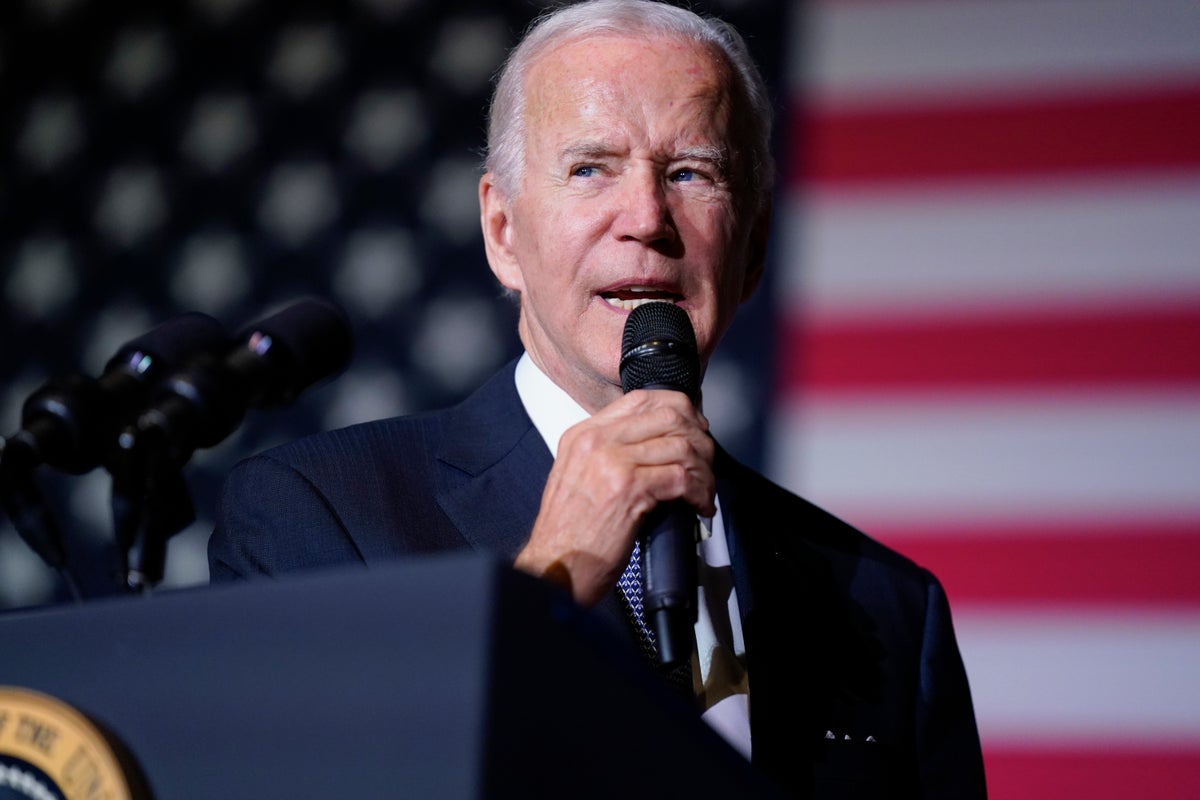

In the days and weeks before the midterm election, President Joe Biden trumpeted his plan to cancel billions in student loans as he rallied young people to support Democrats.

But now the entire initiative is in jeopardy because of legal challenges that could ensure no one receives a dollar of debt relief. The debacle is swiftly becoming a headache for the administration instead of an example of how the president keeps his promises to voters.

The White House insists it will ultimately prevail even though two federal courts blocked the program from taking effect. However, the setbacks have rattled supporters who fear that more than 40 million Americans who expected relief will instead start getting billed for their student debt in January, when a pandemic-era moratorium on payments is slated to expire.

“You cannot ask people to begin repaying on a debt that shouldn’t exist,” said Melissa Byrne, an advocate for loan cancellation. “We bear no blame in this broken system.”

The impasse has left the White House in a bind over whether to extend the moratorium if the legal battle drags on even though Biden has said the pandemic, the original reason for the pause in payments, “is over.”

The freeze has already cost the federal government more than $100 billion in lost revenue, according to the Government Accountability Office. Critics such as the Committee for a Responsible Federal Budget are warning Biden that another extension could worsen inflation and raise the risk of economic recession.

Republicans oppose cancellation as an unfair handout of the wealthy, arguing Americans who didn’t go to college will bear the cost as well. Conservatives have orchestrated a barrage of legal attacks against Biden’s plan, saying it overstepped the president’s authority.

In the meantime, borrowers across the nation yet again face uncertainty. An estimated 20 million were eligible to get their federal student debt canceled entirely by Biden’s plan, which would cancel $10,000 in student loan debt for those making less than $125,000, or households making less than $250,000. Those who receive Pell Grants, typically given to those with lower incomes, would get another $10,000 in debt forgiveness.

Now, it’s unclear if borrowers will be expected to make payments on that debt when the pause ends, and the political hazards are growing. At risk is support from 43 million borrowers who have been promised at least some debt relief, including millions of younger Americans, a demographic that helped deliver key wins for Democrats last week.

About 6 in 10 voters under 45 approve of Biden’s handling of student debt, according to AP VoteCast, a survey of more than 94,000 voters nationwide. Voters as a whole were almost evenly divided on the issue, while Democrats were far more likely to show approval than Republicans.

Supporters say borrowers should be angry not with Biden, but with the Republican-appointed judges who blocked his plan.

Nearly 26 million people already have applied for the debt relief, out of an estimated 43 million eligible. The Education Department stopped accepting new applications Friday after a federal judge in Texas struck the plan down.

Speaking in New Mexico on Nov. 3, Biden said he was on solid legal ground.

“We’re fighting them in court,” he said. We’re not letting them get away with it.”

Without the promised relief, advocates say many borrowers could quickly fall into default on their student loans. Nearly half of borrowers surveyed by the Student Debt Crisis Center say they will be unable to afford student debt payments within six months, according to a report released Tuesday. More than 6 in 10 said savings from debt cancellation would help them buy food.

“Borrowers do not feel that the pandemic is over, they do not feel that the economic impacts are over,” said Natalia Abrams, president of the center. “We need to pause payments until all legal hurdles are cleared.”

The legality of mass student debt forgiveness was in question from the start. After being elected, Biden said it would be best if the measure came from Congress. Soon before leaving office, the Trump administration released a memo concluding that the White House does not have authority for wide cancellation.

Supporters say they still have faith that Biden’s plan will survive, despite predictions that it could go before a Supreme Court that has shifted to the right and curbed Biden’s authority in other decisions. They argue that the Higher Education Act, a sprawling federal law, already gives the president wide power to cancel federal student debt.

Some groups say Biden should pursue other legal avenues to deliver his promise. The Debt Collective, a union of borrowers, is urging Biden to cancel debt immediately by invoking the Higher Education Act, the same legal authority initially suggested by supporters including Sen. Elizabeth Warren, D-Mass.

“He has an ace up his sleeve and he hasn't used it,” said Braxton Brewington, a spokesperson for the collective. “The Biden administration should simply sidestep these lawsuits."

Some legal scholars say Biden should scrap the current plan and start over. Jed Shugerman, a law professor at Fordham University in New York, said he believes the White House made a mistake in its legal reasoning.

“The Biden administration has run into trouble that was clearly foreseeable,” he said. “They should go back to square one.”

Even though that would take time, Shugerman said, it’s better than waiting for a loss from the Supreme Court. The White House, he said, is “sticking to a sure loser” instead of “changing tracks to something that has a better chance.”

___

Associated Press writer Hannah Fingerhut contributed to this report.