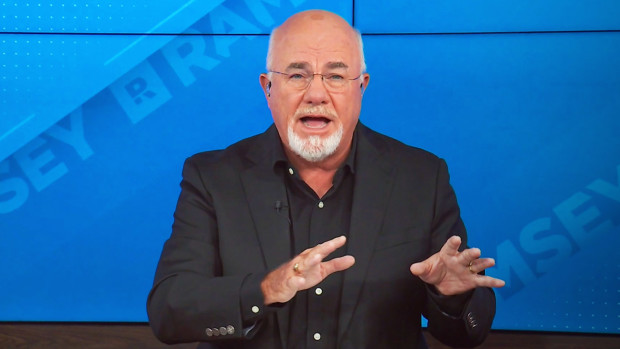

Author and radio host Dave Ramsey often talks about discipline as a vital component of making good financial decisions.

When it comes to buying a house, he believes this is of paramount importance.

DON'T MISS: Las Vegas Strip books classic rock band for farewell residency

In his book, The Total Money Makeover, Ramsey discusses patience as a form of discipline.

"It is human nature to want it and want it now; it is also a sign of immaturity," he wrote. "Being willing to delay pleasure for a greater result is a sign of maturity."

Ramsey, in fact, doesn't believe knowledge is nearly as important as self-control.

"Winning at money is 80 percent behavior and 20 percent head knowledge," he wrote in the book. "What to do isn't the problem; doing it is. Most of us know what to do, but we just don’t do it. If I can control the guy in the mirror, I can be skinny and rich."

The personal finance personality applies a disciplined budget principle to buying a home.

"Never have a payment of over 25 percent of your take-home pay," he wrote. "That is the most you should ever borrow."

A co-host of The Ramsey Show explains this approach further on the Ramsey Solutions website.

"If you’re ready to buy, your next step is figuring out your home-buying budget," wrote Rachel Cruz. "I tell people to buy a house only when the monthly payment is no more than 25% of their monthly take-home pay."

"Anything more than that and you risk being house poor," Cruze continued. "Sticking to a 25% monthly payment leaves plenty of room in your budget to cover home maintenance and repairs while hitting your other money goals, like saving for retirement."

Shutterstock

Tips on saving for the down payment

Cruze acknowledges that shopping around for a house to buy is a lot more fun than saving the necessary money.

"Don’t give in to the temptation of looking at house listings before you have a solid down payment saved up," Cruze wrote. "Because guess what could happen? You’ll find a dream home way outside of your budget, and you’ll try to convince yourself your down payment is enough."

"Don’t do this!" she implored. "A flimsy down payment is a recipe for regret when it comes to buying a home."

Cruze shares her thoughts on the discipline it takes to save enough money to take the big step.

"Just like any goal, buying a home the smart way takes planning and preparation," she wrote. "The most time-consuming part of this whole process is saving cash for the down payment, closing costs and other moving expenses."

Here are three expenses, Cruze emphasizes, that homebuyers need to consider.

Down payment: I want you to put down a minimum of 10% on your new home, but 20% or more is even better because you’ll avoid PMI. PMI is a fee added to your monthly mortgage payment to protect your lender in case you default on your loan, and it won’t go away until you have at least 20% equity in your home. If you’re a first-time home buyer, a 5–10% down payment will be enough, but it means you’ll be paying PMI a little bit longer.

Closing costs: You should save around 3% of your home’s purchase price for closing costs, which cover any property taxes, insurance items, or fees charged by your title company and lender. That percentage might vary depending on what area you’re buying in.

Moving and other expenses: Moving expenses can vary from hundreds to thousands of dollars depending on how much stuff you’re moving and how far away your new home is from your current place. To help with budgeting, call a few moving companies in your area for quotes ahead of time. If you plan to make updates to your home — like painting, installing new carpet, or buying furniture — you’ll need cash for that too.

Ramsey Solutions suggests saving for a down payment is not rocket science and offers words of encouragement.

"But you do need to be intentional about it," Cruze wrote. "Set a plan and focus on your milestones, and you'll have that down payment before you know it. You’ve got what it takes!"

Get exclusive access to portfolio managers and their proven investing strategies with Real Money Pro. Get started now.