Shares of Block (SQ) lately have been trading better, but the bulls have been looking for the payments specialist to join the rally party.

While tech stocks have been roaring higher — just look at how well Nvidia (NVDA) has been doing — Block had been, too.

Block stock rallied 75% from its November low to its first-quarter high. Since topping out near $90 in early February, though, it’s been consolidating quite a bit.

Don't Miss: Bank Stocks Remain Pressured. XLF Chart Support Is a Line in the Sand.

The shares fell about 6% last month and about 2.5% this month. At last glance on Wednesday they were off nearly 4%.

It also doesn’t help that PayPal (PYPL) stock has had trouble gaining upside traction.

Block is currently down about 17% from the February high and traders are wondering if the technical side sees some redemption. Let’s have a look.

Trading Block Stock

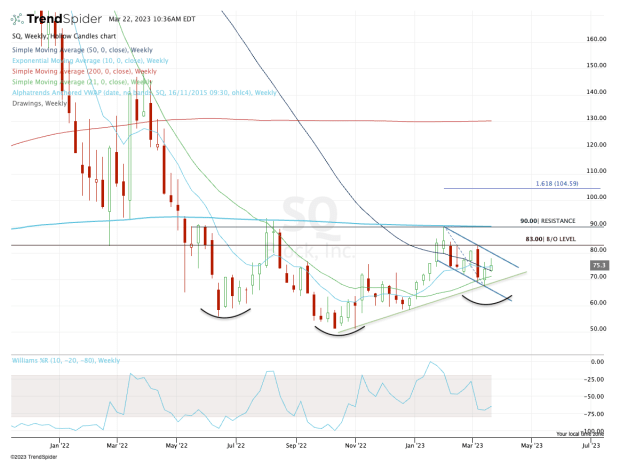

Chart courtesy of TrendSpider.com

Despite the short-term pullback, the weekly chart for Block stock definitely holds some positives that jump off the screen.

For starters, the stock continues to put in a series of higher lows, a bullish technical development. Second, the shares seem to be consolidating in what’s known as a bull-flag pattern, highlighted by the blue lines on the chart.

Still, it’s struggling for upside traction at a time when the Nasdaq is making multiweek highs, as Apple (AAPL) and others forge the way up.

If Block stock is going to catch up, it will need to regain the 50-day moving average near $77. Should the shares regain $77, that opens the door to recent resistance and the prior key level near $83.

Ultimately, though, $90 is still the big resistance level that Block shares must clear.

Don't Miss: Can AMD Stock Break Out Over Major Resistance?

This level has been resistance for several quarters and it’s where the VWAP measure, anchored back to Block’s first trading day, comes into play. It’s worth mentioning that this VWAP measure was resistance back in August, too.

Should the stock clear this level, $100 and $105 are potentially in play next.

On the downside, the bulls can keep it simple. Block stock needs to stay above last week’s low near $67.50 to remain in good shape. A break of that level puts more downside back in play.