Bitcoin prices were hammered and cryptocurrencies broadly have taken a massive dive this year.

Specifically, Bitcoin saw a peak-to-trough decline of nearly 75% and is down 47% so far in 2022.

The moves clearly answered the question of whether bitcoin, ethereum and others would act as a hedge against inflation.

While they did initially jump and rally in 2020 and 2021, investors must question whether this was due to the rally in risk-on assets (like high-growth stocks) or because of inflation.

Given the way bitcoin and other cryptocurrencies have traded lower so far this year, they seem to have a much stronger correlation with growth stocks than they do with inflation, which has been raging higher.

Now, though, bitcoin prices have been on the mend a bit since they bottomed in June. That's even as Tesla (TSLA) and others have sold.

Specifically, bitcoin has risen in four of the past six weeks, while the two down weeks were losses of just 0.26% and 0.58%, respectively.

Can the bulls keep driving bitcoin higher?

Trading Bitcoin

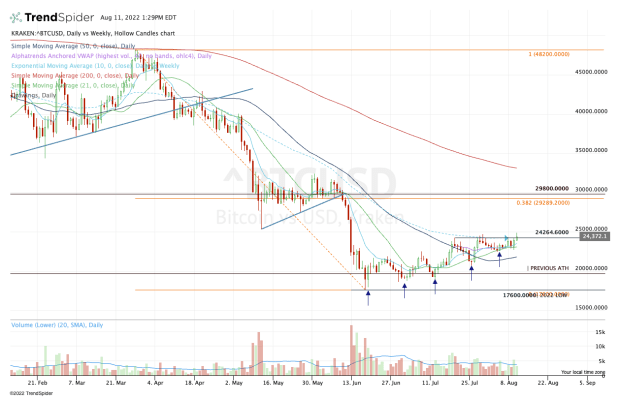

Chart courtesy of TrendSpider.com

Bitcoin hit its low in mid-June on high volume and has traded in a constructive manner since. Specifically, it’s put in a series of higher lows, as noted on the chart above.

It’s also back above its short- and intermediate-term moving averages, while holding its daily VWAP as support.

It’s struggling, however, with the $24,250 to $24,500 zone, as well as the 10-week moving average. If the bulls want the show to go on, the ideal development would be a breakout over this level.

At the end of the day, investors are looking for bitcoin to get back to its bullish ways.

It’s trying, but the rally has been slow to get going. If it can break out over the $24,500 level, though, the bulls could be on to something — particularly if it happens alongside a further rally in risk-on assets.

Specifically, a big breakout could put the $29,000s into play, where it runs into the 38.2% retracement of the 2022 range, an enormous prior support level at $29,800 and the monthly VWAP measure.

On the downside, keep an eye on the 10-day and 21-day moving averages and the daily VWAP measure. If it were to lose all three measures, the 50-day would come back in play.

An increase in risk occurs if the 50-day fails as support, as it puts the July low in play at $20,696 and could accelerate the decline if bitcoin rotates below this low. That could put the mid- to high-$18,000 range in play.

So what’s the bottom line? So far the bulls have short-term control in bitcoin, but that momentum is at risk of waning as the cryptocurrency fails to push through resistance. Above $24,500 is bullish and below is more cautious.