/The%20CoreWeave%20logo%20displayed%20on%20a%20smartphone%20screen_%20Image%20by%20Robert%20Way%20via%20Shutterstock_.jpg)

CoreWeave (CRWV) shares extended gains on Jan. 12 after Michael Intrator – the company’s chief executive – addressed investor concerns regarding GPU depreciation on a Big Technology podcast.

Intrator’s 11% ownership stake signals substantial personal financial alignment with CRWV’s long term success, which is why his rebuttal to bear case arguments has resonated well with institutional investors.

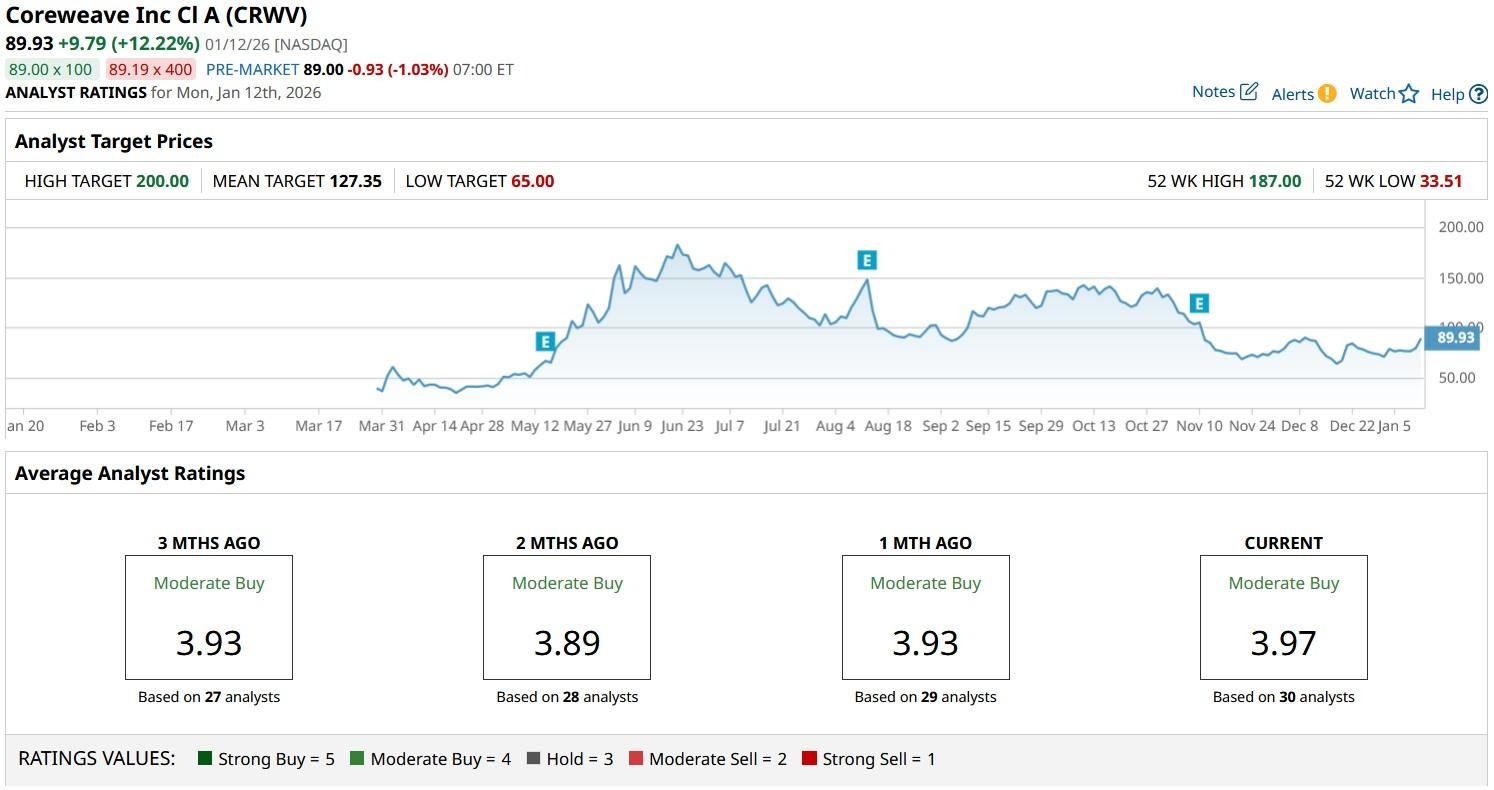

Despite recent gains, CoreWeave stock remains down more than 40% versus its 52-week high.

What Makes CoreWeave Stock Worth Owning in 2026

Intrator's leadership has positioned CoreWeave to integrate Nvidia’s (NVDA) next-gen “Rubin” architecture by the second half of 2026, placing the company among early adopters of the cutting-edge AI tech.

CRWV has signed multibillion-dollar infrastructure deals with major AI labs and social networks, demonstrating its transition from hourly capacity rentals to strategic, long-term partnerships.

A robust backlog that currently stands at over $55 billion underscores the tangible demand Intrator claims validates the firm’s differentiated positioning within the rapidly expanding AI infrastructure market.

Together, all of it suggests CRWV stock is poised to push higher and is therefore worth owning at current levels in 2026.

Rapid Revenue Growth to Drive CRWV Shares Higher

According to Moody’s, the data center market will receive at least $3 trillion in investments over the next five years.

The research and analytics giant also identified CRWV as one of the six U.S. hyperscalers expected to collectively invest $500 billion this year, underscoring the firm’s central role in industry capital deployment.

Investors should also note that CoreWeave has been growing at an exceptional pace. In the first nine months of 2025, the AI infrastructure company more than tripled its revenue to $3.6 billion.

More importantly, experts believe it will grow its top line further by another 134% this year.

The rally on Jan. 12 pushed CoreWeave shares well above their 50-day moving average as well, suggesting the upward momentum may hold in the weeks ahead.

How Wall Street Recommends Playing CoreWeave

While CRWV shares aren’t inexpensive to own at all, Wall Street analysts continue to recommend owning them in 2026.

The consensus rating on CoreWeave stock sits at “Moderate Buy” currently with the mean target of about $127 indicating potential upside of another 40% from here.

This article was created with the support of automated content tools from our partners at Sigma.AI. Together, our financial data and AI solutions help us to deliver more informed market headline analysis to readers faster than ever.