Australia's largest biopharmaceutical company has posted a massive slump in interim profit, pushing its shares to an eight-year low after the sudden retirement of its chief executive.

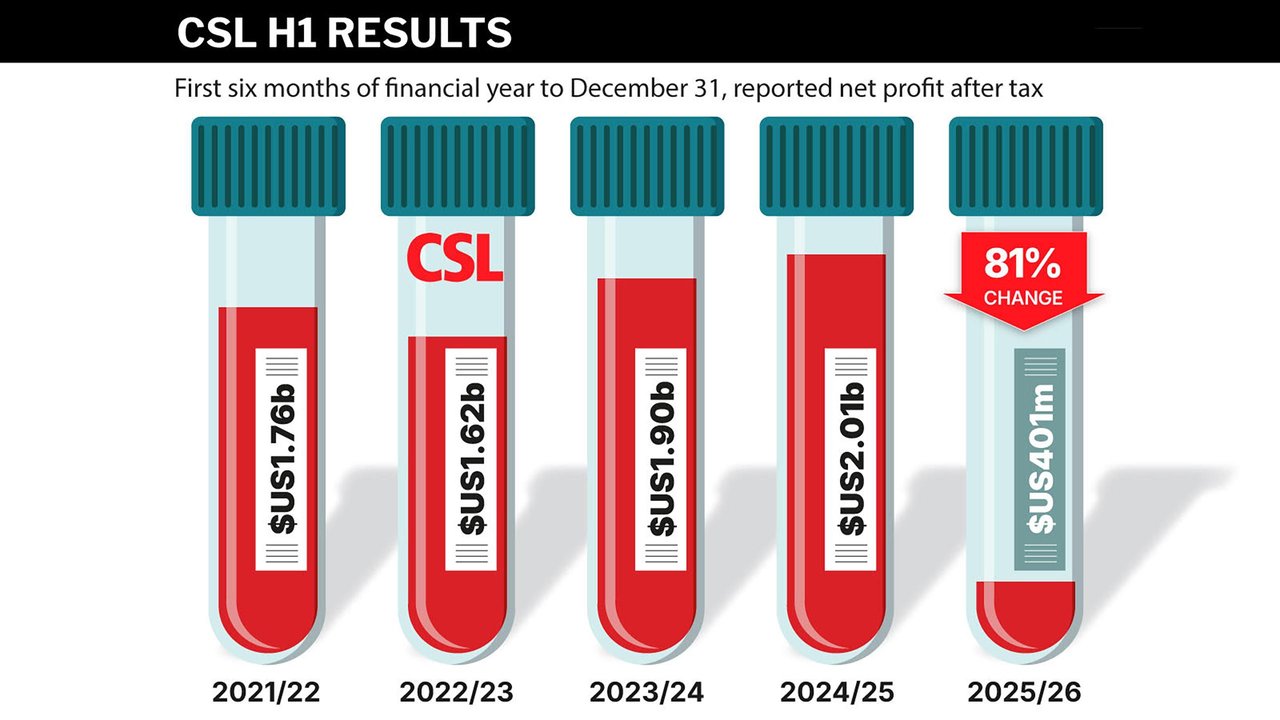

CSL's first-half net profit fell 81 per cent to $US401 million ($A567 million), after government policy changes, one-off restructuring costs and impairments severely impacted its bottom line.

The healthcare giant's underlying result, excluding those impacts, was down seven per cent to $US1.9 billion ($A2.7 billion) for the six months ended December 31.

"We are clearly not satisfied with our performance and have implemented a number of initiatives to drive stronger growth going forward," CSL's chief financial officer Ken Lim said on Wednesday.

"In the second half, we have an ambitious growth plan, driven by immunoglobulin, albumin and our newly launched products."

The Australia-based CSL maintained its guidance for full-year revenue growth of between two to three per cent and a four to seven per cent rise in underlying net profit.

CSL in October downgraded its 2025/26 earnings guidance due to falling US vaccination rates and reduced demand from China for the blood protein albumin.

Just as the Australian stock market was closing on Tuesday, CSL - which makes vaccines and blood plasma-derived therapies - suddenly announced chief executive Paul McKenzie was stepping down.

"When the board sat down recently and looked at our business and where we need to go in the future, we, in discussion with Paul, recognised he didn't have the skills that we wanted for the future," chairman Brian McNamee said.

"We discussed this question of him, therefore, retiring.

"We need new and broader skills to improve performance commercially and also broaden our pipeline activities."

Former CSL senior executive Gordon Naylor, a non-executive director of the company, has been appointed interim CEO and managing director.

On Wednesday, he told investors CSL had an ambitious second half ahead, as it pursued its transformation.

"We must deeply examine CSL's journey, especially over the last decade, to fully understand the opportunities for improving strategic growth and profitability," he said.

"I'm not prepared to accept that we can't do better, and I see opportunities to do so."

CSL shares fell to eight-year lows around $150 during the session, but staged a partial recovery to $163.44 by the close, making it a 4.6 per cent loss for the session.

The loss added to the Tuesday sell off that immediately followed the CEO news, taking the drop to nearly 11 per cent across both sessions.

The shares had dipped in late September after US President Donald Trump threatened to impose 100 per cent tariffs on pharmaceutical imports unless companies built manufacturing plants in the United States.

CSL will pay investors an interim dividend of $US1.30 per share.