Bitcoin (CRYPTO: BTC) funds saw more than $450 million in outflows last week as digital asset investment products saw the largest ever weekly outflows on record.

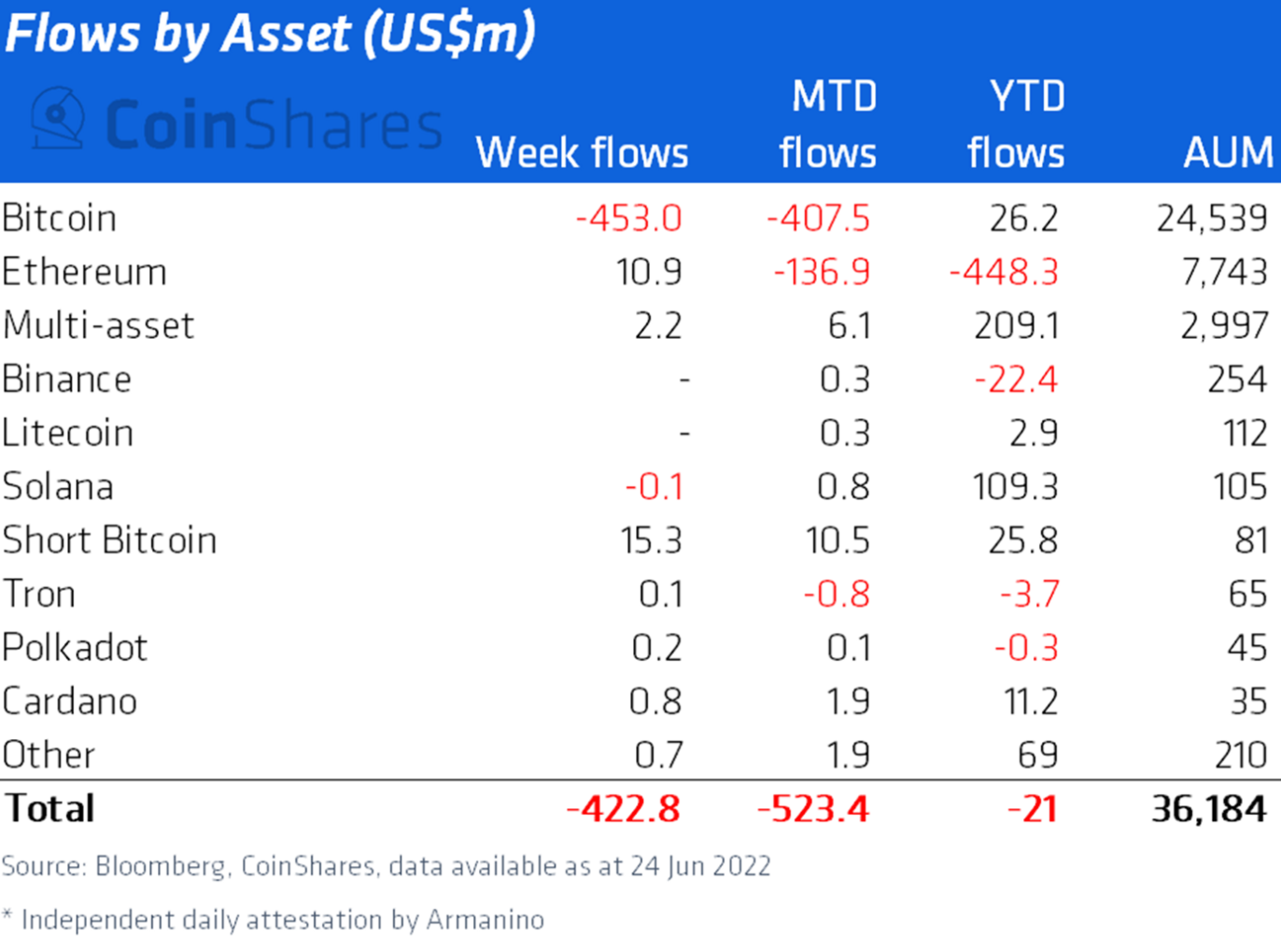

What Happened: According to data from CoinShares, the outflows were solely focused on Bitcoin which recorded $453 million worth of outflows.

“The outflows occurred on 17th June but were reflected in last week’s figures due to trade reporting lags, and likely responsible for Bitcoin’s decline to $17,760 that weekend,” stated CoinShares in its weekly report examining fund flows.

Meanwhile, short-Bitcoin funds recorded $15 million worth of inflows after the launch of the ProShares Short Bitcoin Strategy ETF (NYSE:BITI) last week, suggesting institutional investors were betting on further downside for the leading digital asset.

See Also: IS BITCOIN A GOOD INVESTMENT?

Besides Solana (CRYPTO: SOL), which recorded moderate outflows of $100,000, all altcoin funds recorded inflows over the week, bringing net outflows down to $423 million.

Ethereum (CRYPTO: ETH) saw $10.9 million in inflows, while Cardano (CRYPTO: ADA), Polkadot (CRYPTO: DOT) and Tron (CRYPTO: TRX) saw a cumulative $1.1 million worth of inflows.

Price Action: According to data from Benzinga Pro on Monday afternoon, Bitcoin was trading at $20,751.51 at press time, down 2.05% in the last 24 hours.