Broadcom (AVGO) continues to trade quite well this year, although it gets overshadowed by some of the more popular semiconductor stocks.

Specifically, Nvidia (NVDA) and Advanced Micro Devices (AMD) seem to get most of the attention, particularly related to AI chips.

Up about 14% so far this year, Broadcom lags AMD and Nvidia, which are up 48% and 97%, respectively.

Broadcom also lags the VanEck Semiconductor ETF (SMH), which remains a market leader so far in 2023.

Don't Miss: Do Tax Credits Make First Solar Stock a Buy? Here's What the Chart Says

In the case of Broadcom stock, the shares still pay out a near-3% dividend yield and trade at roughly 15 times this year’s consensus earnings estimate. Analysts expect mid- to high-single-digit earnings and revenue growth both this year and next year.

Do all those data combine to make Broadcom stock an attractive long? The charts can help answer that question.

Trading Broadcom Stock

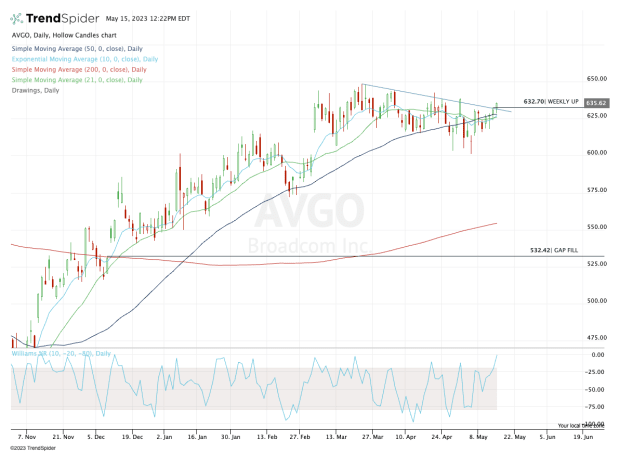

Chart courtesy of TrendSpider.com

One potential catalyst here is the “catch-up trade.” A similar catalyst could give Netflix (NFLX) a boost as well, as it has lagged its FAANG peers.

Broadcom has lagged some of its semiconductor peers and it’s possible we see a rotation into this name.

That rotation, in fact, could be starting now. That’s as Broadcom stock regained its 10-day, 21-day and 50-day moving averages on Friday.

On Monday, it’s working on its fourth straight daily rally and is clearing last week’s high of $632.70. As it does so, it’s also clearing downtrend resistance (blue line).

Don't Miss: Take a Ride With Uber Stock and Buy the Dip. Here's Where.

If Broadcom stock can gain momentum, it opens the door up to the $645 to $650 area, a zone that also contains the 52-week high at $648.50. Ideally, the bulls will see a daily close above last week’s high, then a push into this area.

If that’s the case and if shares gain steam over $650, then the $675 area could be in play. Near that level — at $677 — is the 161.8% extension, which would be a reasonable and attractive upside target.

On the downside, a break of Monday’s low near $628.50 suggests caution. It will crush the breakout attempt and put Broadcom stock back below its key daily moving averages.

It would also open the door down to last week’s low around $616.

Action Alerts PLUS offers expert portfolio guidance to help you make informed investing decisions. Sign up now.