The signature election housing policy of the federal government is worsening affordability for first time homebuyers, even as it gets more people into home ownership.

Prime Minister Anthony Albanese campaigned on widening eligibility to a five per cent deposit guarantee and implemented the policy in October 2025.

In the weeks before the expanded scheme took effect, ministers argued it would not fuel house price growth.

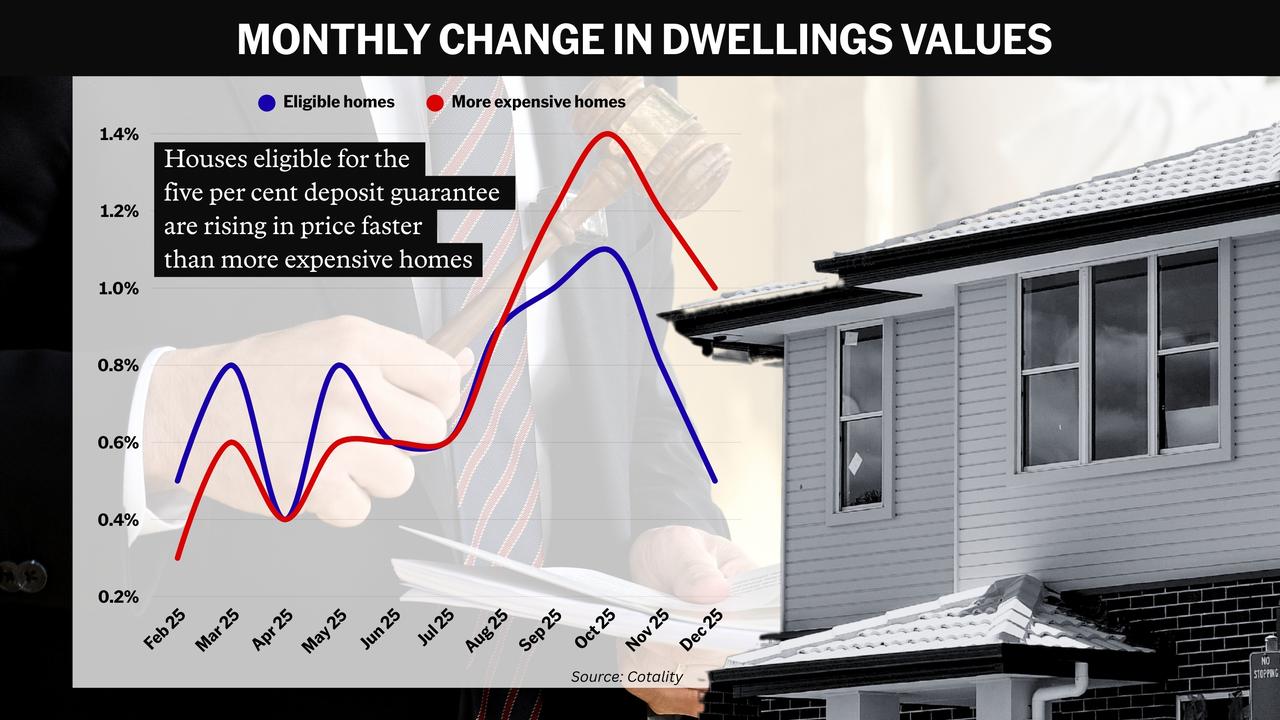

But that's exactly what has happened according to analysis from Cotality showing price growth in the lower-priced cohort of homes eligible to buy with smaller deposits outstripping more expensive properties.

Data for the December quarter showed 3.6 per cent growth in houses priced under the cap - which varies across cities and regions - compared with 2.4 per cent for homes priced above.

"The expanded five per cent deposit guarantee has sharpened demand at lower price points, with under‑cap markets outperforming across almost nine‑in‑ten regions," Cotality research director Tim Lawless said.

The analysis shows the divergence began in August, the same month Mr Albanese announced the scheme's expansion would begin within weeks.

The government maintained the scheme would raise prices by just 0.5 per cent across six years, according to Treasury modelling.

This was seen as an underestimate by many economists, including Centre for Independent chief economist Studies Peter Tulip, who called the divergence expected.

"Early indications are that the effect is larger than the government said it would be," he told AAP.

"This matters because the government claims to be improving affordability.

"However, while demand-side assistance like this helps the lucky recipients, they use the subsidy to outbid others, pushing up prices. Affordability overall is worse."

In October, Housing Minister Clare O'Neil - who did not respond to a request for comment - leant on the unreleased Treasury analysis.

"The best economists in the country looked at this and that's ... the finding they made," she said.

Labor's changes to the scheme "supercharged demand" and fuelled price growth, Opposition housing spokesman Andrew Bragg said.

"Everyone with a brain seems to understand Labor's irresponsible home guarantee scheme expansion is pushing up house prices for first home buyers," he said.

"Labor has wrecked a once targeted scheme by removing the income caps, allowing everyone, including the children of billionaires, to access (it)."

Mr Lawless said there was a "clear shift" with buyers targeting homes under the new price caps, especially in Sydney, which experienced the most pronounced gap.

Under-cap values in Australia's biggest city grew 2.3 per cent, compared to a 0.1 per cent fall for over-cap homes.

In total, 78 out of 88 regions Cotality analysed showed stronger growth for those eligible for the scheme.

The housing market is on a run of red-hot results, the national average house price growing 8.6 per cent in 2025 to be $901,000.

Values increased 1.1 per cent in October - the fastest growth rate since June 2023 - another one per cent in November, and 0.7 per cent in December.

Prior to the scheme, first homebuyers had to stump up 20 per cent of a property's price in a deposit to avoid costly mortgage insurance.

The government is effectively arguing the growth is a fair trade-off to lower the barrier for many first-time homebuyers to just five per cent.

"People desperate to get into the home ownership market, we are giving them a lifeline," Ms O'Neil said.

Like many economists who tipped the bump, Saul Eslake told AAP it was inevitable.

"We have 60 years of history and data going back to the first first homebuyers grant introduced by the Menzies government," he said.

"It unambiguously shows that anything that allows Australians to spend more on housing - tax breaks, lower interest rates, easier credit, shared equity schemes or lower deposit schemes like this - will see them spend more on housing."