KEY POINTS

- One investor said he believes the dip is just a 'technical' move, but it could also be related to holders' fears

- A long-time $BTC holder said it appears there is a 'coordinated' attack on Bitcoin as it nears its all-time high

- Chimp Exchange's Akshay Nassa said it could be linked to MtGox's creditor repayments

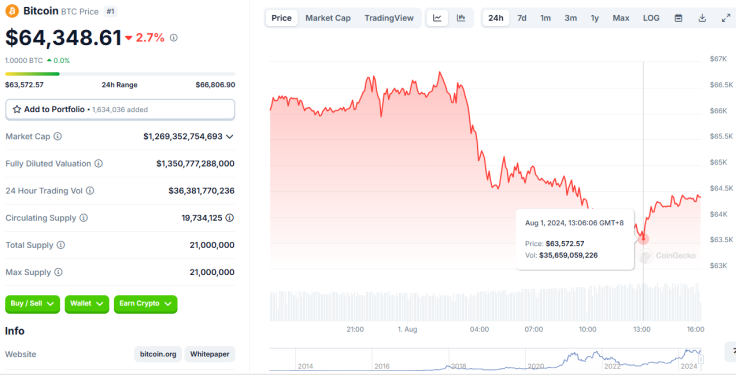

Bitcoin, which has been rallying by over 100% over the past year, is on a gradual retreat. The world's top cryptocurrency by market value has steadily been on a pricing downtrend for a few days now, and industry experts have different takes on why the digital coin is in decline.

Bitcoin retreats after Nashville hype

Following the buzz and excitement around the Bitcoin 2024 conference last week that drove $BTC prices to almost $70,000, the world's first decentralized digital asset plummeted to $66,000 and has since been on a decline.

At one point early on Thursday, the digital currency traded at around $63,500, data from CoinGecko showed. It has since slightly bounced back to around $64,300, but remains in the red over the last 24 hours.

A 'technical correction'?

Investor @Micro2Macr0, who describes himself as a macro economist and a self-made multimillionaire, said he is prepared for $BTC prices to decline further to the $61,000 range. When asked by an X user why he thinks Bitcoin will drop further, Micro2Macr0 said it will probably be "a technical move," or "a small amount of fear" among holders.

#Bitcoin $BTC could totally drop towards the $61,000-$62,500 range.

— Micro2Macr0 (@Micro2Macr0) August 1, 2024

I'm prepared to buy the dip.

Are you? pic.twitter.com/N88r7D4pPK

FUD to block ATH?

For long-time $BTC holder Kyle Chassé, the current Bitcoin dip is something the community has already seen before. "Every time Bitcoin gets near ATH (all-time-high) the FUD (fear, uncertainty, and doubt) attack begins." Bitcoin hit an ATH of $73,780 in mid-March, ahead of its April halving.

He went on to suggest that it appears to be a "coordinated" attack on the leading crypto, but he believes "they won't be able to stop this wave for much longer."

MtGox still a factor?

Last month, MtGox was one of the main drivers of FUD in the crypto space. The collapsed crypto exchange giant has started repaying users, and there have been fears that creditors receiving their Bitcoin payments could dump all at once, potentially affecting prices.

Well-followed trader @CryptoFeras believes the "excessive supply we are getting from MtGox and some governments for Bitcoin ... are the main factors now."

#Bitcoin, #FED decision & #Alts

— Crypto Feras (@CryptoFeras) July 31, 2024

I see too much hype on #Crypto X about rates decision & Powel speech rn

imo, interest rates are still not the major player for our market at the moment.

the excessive supply we are getting from #MtGox & some governments for #BTC & Grayscale… pic.twitter.com/948UTlZsGU

Akshay Nassa, the CEO of fully encrypted Chimp Exchange, noted how MtGox moved some $2.25 billion worth of Bitcoins earlier this week to new wallet, with the $BTC representing a significant portion of the defunct exchange's over $5 billion in Bitcoin holdings.

"Such transfers could create short-term volatility in Bitcoin's price, as the market reacts to the sudden movement of substantial funds and anticipates potential sell-offs by the creditors," he told International Business Times.

Indeed, Bitcoin has already shed some $3,000 since MtGox's latest transfer, backing theories that MtGox's Bitcoin repayments may still have an impact on the coin's price movement.