According to the Capgemini Research Institute's World Wealth Report 2024, the United States significantly outpaced the rest of the world in creating millionaires last year, adding 500,000 new ones and setting records for wealth accumulation. This information technology company collaborates with businesses to "unlock the power of technology" and offers insights into global wealth trends.

The Capgemini analysis estimates that 7.43 million Americans are now millionaires, with more than 300,000 residing in New York City alone. This represents a 7.3 per cent increase since 2023. From 2022, their combined wealth rose by 7 per cent to $26.1 trillion. According to Capgemini, millionaires have investable assets of at least $1 million, excluding their primary residence, collectables, and consumable items.

Wealth Growth Drivers

The US wealth engine continues to be fuelled by trillions of government spending, stimulus measures, and a booming stock market towards the end of 2023. Despite higher interest rates, affluent individuals have seen their fortunes grow at an accelerated pace. In 2023, Americans with a net worth of at least $30 million increased by 7.5 per cent to 90,700, with their combined wealth reaching $7.4 trillion.

Future Prospects for Wealth Growth

The critical question is whether the wealth boom of the past decade can be sustained. Artificial intelligence advancements, the COVID-19 pandemic surge, low interest rates, and abundant liquidity have driven recent wealth creation. Elias Ghanem, the global head of the Capgemini Research Institute for Financial Services, believes that international conflicts, elections, interest rates, and a potential economic slowdown could impede the pace of wealth creation. "The last ten years were exceptional," Ghanem stated. "We now have inflation, a potential recession, geopolitical problems, and elections. The environment is completely different."

Shifts in Investment Strategies

The research indicates that wealthy investors shift from safe, wealth-preservation assets to rapid-growth ones. Their cash and cash-equivalent holdings have decreased from a peak of 34 per cent of their portfolios at the beginning of 2023 to 25 per cent in January, suggesting a move towards utilising their cash. The report also noted an increase in their real estate assets from 15 per cent to 19 per cent, and their fixed income holdings rose from 15 per cent to 20 per cent. Conversely, their stock holdings have dropped to 21 per cent, the lowest in nearly 20 years. Despite solid performances from major stock indexes, with the Nasdaq Composite gaining 14 per cent and the S&P 500 rising 12 per cent, wealthy investors are steering clear of a market dominated by a few large tech companies.

Ghanem highlighted that the most significant capital inflows from affluent investors this year are expected to come from alternatives, particularly private equity and private credit. The report indicates that over 60 per cent of millionaires plan to increase their private equity investments in 2024. "Everything is cyclical, and because private equity has not done well, it's a good entry point," Ghanem said. "They figure if they enter now when it's cheaper, it's a good long-term play."

Global Millionaire Trends

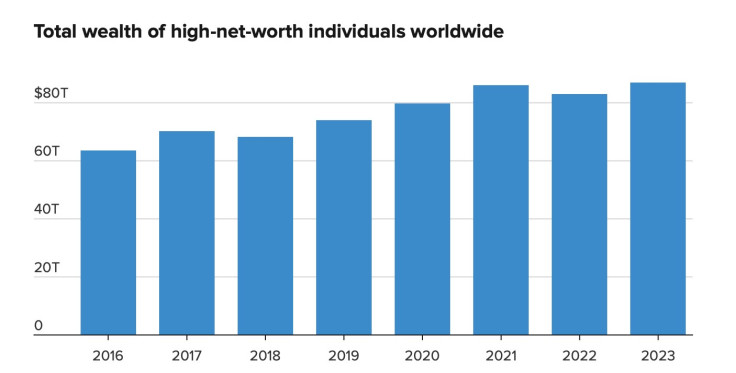

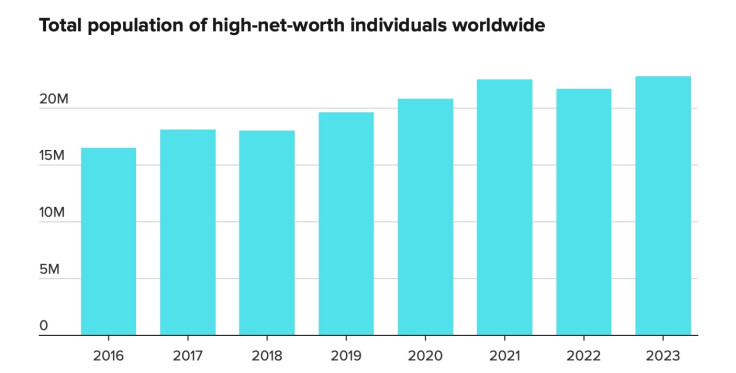

The wealth landscape appears more uneven globally than it does domestically. The survey shows that the global number of millionaires increased by 5.1 per cent, reaching 22.8 million in 2023, with their total net worth hitting an all-time high of $86.8 trillion.

Asia-Pacific, which ranks second to North America regarding millionaire growth, expanded at 4.8 per cent. Europe followed with a 4 per cent growth rate, Latin America at 2.7 per cent, the Middle East at 2.1 per cent, while Africa experienced a slight decline of 0.1 per cent.

Although Asia had outpaced North America in the number of millionaires and wealth growth rate before the COVID-19 pandemic, the United States remains in the lead, according to Ghanem. The study also notes that while only one per cent of millionaires worldwide are ultra-high-net-worth individuals, they control 34 per cent of the total wealth, illustrating the increasing concentration of wealth among the already affluent.