Tech stocks have helped the stock-market higher this year, but that rally seems to be easing.

Apple (AAPL), Microsoft (MSFT), Nvidia (NVDA) and the Nasdaq heavyweights are carrying more and more of the load. And Tesla (TSLA) has been charging higher, up 47% on the year and up almost 80% from the early January low.

Through it all, the tech-focused ARK Innovation ETF (ARKK) has been fairly quiet. While the asset manager Cathie Wood's flagship is down about 6.6% over the past two months, it’s still up about 20% so far in 2023.

Don't Miss: AMD Stock Presents a Buy-the-Dip Opportunity for the Bulls

Investors want to know: What’s next for this ETF, which has become a leader for growth stocks?

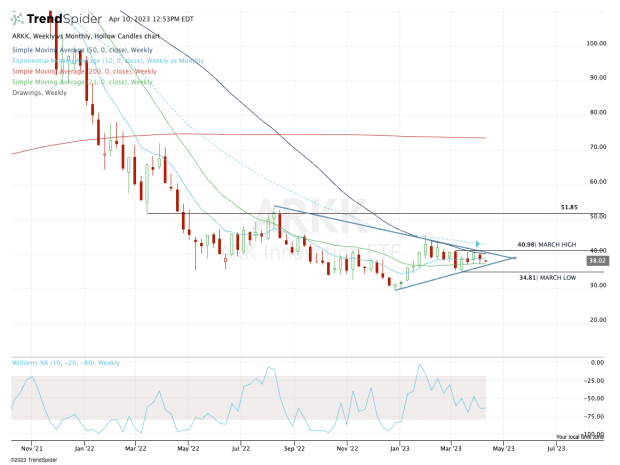

Ultimately, we need to see a move out of the tightening range in which the stock has been trading the past few months.

The broad trend has been to the downside and the recent trend has been higher. Could a larger upside rally be in store? Let’s look at the charts.

Trading the ARKK ETF

Chart courtesy of TrendSpider.com

As well as the ARK ETF has been trading for most of this year, it has failed to break above the declining 50-week and 10-month moving averages.

In fact, both measures continue to act as resistance, while the stock dances around its shorter-term moving averages (like the 10-week and 21-week).

The trading range continued to tighten in March, frustrating active traders on both sides of the tape, the bulls and the bears).

Ultimately, we’re looking to see how the ARKK ETF handles its March range.

Don't Miss: Anheuser-Busch Stock Charges to New Highs. Here's the Trade.

Moving above the March high of roughly $41 would put the 50-week moving average in play, followed by the 10-month moving average, then the $44 level. If the ARKK ETF can clear all those levels, the door opens to the $50 to $52 range.

On the downside, the March low is at $34.81. A break of this level opens up more downside for the stock. Further, a move below this mark puts ARKK below all its weekly moving averages, as well as its current uptrend support level.

If it can’t hold the March low (or regain it after a break below), then it could open the door down to $30, particularly if the market starts to decline from current levels.