Whales with a lot of money to spend have taken a noticeably bullish stance on Constellation Energy.

Looking at options history for Constellation Energy (NASDAQ:CEG) we detected 52 trades.

If we consider the specifics of each trade, it is accurate to state that 46% of the investors opened trades with bullish expectations and 30% with bearish.

From the overall spotted trades, 5 are puts, for a total amount of $281,144 and 47, calls, for a total amount of $2,195,419.

Predicted Price Range

After evaluating the trading volumes and Open Interest, it's evident that the major market movers are focusing on a price band between $180.0 and $360.0 for Constellation Energy, spanning the last three months.

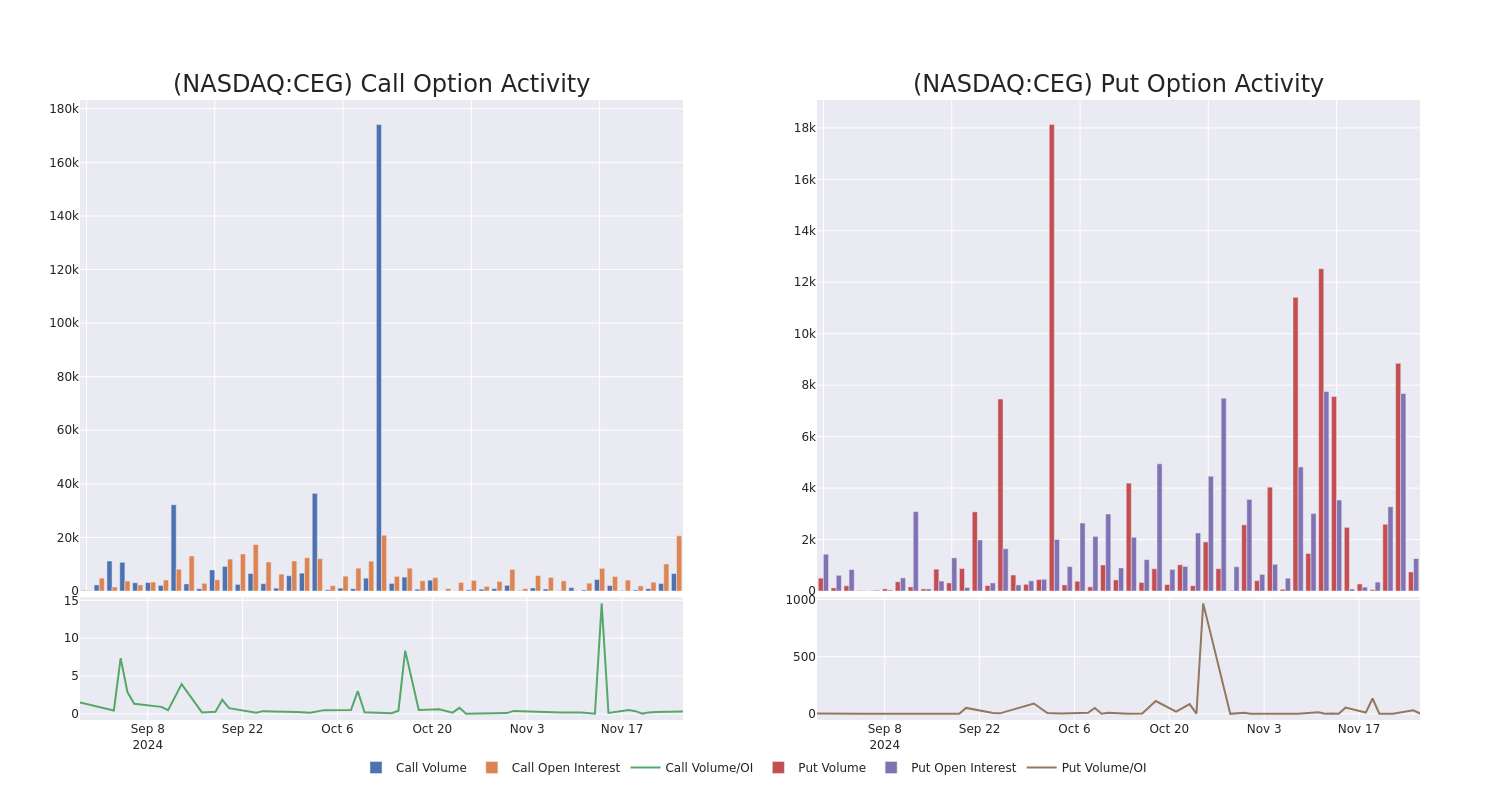

Volume & Open Interest Development

Looking at the volume and open interest is a powerful move while trading options. This data can help you track the liquidity and interest for Constellation Energy's options for a given strike price. Below, we can observe the evolution of the volume and open interest of calls and puts, respectively, for all of Constellation Energy's whale trades within a strike price range from $180.0 to $360.0 in the last 30 days.

Constellation Energy Call and Put Volume: 30-Day Overview

Largest Options Trades Observed:

| Symbol | PUT/CALL | Trade Type | Sentiment | Exp. Date | Ask | Bid | Price | Strike Price | Total Trade Price | Open Interest | Volume |

|---|---|---|---|---|---|---|---|---|---|---|---|

| CEG | CALL | TRADE | NEUTRAL | 01/17/25 | $6.5 | $6.3 | $6.4 | $300.00 | $128.0K | 4.1K | 440 |

| CEG | CALL | SWEEP | BEARISH | 12/20/24 | $6.0 | $5.8 | $5.8 | $280.00 | $115.4K | 782 | 342 |

| CEG | CALL | SWEEP | BULLISH | 12/20/24 | $18.5 | $17.2 | $17.85 | $250.00 | $107.6K | 859 | 447 |

| CEG | PUT | TRADE | BEARISH | 01/16/26 | $21.7 | $19.3 | $21.0 | $210.00 | $105.0K | 21 | 50 |

| CEG | CALL | TRADE | BEARISH | 02/21/25 | $24.3 | $22.5 | $22.5 | $260.00 | $101.2K | 271 | 45 |

About Constellation Energy

Constellation Energy Corp offers energy solutions. It provides clean energy and sustainable solutions to homes, businesses, the public sector, community aggregations, and a range of wholesale customers (such as municipalities, cooperatives, and other strategics). The company offers comprehensive energy solutions and a variety of pricing options for electric, natural gas, and renewable energy products for companies of any size.

Following our analysis of the options activities associated with Constellation Energy, we pivot to a closer look at the company's own performance.

Present Market Standing of Constellation Energy

- Currently trading with a volume of 2,588,934, the CEG's price is up by 5.87%, now at $263.55.

- RSI readings suggest the stock is currently may be approaching overbought.

- Anticipated earnings release is in 91 days.

Professional Analyst Ratings for Constellation Energy

In the last month, 5 experts released ratings on this stock with an average target price of $283.2.

Turn $1000 into $1270 in just 20 days?

20-year pro options trader reveals his one-line chart technique that shows when to buy and sell. Copy his trades, which have had averaged a 27% profit every 20 days. Click here for access. * Consistent in their evaluation, an analyst from Barclays keeps a Overweight rating on Constellation Energy with a target price of $270. * An analyst from BMO Capital persists with their Outperform rating on Constellation Energy, maintaining a target price of $291. * An analyst from Morgan Stanley persists with their Overweight rating on Constellation Energy, maintaining a target price of $322. * An analyst from Mizuho persists with their Neutral rating on Constellation Energy, maintaining a target price of $235. * An analyst from BMO Capital has decided to maintain their Outperform rating on Constellation Energy, which currently sits at a price target of $298.

Options are a riskier asset compared to just trading the stock, but they have higher profit potential. Serious options traders manage this risk by educating themselves daily, scaling in and out of trades, following more than one indicator, and following the markets closely.

If you want to stay updated on the latest options trades for Constellation Energy, Benzinga Pro gives you real-time options trades alerts.