KEY POINTS

- Bitcoin hit $89,560 at one point Sunday night amid a 30% weeklong surge

- $BTC is now the world's 8th largest asset, pushing silver to 9th and leaving Meta at 10th

- Many crypto users are hopeful Trump will keep his Bitcoin and crypto promises

Bitcoin has surged once more just days after setting new all-time highs, this time surging above $89,000, allowing the world's first decentralized cryptocurrency to flip silver's market capitalization.

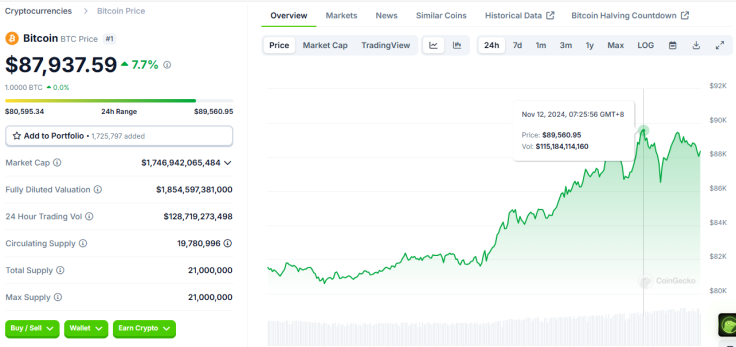

Data from CoinGecko shows that at one point on Monday night, the digital currency spiked to $89,560.95 amid a 7.8% surge in the last 24 hours. The coin has also increased by nearly 30% in the last seven days.

$BTC Flips Silver To Become World's 8th Largest Asset

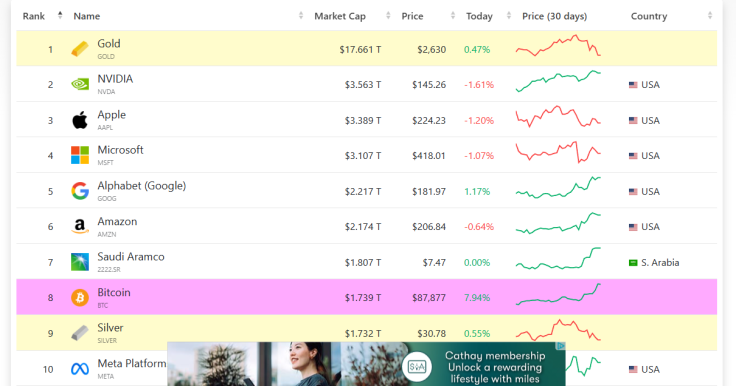

As Bitcoin prices continued to surge Monday night, the world's largest crypto asset overtook silver in the ranks of the world's largest assets. According to data from Companies Market Cap, BTC is now the world's 8th largest asset, pushing silver to the 9th spot and leaving Meta (Facebook) on the 10th position.

Silver's market cap stands at $1.732 trillion, while BTC is now at a staggering $1.739 trillion, while Meta is farther behind with $1.472 trillion.

Bitcoin's new milestone puts it closer to Saudi Aramco, the Kingdom of Saudi Arabia's integrated energy and chemicals company. It is dubbed the world's most profitable company and also the world's largest oil producer.

While gold remains the world's most valuable asset, it has underperformed compared to Bitcoin. Gold's 30-day chart is in the red, while BTC's chart in the last month has been on a green uptrend. So far in the last 24 hours, BTC prices are up by nearly 8%, while gold increased by 0.47%.

Will Bitcoin Surge Further Under Trump?

Prior to the U.S. elections, some analysts had already predicted that a second Donald Trump presidency would drive Bitcoin prices up.

For Bitget Research chief analyst Ryan Lee, a monumental spike is possible now that Trump is set to return to the White House. Aside from Trump's comeback, the crypto industry will welcome what crypto leaders have called the "most pro-crypto Congress" in U.S. political history.

Some industry experts predict that a $100,000 spike may even come sooner than later, "given we have a combination of positive political momentum, social media hype, a continuation of interest rate cuts, and the prospects of Bitcoin becoming a strategic reserve asset in the U.S.," said CoinShares Head of Research James Butterfill.

David Bailey of Bitcoin Magazine has said establishing the Strategic Bitcoin Reserve must be accomplished "in the first 100 days" of the Trump administration.

The Bitcoin and Crypto industry’s policy wishlist is long and pressing… but the Strategic Bitcoin Reserve is the #1 most urgent and transformational policy on President Trump’s agenda. The downstream effects change everything.

— David Bailey🇵🇷 $0.85mm/btc is the floor (@DavidFBailey) November 11, 2024

We must get it done in the first 100 days.

Since winning the elections, Trump has yet to talk about his campaign promises related to Bitcoin and the broader crypto industry, but there is much optimism that he will stay true to his word.

On the other hand, some industry observers are neutral, remaining cautious until Trump proves that he is the crypto president as he promised.