TheStreet’s Conway Gittens brings the latest business headlines from the floor of the New York Stock Exchange as markets open for trading Wednesday, May 22.

Related: A top student loan company allegedly told staff to keep borrowers on hold

Full Video Transcript Below:

CONWAY GITTENS: I’m Conway Gittens reporting from the New York Stock Exchange. Here’s what we’re watching on TheStreet today.

Stocks react to weaker than expected earnings from Target as consumers pull back spending due to inflation. Separately on the earnings front, investors are looking ahead to results from Nvidia – this report is key as the stock continues to lift the tech heavy Nasdaq.

Wall Street will also be monitoring minutes from the Federal Reserve’s May meeting for hints on the central bank’s path forward on interest rates.

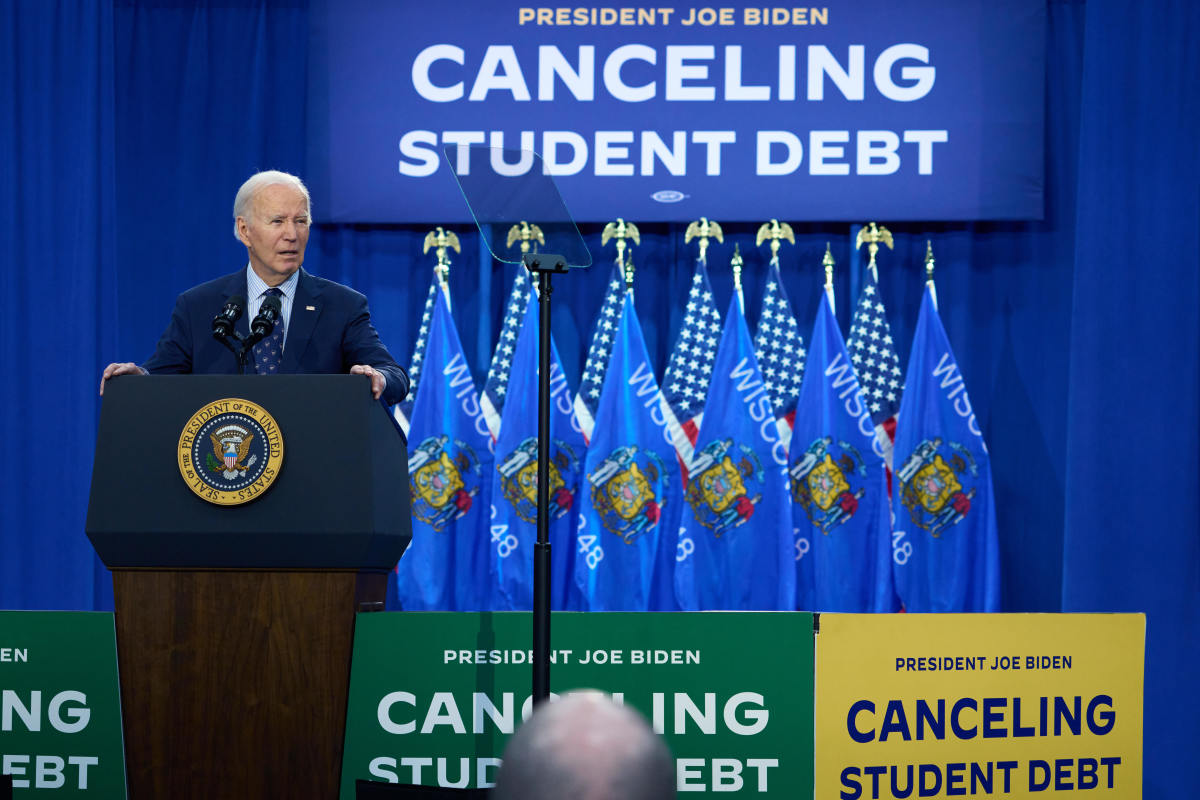

In other news - The Biden Administration has announced another round of student loan forgiveness. This time it plans to forgive $7.7 billion in loans for more than 160,000 borrowers.

Watch More Videos:

- New dyslexia treatment aims to overcome biggest hurdle in cognitive healthcare

- How this YouTuber built a huge audience by playing slots

- Yes, there are fewer chips in the bag: Shrinkflation, explained

The U.S. Education Department announced $5.2 billion would be forgiven for roughly 67,000 borrowers through its Public Service Loan Forgiveness program. Another $1.9 billion will be wiped out for about 39,000 borrowers enrolled in income-driven repayment plans.

That’s not all….$613 million will go to about 54,000 borrowers through the Administration’s SAVE plan, which allows for loan forgiveness after 10 years to those who borrowed $12,000 or less.

U.S. Secretary of Education Miguel Cardona said in a statement: “The Biden-Harris Administration remains persistent about our efforts to bring student debt relief to millions more across the country.”

After this newest round of relief, $167 billion in student loans have been forgiven for 4.75 million Americans.

That’ll do it for your daily briefing. From the New York Stock Exchange, I’m Conway Gittens with TheStreet.

Related: Veteran fund manager picks favorite stocks for 2024