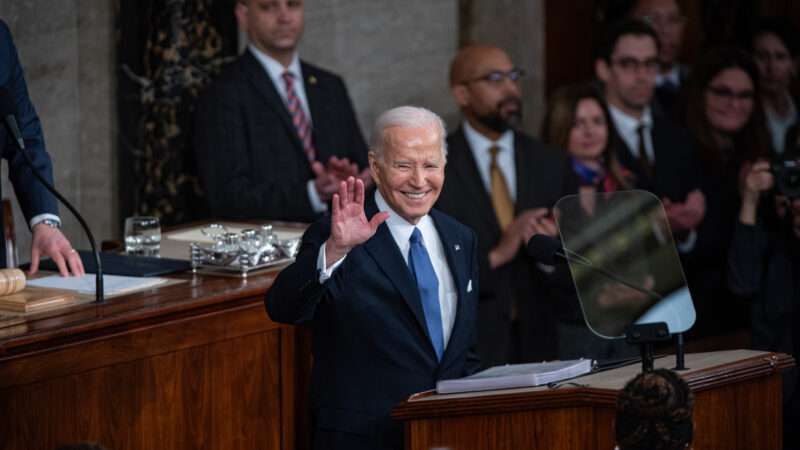

President Joe Biden did not dwell long on the question of how to solve the serious entitlement crisis facing America during Thursday's State of the Union address before pivoting to discuss obviously more serious problems like the size of snack food packages.

Still, one point he made is worthy of deeper analysis.

In trying to draw a contrast between his own plans and what he claimed Republicans are aiming to do, Biden claimed that "working people who built this country pay more into Social Security than millionaires and billionaires do. It's not fair."

Moments later, he promised to "protect and strengthen Social Security and make the wealthy pay their fair share."

Though he did not spell it all out in Thursday night's speech, those two comments seem to be pointed toward the same aspect of how Social Security is funded. Under current law, the payroll tax that funds Social Security is capped so that, for this year, only the first $168,600 in earnings are subject to it.

Raising that cap—or eliminating it—is frequently discussed as one possible solution to Social Security's approaching insolvency. That seems to be the idea that Biden was gesturing towards in his speech.

On its face, this isn't necessarily the worst idea. The cap is completely arbitrary, so there's no principled reason why all earnings shouldn't be treated equally. And there's no doubt that raising the cap would generate more revenue to help keep Social Security afloat. The Congressional Budget Office estimates that applying payroll taxes to higher income levels could raise $1 trillion in revenues over a 10-year period (though the amount of revenue would depend on how the cap was altered, and whether benefits increased as well).

But there are also serious trade-offs. For one, this would be a tax increase on working Americans to fund a transfer of wealth to retirees. That's not great. A significant portion of that tax increase would fall on people making less than $400,000 annually—remember, the cap is currently set around $168,000—a cohort that Biden promised again in Thursday's speech would not face tax increases.

Perhaps most importantly, raising or eliminating the payroll tax gap doesn't come close to solving the long-term Social Security shortfall. It might generate $1 trillion over 10 years, which is a lot of money, but it doesn't come close to the $2.8 trillion deficit the program is expected to run over the next decade.

"Eliminating the tax cap would either raise benefits as well (reducing the proposals' savings), or—if the accompanying benefits are canceled—turn Social Security into a true welfare program by delinking contributions and benefits," writes Brian Riedl, a senior fellow at the Manhattan Institute and former Senate budget staffer, in a recent piece debunking some common myths about Social Security reform. "Moreover, eliminating the cap would not bring permanent solvency or avert the need for benefit changes….The system would return to deficits by 2029. Lawmakers would still need to reform benefit levels and the eligibility age."

Ah, but Biden also used Thursday's speech to kneecap any discussion of making those other changes.

"If anyone here tries to cut Social Security or Medicare or raise the retirement age," he vowed, "I will stop them."

It's nice to see the president at least acknowledge one of the difficult choices that lie ahead for policymakers grappling with the coming insolvency of America's entitlement programs. On that count, he's at least marginally ahead of his prospective electoral opponent, former President Donald Trump, who maintains that Social Security needs no reforms.

Still, Biden's a long, long way from anything that sounds like a workable proposal—and the lack of details in Thursday's speech suggests the White House would prefer to stay away from this topic during an election year.

The post Biden Says He'll Make the Wealthy Pay More To Fix Social Security. Here's Why That Won't Work. appeared first on Reason.com.