The stock market is a sea of red on Thursday, but investors can find some pockets of strength, particularly in tech.

Amazon (AMZN) stock is rallying after a 20-for-1 stock split and a $10 billion buyback (here’s the trade setup on that one).

And CrowdStrike (CRWD) is rallying 14% after the cybersecurity company reported better-than-expected results.

The company delivered a top- and bottom-line beat and, more important, management issued a full-year revenue and earnings outlook that came in above analysts’ expectations.

Even in a difficult trading environment, it’s hard to sell this one lower on a report like that. That’s particularly true as CrowdStrike stock came into the event down 43% from the highs.

But, ...

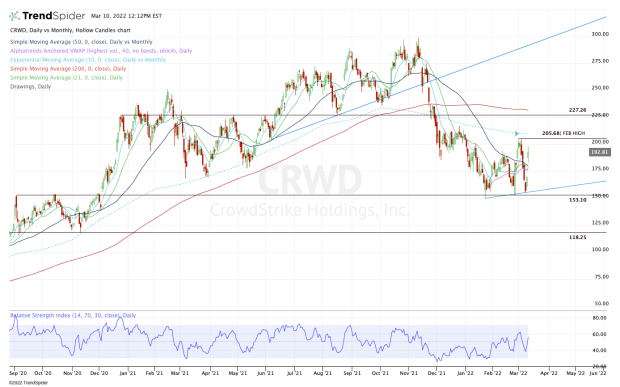

The chart shows a glaring level to which investors must pay attention.

Trading CrowdStrike Stock

Chart courtesy of TrendSpider.com

As CrowdStrike stock was trading around $197 in the after-hours session last night, I flagged this key level in the $200 to $204 range. With the stock climbing as high as $198.54 in today’s session, it's certainly a level worth knowing.

Last month, the stock tried to push through this level for three sessions before getting rejected and falling back into the $150s.

This area has been marked as resistance as a result, while it also comes into play near the declining 10-month moving average, as well as the February high near $205.50.

If CrowdStrike stock can reclaim this zone and clear these measures, then it could open up even more potential gains, possibly putting the $225 to $228 area in play, followed by the 200-day moving average.

At some point, one would expect tech stocks to rally, but that point has not yet come. When it does, those with strong businesses and favorable reactions to earnings can lead the market higher — like CrowdStrike.

On the downside, keep an eye on today’s low near $182.50.

A break of that level puts $180 in play. There, CrowdStrike stock finds its 10-day, 21-day, and 50-day moving averages, as well as the daily VWAP measure.

If those fail as support, the $150s could be back in play, along with uptrend support (blue line). Right now, the line in the sand is at $153.

If CrowdStrike breaks below that level and closes below $150, we could see significantly more downside in the weeks ahead.