Cathie Wood, chief of Ark Investment Management, frequently buys big-name technology stocks, especially the megacaps.

That’s what she has done this week. The megacaps can provide ballast to Ark’s funds when their smaller, more speculative positions fall.

Related: Veteran analyst makes surprising decision on Rocket Lab stock after surge

Investors and analysts are divided in their views of Wood, possibly the country’s best-known investor after Warren Buffett. Boosters see her as a technology guru, while critics argue she’s just a mediocre money manager.

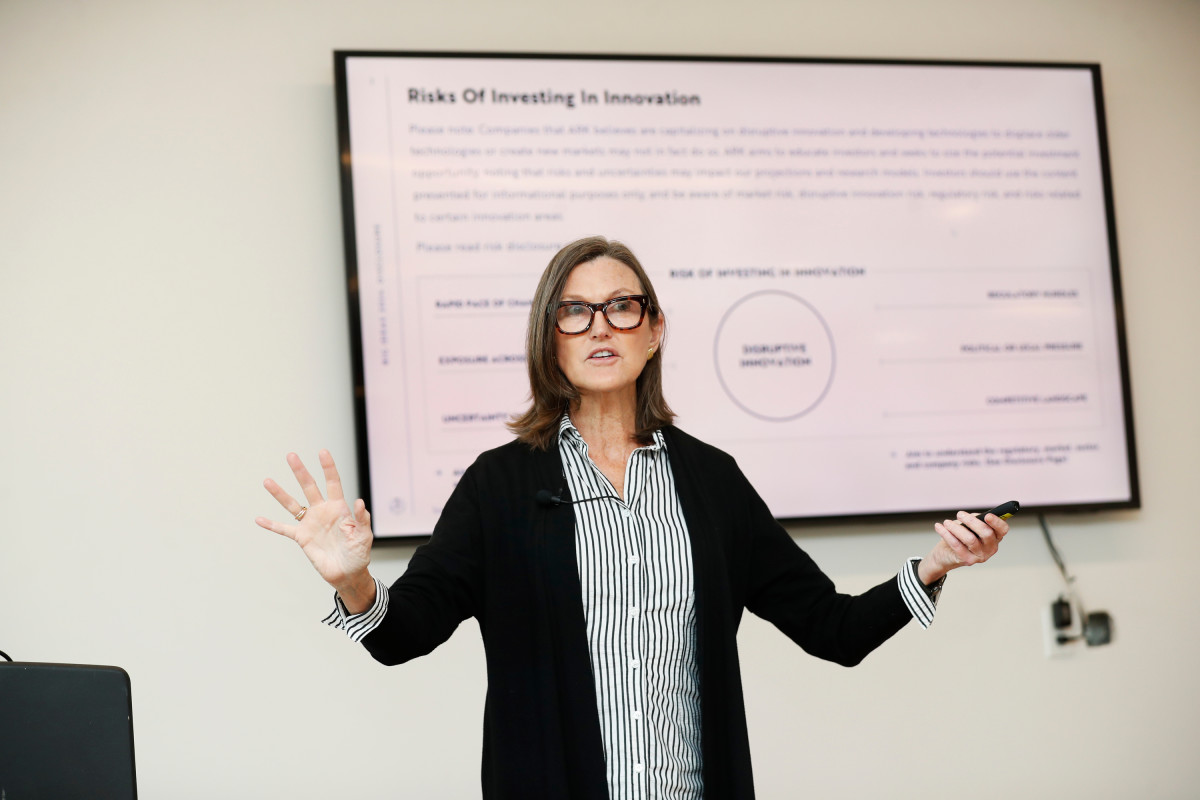

PATRICK T. FALLON/AFP via Getty Images

Wood (Mama Cathie to her followers) soared to fame after a stupendous return of 153% in 2020 and clear explanations of her investment strategy in frequent media appearances.

But her longer-term performance doesn’t exactly challenge Buffett. Wood’s flagship Ark Innovation ETF (ARKK) , with $5.8 billion in assets, produced annualized returns of 23% for the past 12 months, negative 26% for three years and positive 3% for five years.

Sign up for TheStreet's free daily newsletter.

That doesn’t come close to the S&P 500. The index registered positive annualized returns of 36% for one year, 11% for three years, and 16% for five years.

Cathie Wood’s straightforward strategy

Her investment philosophy is easy to grasp. Ark ETFs usually purchase emerging-company stocks in the high-tech categories of artificial intelligence, blockchain, DNA sequencing, energy storage, and robotics.

Wood maintains that companies in those categories will change the world. Of course, these stocks are quite volatile, so Ark funds’ values often shift widely.

Renowned investment research firm Morningstar is highly critical of Wood and Ark Innovation ETF.

Related: Cathie Wood divests $23 million of surging tech stocks

Investing in young companies with slim earnings “demands forecasting talent, which Ark Investment Management lacks,” Morningstar analyst Robby Greengold wrote in a commentary. “Results range from tremendous to horrendous.”

Morningstar portfolio strategist Amy Arnott calculated that Ark Innovation destroyed $7.1 billion of shareholder wealth from its 2014 inception through 2023. That put the ETF No. 3 on her wealth destruction list for mutual funds and ETFs over the past decade.

Short seller rips Cathie Wood

Fraser Perring, a short-seller who founded Viceroy Research, unleashed a harsh assessment of Wood in 2022.

“I wouldn’t even put your money with Cathie Wood,” he told New York magazine. “She is part of the problem…. She’s a capital depleter. With the amount of capital she’s evaporated, how can people even suggest she’s successful? She’s successful at failing.”

Wood defended herself in a July 2024 posting on Ark’s website. She acknowledged that “the macro environment and some stock picks have challenged our recent performance.”

Related: Cathie Wood buys $40 million of four beat up tech stocks

But her “commitment to investing in disruptive innovation has not wavered,” Wood said. Many of Ark’s stocks are in “rare, deep value territory,” she said.

And if interest rates fall, as has begun, her “disruptive innovation strategies should benefit disproportionately, as they did in the fourth quarter of 2023 and during the coronavirus crisis,” Wood said.

Some of her customers apparently agree with the critics. Over the past 12 months, Ark Innovation ETF suffered a net investment outflow of $2.4 billion, according to ETF research firm VettaFi.

Cathie Wood's buys this week: Amazon, PayPal

As for Wood’s activity this week, the megacap stock she bought was retail/tech titan Amazon (AMZN) .

Ark Autonomous Technology & Robotics ETF (ARKQ) snagged 4,019 shares, valued at $768,000 as of Thursday’s close. That’s the day she last bought it. The stock has climbed 24% year to date.

Dan Davidowitz, co-manager of Polen Growth Fund (POLRX) , which has $7.1 billion in assets, shares Wood’s bullishness toward Amazon. It’s his fund’s biggest holding.

“It has some of the most competitive advantages in the world,” he told TheStreet in a recent interview. “It has underappreciated earnings growth and a comfortable valuation.” The company’s profit margin is a healthy 10%, and that’s likely to increase, he said.

Fund manager buys and sells:

- Experts cite stocks to buy after Fed rate cut

- Cathie Wood divests $23 million of surging tech stocks

- Top value fund manager says Alphabet is deep-value stock

Wood also picked up a smaller large-cap stock this week: financial services company PayPal (PYPL) .

Ark Fintech Innovation ETF (ARKF) snatched 57,824 shares, valued at $4.5 million as of Monday’s close. That’s the day Wood got it.

The stock has gained 29% year to date. Morningstar analyst Brett Horn also is bullish, giving the company a narrow moat. That means he thinks it has competitive advantages that will last at least 10 years.

Horn puts fair value for the stock at $104. It traded at $79 Friday, indicating potential upside of 32%.

“PayPal’s second quarter showed new Chief Executive Alex Chriss making good progress in his attempts to shift the company toward a focus on profitable growth,” Horn said. He thinks the company “can get back on track” after the stock’s 71% drop over the past three years.

The author owns shares of Amazon and PayPal.

Related: The 10 best investing books, according to our stock market pros