/Blackstone%20Inc%20NY%20HQ-%20by%20John%20Hanson%20Pye%20via%20Shutterstock.jpg)

With a market cap of $114.8 billion, Blackstone Inc. (BX) is a global alternative asset management firm specializing in private equity, real estate, hedge fund solutions, credit, and multi-asset investment strategies across a wide range of industries and geographies. The firm invests worldwide across company life cycles and asset classes, with a strong presence in North America, Europe, Asia, and Latin America.

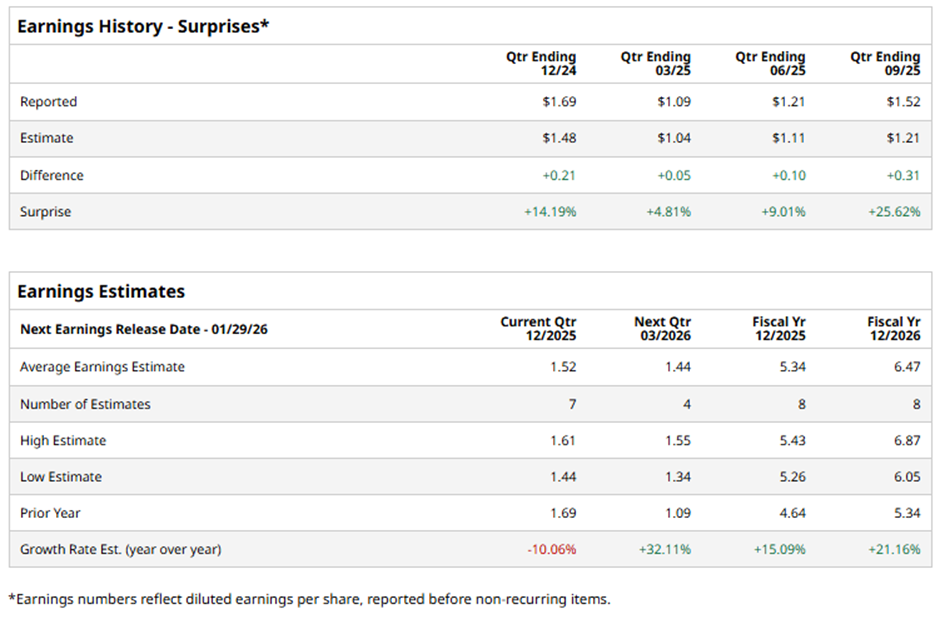

The New York-based company is expected to release its fiscal Q4 2025 results soon. Ahead of this event, analysts forecast BX to report an adjusted EPS of $1.52, down 10.1% from $1.69 in the prior year's quarter. However, it has surpassed Wall Street's bottom-line estimates in the past four quarters.

For fiscal 2025, analysts anticipate the investment manager to post an adjusted EPS of $5.34, reflecting a 15.1% increase from $4.64 in fiscal 2024. Looking ahead, adjusted EPS is projected to grow 21.2% year-over-year to $6.47 in fiscal 2026.

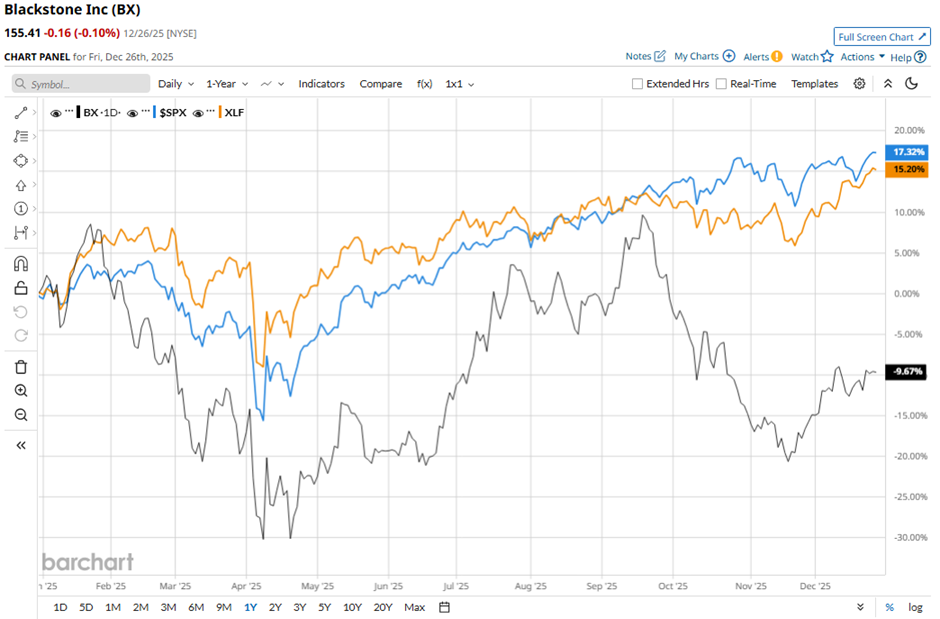

Shares of Blackstone have decreased 11.9% over the past 52 weeks, underperforming both the S&P 500 Index's ($SPX) 14.8% gain and the State Street Financial Select Sector SPDR ETF's (XLF) 13.3% return over the period.

Despite beating expectations with Q3 2025 adjusted EPS of $1.52 and adjusted revenue of $3.3 billion, Blackstone shares fell 4.2% on Oct. 23 because investors focused on a sharp deterioration in GAAP results, with net income dropping to $624.9 million ($0.80 per share) from $780.8 million ($1.02 per share) a year earlier, well below expectations. Total reported revenue declined 15.7% year-over-year to $3.09 billion.

Analysts' consensus view on BX stock is cautiously optimistic, with a "Moderate Buy" rating overall. Among 22 analysts covering the stock, eight recommend "Strong Buy," two suggest "Moderate Buy," 11 indicate “Hold,” and one has a "Strong Sell." The average analyst price target for Blackstone is $179.80, indicating a potential upside of 15.7% from the current levels.