Bitcoin, Dogecoin, and Ethereum were muted on Wednesday evening, with the global cryptocurrency market cap edging 0.4% lower to $2 trillion, as the U.S. Federal Reserve stuck to a hawkish tone even as war raged on in Ukraine.

| Coin | 24-hour | 7-day | Price |

|---|---|---|---|

| Bitcoin (CRYPTO: BTC) | -0.6% | 17.8% | $43,999.10 |

| Ethereum (CRYPTO: ETH) | 0.9% | 14.3% | $2,966.70 |

| Dogecoin (CRYPTO: DOGE) | -0.1% | 4.3% | $0.13 |

| Cryptocurrency | 24-Hour % Change (+/-) | Price |

|---|---|---|

| Anchor Protocol (ANC) | +20% | $4.49 |

| Convex Finance (CVX) | +13.1% | $21.27 |

| JUNO (JUNO) | +12.3% | $45.16 |

See Also: How To Buy Bitcoin (BTC)

Why It Matters: The U.S. Federal Reserve Chair Jerome Powell, in his semi-annual address to the Congress, said that rate hikes were coming despite the ongoing war between Russia and Ukraine.

“The bottom line is we will proceed, but we will proceed carefully as we learn more about the implications of the Ukraine war for the economy,” said Powell.

"We will avoid adding uncertainty to what is already an extraordinarily challenging, uncertain environment."

On Tuesday, the Bank of Canada raised interest rates to 0.5%, a 25 basis-point hike for the first time since 2018.

“Wall Street is still going through a major reset with portfolios as the war in Ukraine poses major risks to economic growth and inflationary pressures,” wrote Edward Moya, a senior market analyst with OANDA, in a note seen by Benzinga.

Moya noted that Bitcoin was diversifying away from fiat currencies, and growth concerns were prompting investors to look for “alternative investments” from equities. However, he said the current rally could be losing steam.

“Bitcoin has had a nice run, but exhaustion in this rally will likely settle in as surging energy costs will likely impact some mining abroad," Moya said, adding that the Ukraine war uncertainty still had the potential to trigger major de-risking moments.

On Wednesday, the dollar index - a measure of the greenback’s strength against six of its peers - traded nearly flat. It edged up 0.03% to $97.3290, according to a Reuters report.

Cryptocurrency trader Justin Bennett said the dollar index would be a “key driver” for digital assets in 2022.

“If [Bitcoin] intends to hit all-time highs, the DXY will lead the way with a move below 95,” tweeted the analyst.

"Most are overlooking this, but the #DXY will be a key driver for #cryptos in 2022."

— Justin Bennett (@JustinBennettFX) March 1, 2022

If #Bitcoin intends to hit all-time highs, the DXY will lead the way with a move below 95.

Until then, it's wise to remain a little skeptical.

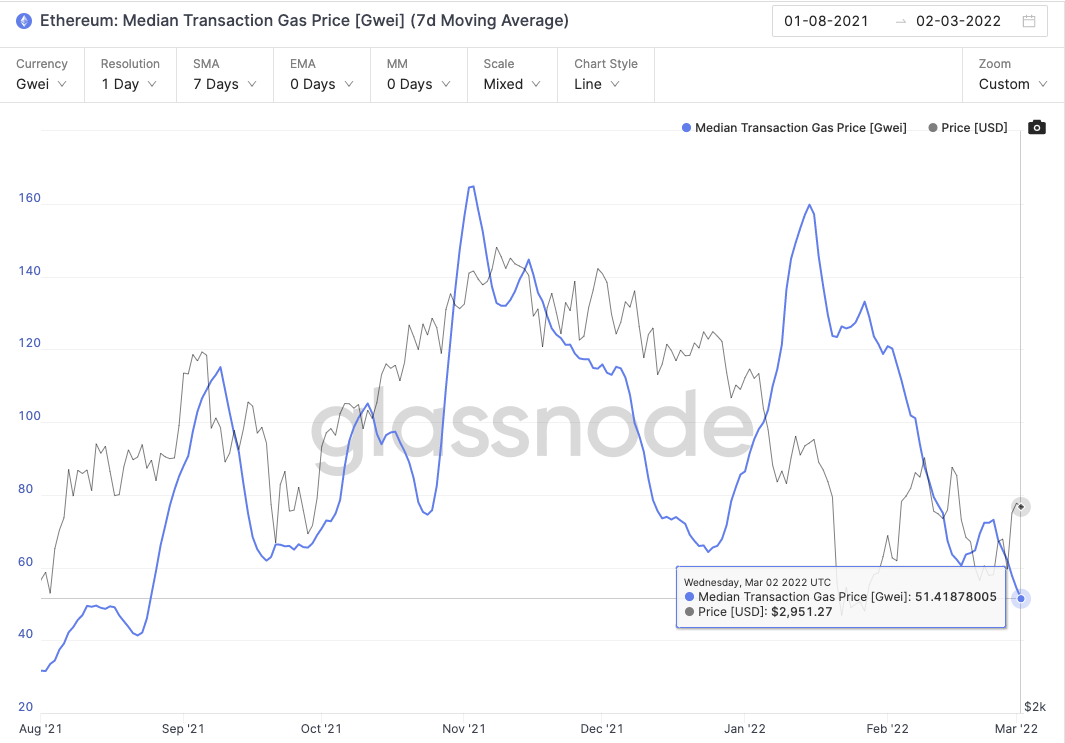

On the Ethereum front, Median Gas Price (7-day moving average) reached a 6-month low of 57.884 GWEI, according to data from Glassnode, an on-chain analytics firm.

The average ETH transaction fee stood at 0.0046 ETH or $13.69 at press time, according to data from BitInfoCharts.

Read Next: Citadel Securities Will Engage In Crypto This Year: Ken Griffin