/Best%20Buy%20Co_%20Inc_%20logo%20by-LukeandKarla_Travel%20via%20Shutterstock.jpg)

Valued at a market cap of $14.8 billion, Best Buy Co., Inc. (BBY) offers a wide range of products, including computers, smartphones, televisions, home appliances, and accessories, along with services such as installation, repair, and technical support. The Richfield, Minnesota-based company operates through a strong omnichannel model that combines physical stores with a robust online platform.

This retail company has notably underperformed the broader market over the past 52 weeks. Shares of BBY have declined 21% over this time frame, while the broader S&P 500 Index ($SPX) has gained 15.6%. Moreover, on a YTD basis, the stock is up marginally, compared to SPX’s 1.7% rise.

Narrowing the focus, BBY has also lagged the State Street SPDR S&P Retail ETF (XRT), which surged 13.8% over the past 52 weeks and 4.4% on a YTD basis.

On Nov. 25, BBY shares climbed 5.3% after delivering better-than-expected Q3 results. Due to strong growth across computing, gaming and mobile phones, the company’s comparable sales grew 2.7%, while its total revenue increased 2.4% year-over-year to $9.7 billion, surpassing consensus estimates by a slight margin. Moreover, its adjusted EPS advanced 11.1% from the year-ago quarter to $1.40, topping analyst expectations of $1.31. Adding to the uptick, BBY raised its fiscal 2026 outlook, expecting adjusted EPS guidance to be between $6.25 and $6.35.

For the current fiscal year, ending in January, analysts expect BBY’s EPS to decline marginally year over year to $6.31. The company’s earnings surprise history is promising. It topped the consensus estimates in each of the last four quarters.

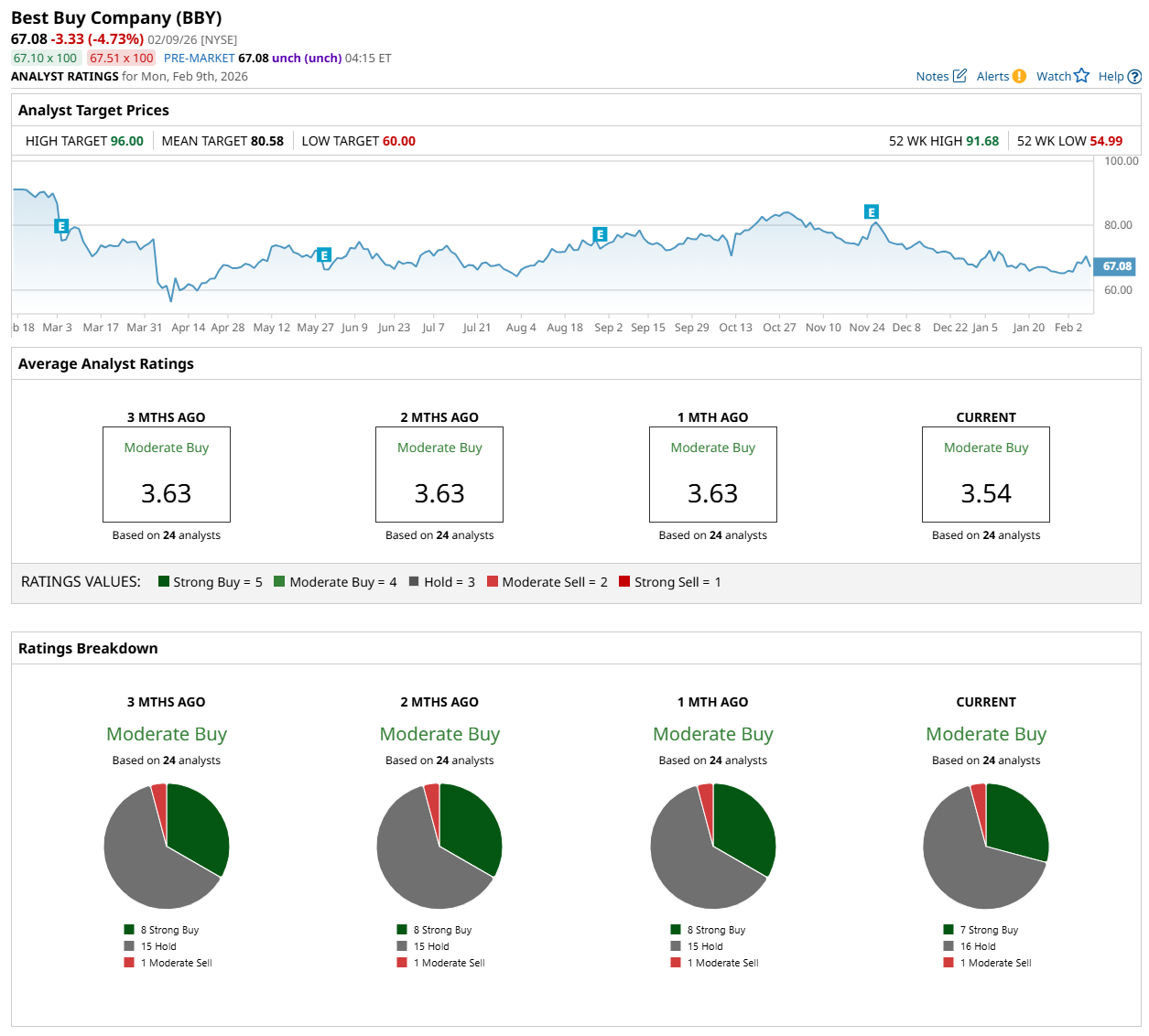

Among the 24 analysts covering the stock, the consensus rating is a "Moderate Buy,” which is based on seven “Strong Buy,” 16 “Hold,” and one "Moderate Sell” rating.

The configuration is less bullish than a month ago, with eight analysts suggesting a “Strong Buy” rating.

On Feb. 3, Evercore Inc. (EVR) maintained an "In Line" rating on BBY but lowered its price target to $70, indicating a 4.4% potential upside from the current levels.

The mean price target of $80.58 represents a 20.1% premium from BBY’s current price levels, while the Street-high price target of $96 suggests a 43.1% potential upside from the current levels.