According to a Bloomberg report, the U.S. Department of Defense is set to issue a first-time gallium recovery contract to either American or Canadian firms by the end of the year after China put restrictions on gallium and germanium exports. While the Pentagon has reserves of germanium, it does not have reserves of gallium, which it now plans to recover from 'waste streams'. Gallium is used in a variety of Pentagon applications. These include radars, telecoms, and power chips. It is crucial for the DoD to have this metal.

The Pentagon intends to leverage the Defense Production Act (DPA) to prioritize contract awards by the end of the year, with a focus on reclaiming gallium from other product waste streams, according to spokesperson Jeff Jurgensen. The DPA facilitates the funding of crucial domestic industry sectors for national security reasons. The Pentagon has indicated that the fastest way to make such materials readily available in the U.S. is through recovery, rather than mining, a method not previously funded under the DPA.

Gallium can handle high voltages at high temperatures and plays a crucial role in the Navy's shipboard radar systems for air and missile defense, as well as in the Army and Marines' land-based radar systems for identifying rockets, artillery, mortars, cruise missiles, and both manned and unmanned aerial drones.

The Department of Defense refrained from disclosing how much money will be allocated to the contract, the number of companies that might be involved, or the amount of gallium it wants to recover.

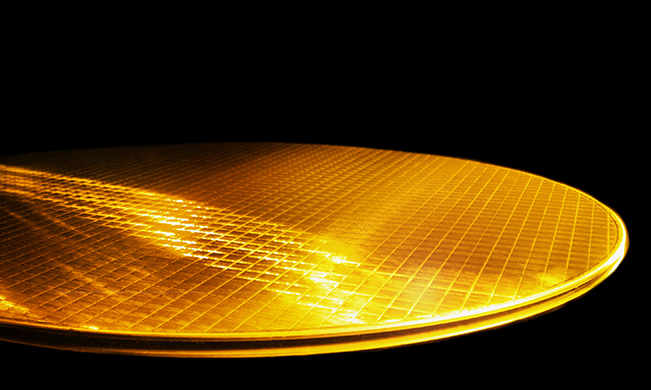

Gallium that is suitable for recycling can be sourced from the waste produced during semiconductor wafer manufacturing and from used or faulty devices. The recycling process refines mid-grade gallium to a higher-purity grade, which is then used to make various microelectronics, according to Alexander Holderness, an analyst with the Defense Initiatives Group of the Center for Strategic and International Studies, cited by Bloomberg.

"This is a perfectly reasonable strategy," said Holderness.

China recently imposed new export rules that require local companies to get an export license to sell gallium and germanium outside of the country. China is currently controls some 94% of the global gallium production as well as around 60% of the global germanium output.

Even though these metals are not exactly rare and in some cases gallium and germanium are obtained as byproducts of mining operations for other materials, their low cost has been maintained by China (which managed to make the process of their refinement cheaper), making extraction in other locations more expensive. While China's restrictions may initially raise prices and even disrupt production of certain components, it could encourage other countries to mine these metals, potentially disrupting China's market dominance over time.