It has not been a very smooth ride for Beyond Meat (BYND) lately. The stock has been getting thrashed as volatility in the market remains high.

Even worse, a bear market in growth stocks has really made life tough for investors in the El Segundo, Calif., producer of plant-based meat.

As if there weren’t enough things to take stock of over the past 48 hours, Beyond Meat reported earnings after the close on Thursday.

The company reported a slight year-over-year decline in revenue, which missed analysts’ expectations. For a growth stock, that’s a double-whammy no-no.

Competition is clearly weighing on the company’s business, as it becomes harder and harder to generate growth.

While a bear market certainly doesn’t help, the increasing difficulty in sales growth is being reflected in the share price, too.

The stock recently was down about 80% from the 2021 high. When will the market finally have the right valuation on this stock?

Trading Beyond Meat Stock

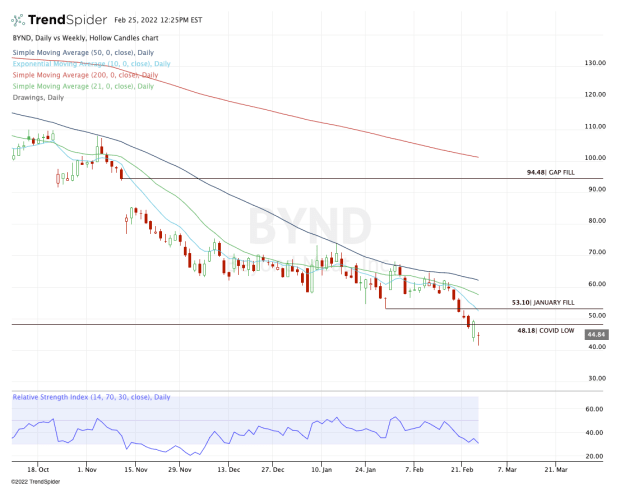

Courtesy of TrendSpider.com

Beyond Meat has been in a relentless decline — a bear market of its own. We talked about this a month ago, as the shares were trying to rally off the January low.

Instead, the stock ran right into the declining 50-day moving average and was rejected. Now it's making new lows on the day -- but at least one silver lining is showing.

Beyond Meat stock initially moved lower on the day, but the bulls were able to bid it up off the lows. Granted, it’s still down almost 10%, but it undercut Thursday’s low and reclaimed it.

That at least gives bulls an area of interest to measure against and could be a sign that the selling is becoming a bit exhausted.

That said, we must remember that this stock is in a brutal downtrend. One little silver lining isn’t going to change that. Nor is it going to make it a safe holding going forward.

If we see some further short-covering, let’s see whether Beyond Meat stock can reclaim the Covid low from March 2020 at $48.18. Above that puts $53 in play and the declining 10-day moving average.

A real jolt higher unlocks the 21-day, then active resistance via the 50-day moving average.

As for the downside, keep an eye on today’s low. A break of that mark — and in particular, a close below it — does not bode well for bulls. Another level to keep an eye on is $44.69, the prior all-time low before today’s move.