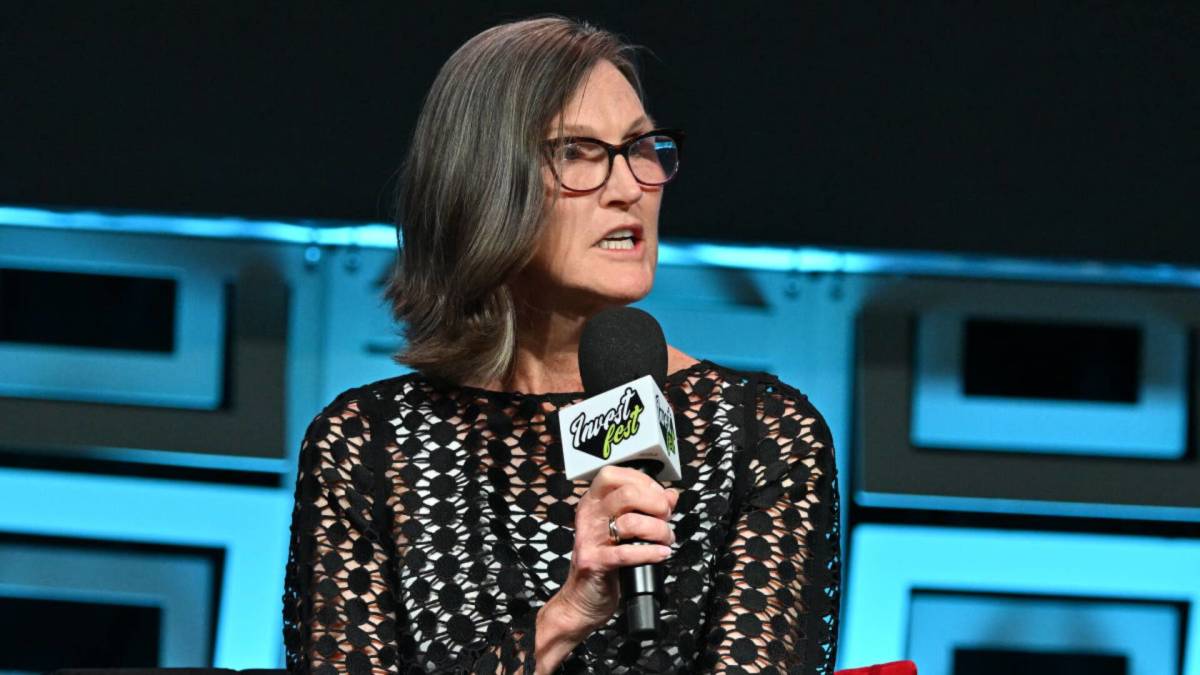

Cathie Wood largely makes long-term bets — a dip in the stock of one of Ark Invest's identified innovators is nothing but an opportunity to boost the firm's holding in that company.

The strategy on Wednesday was on display as the firm poured roughly $2.5 million into Global-E (GLBE) -), whose stock plummeted the day after the software company reported third-quarter results.

Related: Cathie Wood explains why she cut Ark's Tesla holding

Shares of Global-E closed the day down more than 27% at $28.75. The stock is now up 39% for the year.

Amid the tumble, Ark's Fintech ETF (ARKF) -) bought 90,420 shares of Global-E, boosting the fund's holding to around 1.1 million shares, valued at $31.2 million and weighted at 3.56% of the fund.

Global-E reported revenue of $133.6 million for the quarter, a 27% year-over-year increase, and non-GAAP gross profit of $59.3 million, a 36% increase from the year-ago period.

The company, however, reported a net loss of $33.1 million for the quarter.

Global-E says on its website that its platform enables retailers and brands to "increase international traffic conversion and grow sales by offering customers in over 200 destinations worldwide a seamless localized shopping experience."

Amid announcements of expanded partnerships with brands, merchant groups and Shopify, the company pared back its full-year revenue guidance. It now expects to see between $563 million and $571 million for 2023, below its previous range of $570 million to $590 million.

The company attributed the downward revision to its revenue for the quarter coming in below its own guidance range. The new range lagged analyst expectations of $588 million.

Global-E sees boost from deal with Shopify

Still, company executives told investors on Global-E's earnings call that they expected growth to accelerate in the coming quarters due to growth in Shopify Markets Pro and the "improvement of consumer sentiment we have witnessed since late October."

“The results of the third quarter of 2023 once again demonstrate the robustness of our business model, as evident from the top-line growth, improved profitability and our healthy pipeline,” Founder and Chief Executive Amir Schlachet said in a statement.

The stock has an analyst consensus buy rating and an average price target of $45. On Thursday Investment bank Raymond James cut its price target for Global-E to $41 from $45.

Shares of Global-E at last check were up 2.6% at $29.50.

Related: Cathie Wood snaps up nearly 4 million shares of a surging, cheap stock

Get investment guidance from trusted portfolio managers without the management fees. Sign up for Action Alerts PLUS now.