Carnival Cruise (CCL) reported earnings before the open on Friday and the results weren’t that inspiring. The stock is down 20% at last check, although it’s off the session low, which was barely above $7.

Carnival stock is giving Nike (NKE) a run for its money today, as the athletic-gear provider is down 12% on disappointing earnings — here’s the strong support zone we highlighted yesterday.

For the third quarter, Carnival reported top- and bottom-line misses. A loss of 65 cents a share missed expectations by 51 cents, while revenue of $4.31 billion came up short of estimates by $600 million. For next quarter, management expects a net loss.

Put it all together and investors just aren’t buying Carnival today, even as the overall market rallies.

In fact, earlier this morning Carnival Cruise stock took out the 2020 covid low.

That gives rise to an interesting opportunity.

Trading Carnival Cruise Stock

Chart courtesy of TrendSpider.com

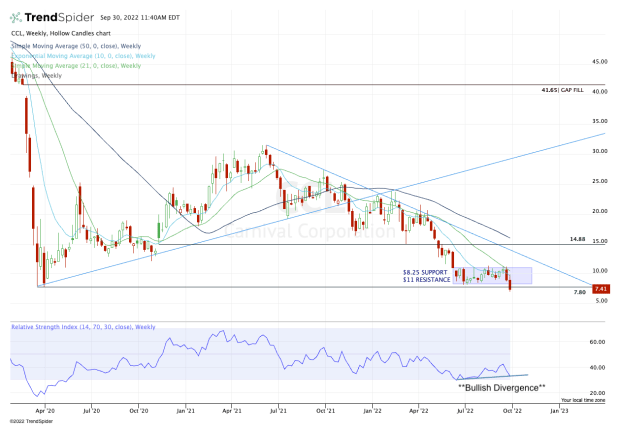

The weekly action above dates to 2020. But the more recent action shows how Carnival was holding the $8.25 to $8.50 area as support, while struggling with $11 resistance.

With today’s move, Carnival Cruise stock is breaking below the 2020 low of $7.80.

And there’s actually some good news with this development: The $7.80 level can act as a line in the sand for traders.

If Carnival Cruise stock can reclaim this level, bullish traders can use the new low as their stop-loss and look for a push back into prior support near $8.25 to $8.50.

If Carnival Cruise stock can’t reclaim the $7.80 level — or if the risk level grows too wide — then it’s simply a no-touch down here.

At some point, Carnival stock likely presents value, but I don’t know where that point is just yet. Despite the big rebound in revenue, the fundamentals aren’t good at the moment -- as evidenced by the recent quarter.

Add in a bear market in equities, and bullish traders aren’t really in a speculative mood. The exception would come if Carnival Cruise stock can reclaim $7.80.