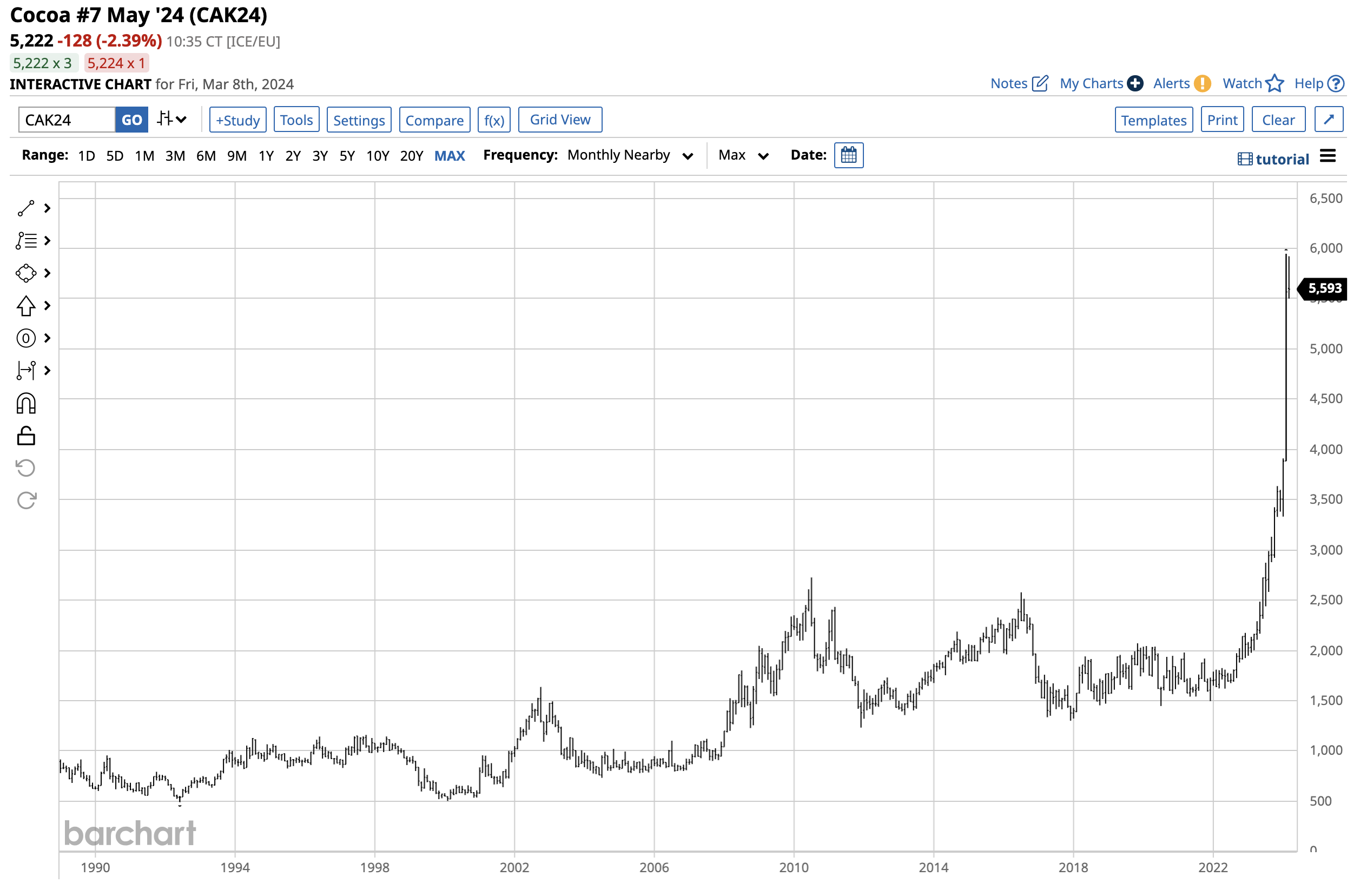

Cocoa moved from a bullish trend to a parabolic explosive rally in 2024. In a February 9, Barchart article, I asked How Far Can the Rally Go? In that piece, I wrote:

There is no limit on the upside potential in a bull market, but the results can be devastating when the trend bends in commodities and other asset classes. The higher cocoa prices rise, the greater the odds of an implosive correction.

Nearby March cocoa futures traded at $5,801 per ton on February 9 after reaching a $6,030 high. The bullish price action has continued as the price increased and now looks down at the $6,000 level.

Cocoa prices moved above $7,000 per ton

U.S. ICE cocoa futures traded over $7,000 per ton in March 2024.

As the chart highlights, the continuous cocoa futures contract reached a record high at $7,170 per ton in March. The previous all-time high was in 1977 at $5,379 per ton. Cocoa futures eclipsed that level in February as the parabolic rally took the price $1,791 per ton higher.

Cocoa #7 futures trade in Europe on the Intercontinental Exchange. The contract price is in GBP per ton.

The chart shows the February 2024 rally that took cocoa futures to GBP 5,946 per ton.

West African supplies cannot meet the demand

With three-quarters of the world’s cocoa production coming from West Africa, the weather in the region is a critical factor for worldwide supplies.

The El Nino weather pattern causing drier temperatures in the region is “permanently impairing” cocoa crop yields. The Ivory Coast and Ghana produce over 60% of the world’s cocoa beans.

The chart shows West African cocoa production’s dominant position. Cocoa crops thrive in West Africa’s equatorial climate. As crop yields decline, prices have skyrocketed as supplies have become scarce.

Chocolate manufacturers face rising costs

Making chocolate is a big business. The cocoa bean-to-chocolate bar processing that creates the epicurean treats that feed chocoholics worldwide is facing a severe issue as bean prices soar and supplies decline.

The ten leading chocolate manufacturers worldwide, in order of annual sales, are:

- Mars Wrigley Confectionery

- Ferrero Group

- Mondelez International

- Meiji Co Ltd

- The Hershey Company

- Nestle SA

- Lindt & Sprungli AG

- Pladis

- Glico Group

- Orion Confectionery

These companies, and others relying on cocoa products for food manufacturing, are scrambling to secure supplies as prices rise to record highs in early 2024.

Hershey stock suffers from rising cocoa prices

Hershey Foods Corporation (HSY) could be a case study for the impact of rising cocoa prices on the company’s cost of goods and revenues.

In May 2023, HSY shares reached a record $276.88 record high. Nearby U.S. ICE cocoa prices were on either side of $3,000 per ton in May 2023.

The chart shows a 29.9% decline to $194.19 per share on March 8 as cocoa prices more than doubled. The cost of producing those Hershey Kisses, Hershey bars, and other products has eaten away profit margins.

Demand elasticity has yet to kick into the cocoa market

HSY is just one of the many companies that will need to increase prices or cut portions to keep pace with the rise in cocoa prices and the scarce availability. “Sizeflation,” where companies cut back on portion sizes, could be the next move for many chocolate manufacturers who do not want to increase prices.

Meanwhile, in most commodities, demand elasticity causes consumers to seek alternatives or cut back on purchases when prices rise. However, chocoholics could be a special case as many consumers may be willing to pony up and pay double or even triple for their daily fixes of the tasty treats. A captive consumer audience could allow Hershey and other chocolatiers to boost prices to reflect the increased cost of cocoa beans over the coming months.

Hershey and the other manufacturers are likely playing a waiting game as they know commodity prices can be highly volatile, and the higher cocoa prices rise, the greater the odds of a significant correction. Cocoa prices are in the stratosphere, and the odds favor increasing production that will send prices back down to earth. Meanwhile, consumers are likely to come up with the short end of the chocolate bar as price increases are likely to stick when input prices eventually decline.

The bottom line is that chocolate prices will increase, and even if cocoa futures decline, we will be paying more for those epicurean delights. When it comes to the rally in the cocoa futures arena, fighting the bullish trend is dangerous as prices can continue to rise. Cocoa prices can continue to rise if the weather in West Africa does not improve, and sellers must limit supplies. Expect lots of volatility in the cocoa futures arena over the coming weeks and months.

On the date of publication, Andrew Hecht did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.