Coinbase (COIN) stock exploded on Thursday as the crypto specialist reported it would partner with the gigantic asset manager BlackRock (BLK).

The shares leaped 44% in early trading and have since settled back, up about 10% and approaching $89.

That follows yesterday’s gain of 20% and Tuesday’s rally of 7.2%. With gains like that, it’s got to have Cathie Wood & Co. feeling a bit glum.

Wood’s Ark Invest dumped more than 1.4 million shares at around $53. That’s after sporting an average cost basis near $255 a share — so around an 80% loss at the time of selling. The sales also came after reports of an SEC investigation into the company.

At today's high of $116.30 this morning, the stock more than doubled from Ark’s sale price. While the rally is looking like it will struggle to maintain momentum, such a sharp, sudden rally still has to sting for those that just stopped out.

Now investors are wondering whether Coinbase can keep rallying or whether today’s move will mark a short-term top in the stock.

Trading Coinbase Stock

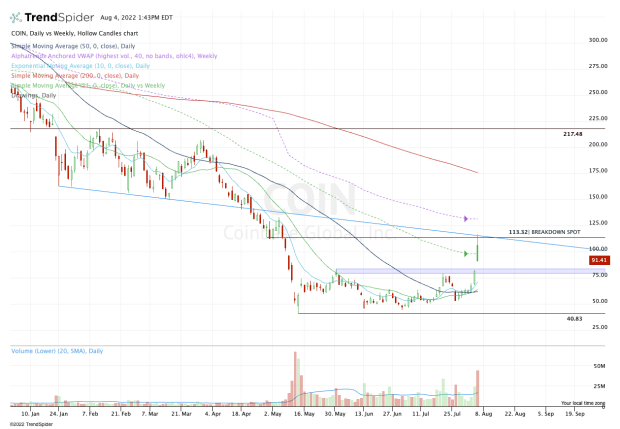

Chart courtesy of TrendSpider.com

I love when an old trendline or key level that I’ve drawn on a chart comes back in play months down the road.

In this case, I had the breakdown level of $113.32 drawn on the chart from late-April and early May.

I also had the downtrend mark noted on the chart (blue line), which followed the lower lows from the first quarter.

While that’s hardly prophetic, to see the stock gap up and rally to these levels and then fade precipitously does speak to the help that technical analysis can give to traders.

That’s not to say fundamentals don’t play a role — they do — but knowing how to blend both of them can pay big dividends.

With today’s action, Coinbase stock faded hard from a key level on the charts. That’s bearish.

If the price action was bullish, the stock would have reclaimed prior resistance and used it as support to push even higher. The stock in fact ramped considerably higher, so deflating it a bit only makes sense. But the bulls would have liked to see it hold above the psychologically relevant level of $100, as well as the 21-week moving average.

If it continues to fade, the bulls will want to see it hold the $79 to $82 area. This was prior resistance and marks the gap-fill level from today's session. If this area holds, the bulls could have a potential long setup to work with.

If the shares lose the 10-day moving average, the 21-day and 50-day could be in play in the low-$60s.

On the upside, a move back above $100 puts the $113 to $116 area in play, followed by the weekly VWAP measure near $130.