Even if Social Security has only a small role in your overall retirement income plan, a payment reduction is an unappealing possibility. But if you rely heavily or entirely on your monthly Social Security benefits to make ends meet, a cut in benefits could be devastating.

If you’re concerned about having enough money when you retire, there may be positive changes you can make now to shore up your retirement income — no matter what happens down the road.

- Cut costs. Although inflation is driving up some costs, cutting both discretionary and non-discretionary spending on food, eating out, streaming services, vacations and more can be challenging, but worthwhile for your budget.

- Get a side hustle. Even if you’ve reached retirement age, getting a side hustle can supplement your income from Social Security, so a cut doesn't cause as much pain and hardship. But understand, if you haven’t yet reached your full retirement age, there are yearly limits on how much you can earn before the SSA will reduce your monthly Social Security benefit amount.

- Work with a retirement professional. If you haven’t already, now is a great time to contact a financial adviser who can help you focus on retirement planning and plan ahead to secure your financial future no matter what happens.