Carvana (CVNA) shares closed down more than 14% on Jan. 28 after Gotham City Research issued a short report against the online used car retailer.

Gotham accused Carvana of more than $1 billion in overstated earnings for 2023-2024.

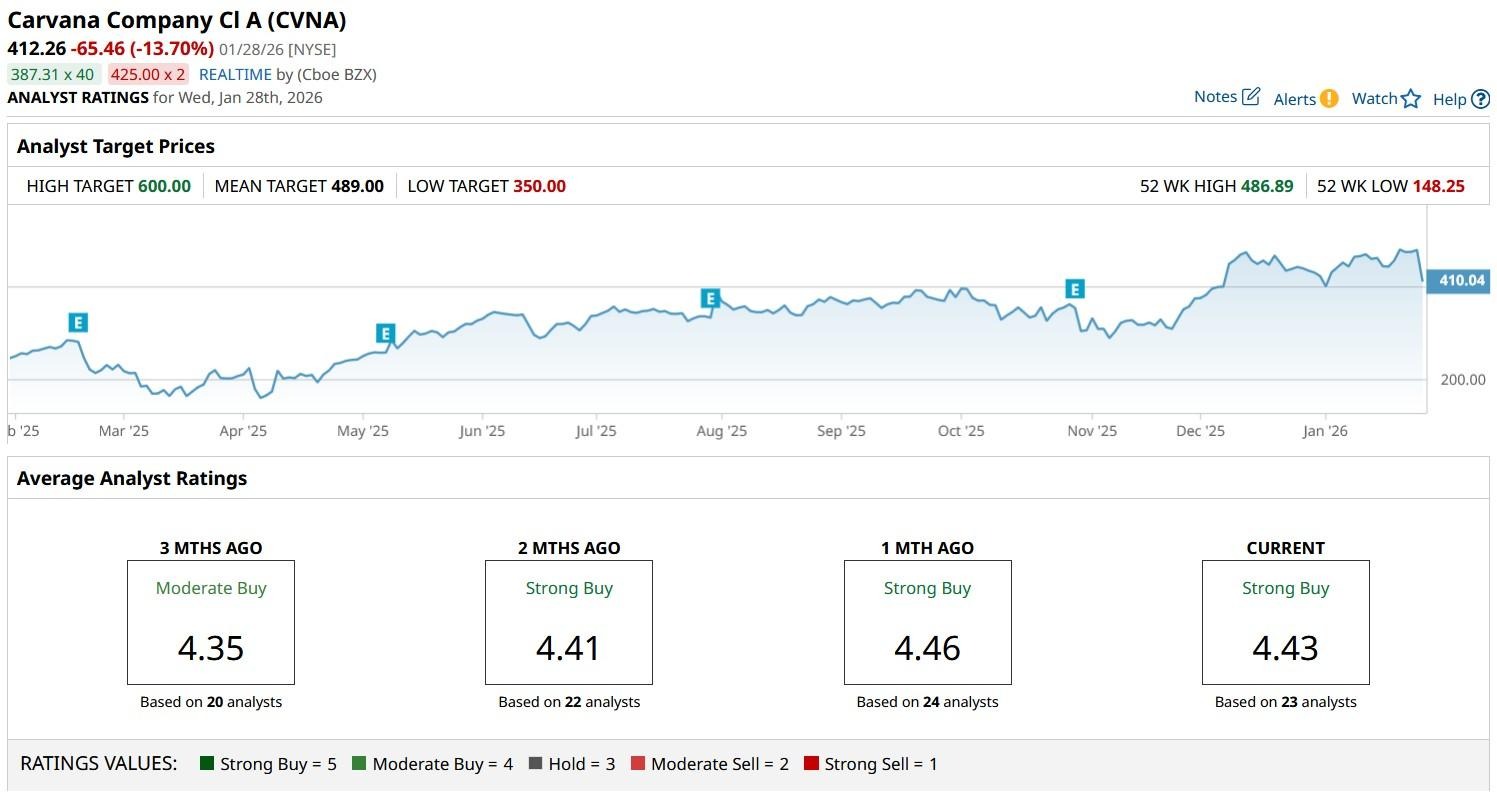

Despite a sharp decline on Wednesday, Carvana stock remains up some 40% versus its November low.

What Gotham Alleged in Short Report Against Carvana Stock

According to Gotham City Research, the NYSE-listed firm’s celebrated “turnaround” is built on a foundation of accounting irregularities and undisclosed related-party transactions.

Its short report on CVNA shares focused on the company’s ties with entities like “DriveTime” and “Bridgecrest,” which are controlled by its chief executive’s father, Ernest Garcia II.

Carvana exploits these entities to “pull profit forward” and inflate its adjusted EBITDA, the short-seller further alleged.

Gotham predicts a delayed annual 10-K filing and potential financial restatements, questioning the integrity of Carvana’s reported $550 million net income over the past two years.

Why Long-Term Investors Should Buy the Dip in CVNA Shares

While Gotham’s short call did quite a bit of damage on Jan. 28, the structural bull case for Carvana shares centered on the company’s unmatched operational efficiency remains intact.

The Tempe-headquartered firm’s vertical integration and proprietary logistics software create a moat that traditional dealers just can’t replicate.

CVNA has achieved “industry-leading” adjusted EBITDA of 11.3%, and its recent addition to the benchmark S&P 500 Index ($SPX) signals institutional validation.

Importantly, JPMorgan analysts raised their price target on Carvana this week to $510. dismissing short-seller narratives as rehashed “old news.”

For long-term investors, therefore, the pullback in CVNA offers a rare price to enter a dominant e-commerce player that’s expected to grow revenue by a staggering 30% this year.

Note that Carvana stock bounced from its 100-day moving average (MA) on Wednesday, further reinforcing that the broader uptrend remains intact.

Carvana Remains a ‘Buy’ Among Wall Street Analysts

Gotham’s short report on CVNA stock has failed to budge Wall Street analysts as well.

The consensus rating on Carvana remains at “Strong Buy” with the mean target of $489 signaling potential upside of nearly 20% from here.