Tesla (TSLA) tends to dominate the auto-sector headlines, but Ford (F) holds its own.

That said, the stock performances of the two have been on different trajectories this year.

Tesla shares are up about 50% so far in 2023, more than four times Ford stock’s 10.5% return. But Ford stock holds the edge over the past year, down 16% over the prior 12 months vs. Tesla’s 44% tumble.

Don't Miss: Regional-Bank Preview: The Technical Setup as Earnings Reports Loom

While Tesla has been leading the electric-vehicle trend, Ford has been fighting in the sector, too.

The company’s F-Series pickup — the most popular vehicle in the U.S. — now has an all-electric offering and demand has been strong.

Tesla’s Cybertruck will eventually compete with Ford’s electric pickup (as will the Ram 1500 REV when it comes to market).

With Ford stock up about 6% in the past month but running into resistance, let’s take an updated look at the chart.

Trading Ford Stock

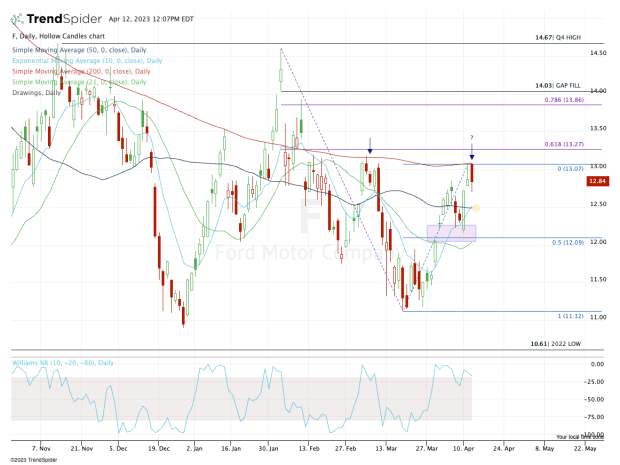

Chart courtesy of TrendSpider.com

Ford stock has made a nice rally off the low near $11, reclaiming its 10-day, 21-day and 50-day moving averages in the process.

Now the shares are running right into the 200-day moving average. This measure was key resistance in early March, which kickstarted the stock’s correction.

If it pulls back further, keep an eye on the $12.50 level. That’s where we find the 10-day and 50-day moving averages, and the bulls would like to see this level hold.

Should this area act as support, then a retest of the $13 level and the 200-day moving average is in store.

Don't Miss: Time to Own AT&T, Verizon and T-Mobile?

Ultimately, the bulls want to see a move over $13.25, opening the door to the $13.85 to $14 zone. That’s where Ford stock would find the 78.6% retracement of the pullback, as well as a gap-fill level from early February.

If the $12.50 level doesn’t hold as support, it could put $12 back in play. Near that mark we find the 50% retracement and 21-day moving average. Below it and more weakness could ensue.

Keep it simple: For now, watch $12.50 on the downside and $13 on the upside.

Get investment guidance from trusted portfolio managers without the management fees. Sign up for Action Alerts PLUS now.