KEY POINTS

- Bitcoin and several other top cryptocurrencies declined in the last 24 hours

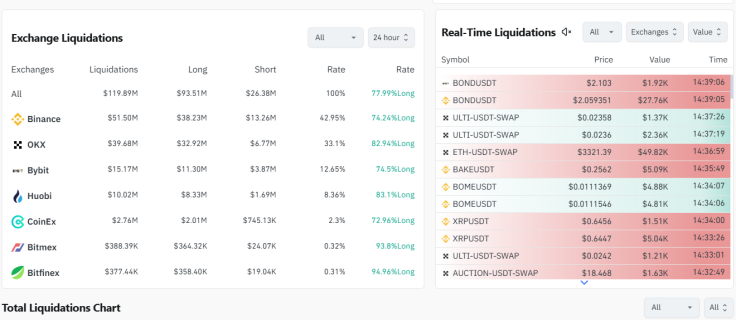

- Binance and OKX suffered most of the past day's liquidations

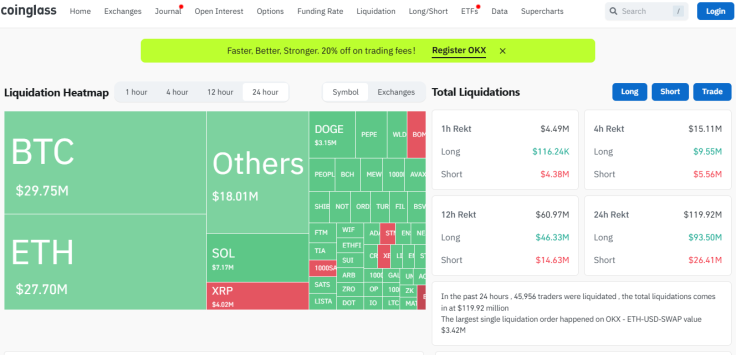

- Bitcoin and Ether were close in total liquidations in the last day

Binance, which is the world's largest cryptocurrency exchange by trading volume, saw the most liquidations over the last 24 hours as Bitcoin, the world's top digital asset by market value, continued seeing red.

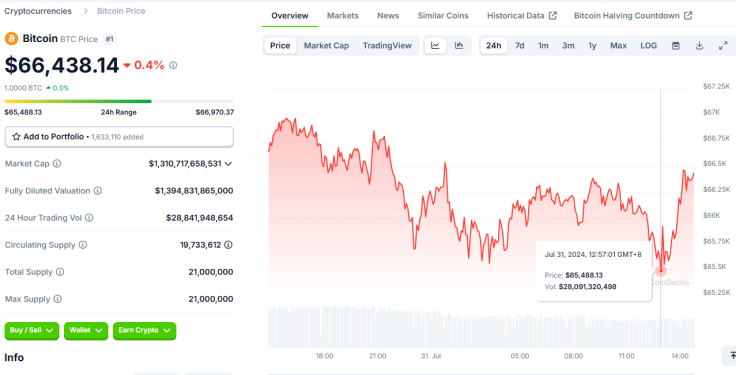

$BTC prices down

Bitcoin was trading below $66,000 Tuesday after the digital coin shed some $4,000 earlier in the week amid news that a digital wallet linked to the U.S. government moved $2 billion worth of seized $BTC.

The digital currency has since recovered and is trading above $66,000 as of writing, but remains down by some 0.4% in the last day, as per CoinGecko data.

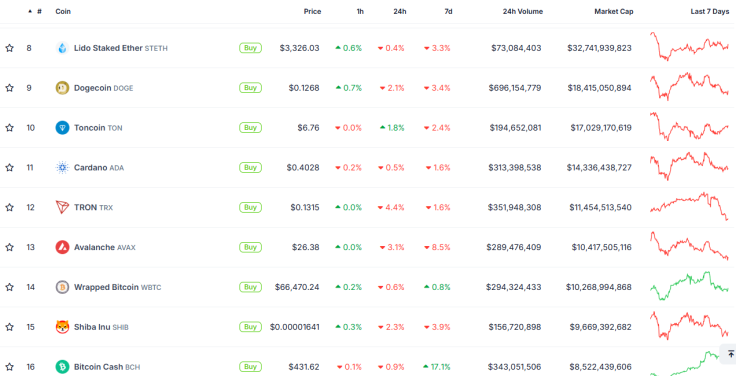

Other major coins plunge

Several other crypto tokens on CoinGecko's ranking of top 20 digital assets by market value have been down in the past 24 hours, including $DOGE (over 3%), $TRX (4.4%), $AVAX (3.1%), and $SHIB (2.3%).

Binance suffers the most liquidations

Binance saw the most liquidations in cryptocurrencies in the last 24 hours, as per CoinGlass. The exchange saw a total of $51.50 million in liquidations, with over $38 million being long positions.

OKX closed in on Binance, seeing more than $39 million liquidated, most of which were long positions. Some $15 million was wiped out from Bybit on the last day, while Huobi saw over $10 million liquidated.

Ether nears Bitcoin in liquidations

Ether, the native cryptocurrency of the Ethereum blockchain, saw more than $27 million liquidated in the last 24 hours, a figure close to Bitcoin's $29.75 million. Solana ($SOL) lost $7.17 million, and $XRP saw $4.02 million liquidated.

Popular memecoin Dogecoin ($DOGE) lost $3.15 million, and $PEPE shed over $2 million in the past day.

Nearly 47,000 traders were liquidated in the last day, with the largest single transaction taking place on OKX, valued at $3.42 million.

Crypto ETFs feel the heat

Tuesday's liquidations came as some crypto exchange-traded funds (ETFs) also saw significant outflows in the last day, including Grayscale's Ethereum ETF $ETHE, which shed $120.3 million, as per data from Farside Investors.

Spot Bitcoin ETFs had a negative day, with five funds bleeding more than $93 million – an amount BlackRock's $IBIT inflow of $74.9 million couldn't beat.

Better days ahead for $BTC and crypto?

Meanwhile, some crypto users remain positive that the market will see some relief in the coming days. Jack Mallers, the founder of $BTC investment and payments company Zap, reminded Bitcoin users that the world's first decentralized digital asset is the first "exit door" and no one can stop it from going up. He said holders shouldn't regret that they have "a way out," given the depreciation of fiat currencies.

All fiat assets are being depreciated and everyone knows it.

— Jack Mallers (@jackmallers) July 30, 2024

For the first time in history, we the people built an alternative: #Bitcoin. A global, decentralized money owned by everyone. An open-source exit door.

This will never happen again. Don't look back with any regrets. pic.twitter.com/fNtUHLgt95

Hany Rashwan, the CEO of 21Shares' parent company, said many people these days are excited about blockchain and crypto, and he expects such excitement to continue, given the public's growing fears over debt, politics, and other issues that could affect the traditional financial system.

21 Shares has more than $7 billion in Assets Under Management.

— Anthony Pompliano 🌪 (@APompliano) July 31, 2024

CEO @hany outlines where investors are putting their capital, when countries will buy bitcoin, and what we can learn from other regulatory jurisdictions.

Full episode on X.

LISTEN: https://t.co/FAArbjL3EQ pic.twitter.com/wR4xIOt2z6