High-rolling investors have positioned themselves bullish on Affirm Holdings (NASDAQ:AFRM), and it's important for retail traders to take note. \This activity came to our attention today through Benzinga's tracking of publicly available options data. The identities of these investors are uncertain, but such a significant move in AFRM often signals that someone has privileged information.

Today, Benzinga's options scanner spotted 9 options trades for Affirm Holdings. This is not a typical pattern.

The sentiment among these major traders is split, with 66% bullish and 33% bearish. Among all the options we identified, there was one put, amounting to $26,750, and 8 calls, totaling $427,221.

What's The Price Target?

Taking into account the Volume and Open Interest on these contracts, it appears that whales have been targeting a price range from $40.0 to $85.0 for Affirm Holdings over the last 3 months.

Volume & Open Interest Trends

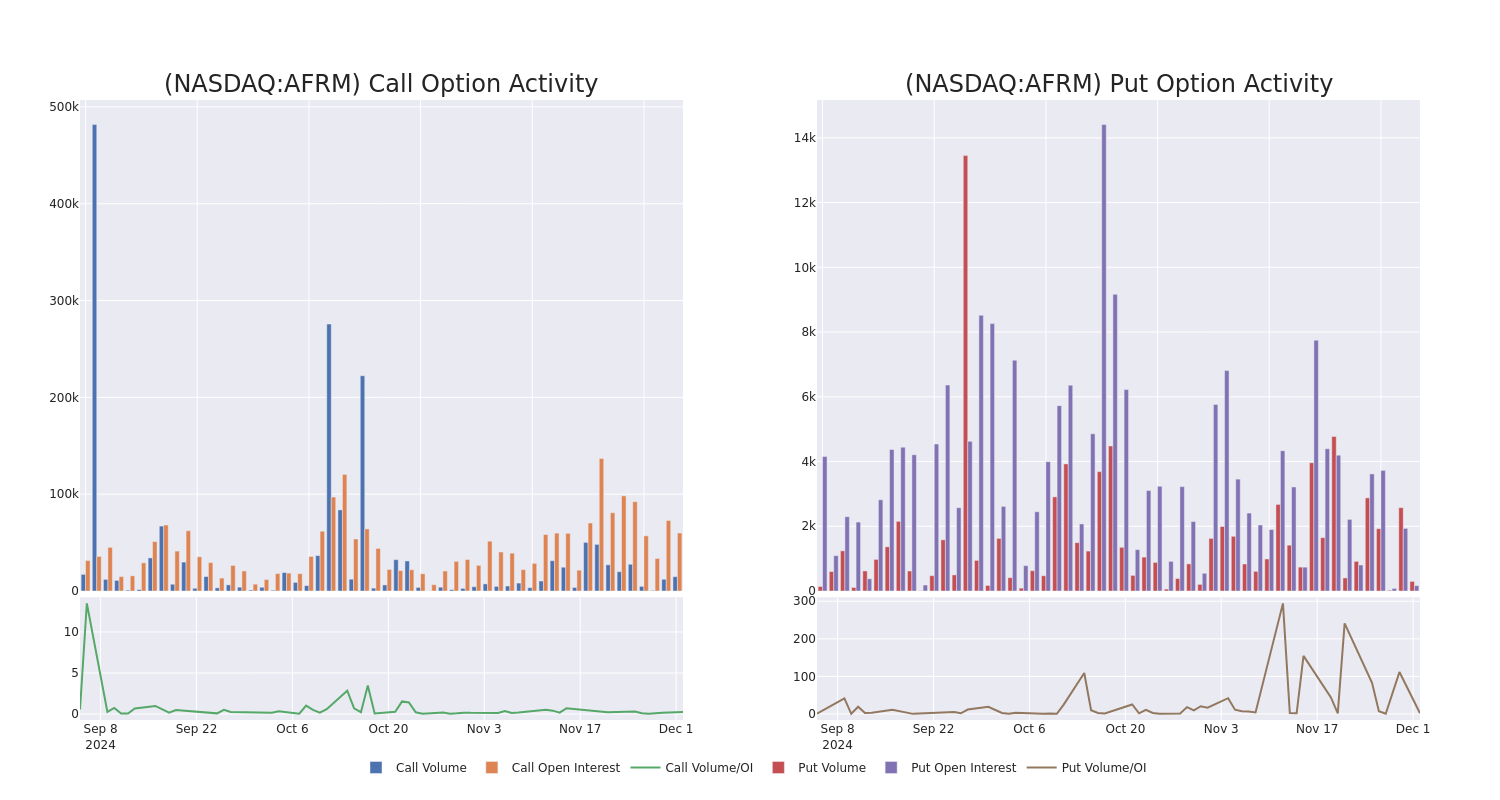

In today's trading context, the average open interest for options of Affirm Holdings stands at 3803.75, with a total volume reaching 802.00. The accompanying chart delineates the progression of both call and put option volume and open interest for high-value trades in Affirm Holdings, situated within the strike price corridor from $40.0 to $85.0, throughout the last 30 days.

Affirm Holdings Call and Put Volume: 30-Day Overview

Largest Options Trades Observed:

| Symbol | PUT/CALL | Trade Type | Sentiment | Exp. Date | Ask | Bid | Price | Strike Price | Total Trade Price | Open Interest | Volume |

|---|---|---|---|---|---|---|---|---|---|---|---|

| AFRM | CALL | TRADE | BULLISH | 02/21/25 | $30.2 | $29.25 | $30.2 | $40.00 | $120.8K | 1.1K | 40 |

| AFRM | CALL | SWEEP | BEARISH | 01/17/25 | $21.75 | $21.45 | $21.45 | $50.00 | $107.1K | 6.7K | 50 |

| AFRM | CALL | SWEEP | BULLISH | 01/17/25 | $28.15 | $27.8 | $28.15 | $42.50 | $42.2K | 4.1K | 21 |

| AFRM | CALL | SWEEP | BULLISH | 12/06/24 | $2.49 | $2.42 | $2.48 | $70.00 | $40.7K | 3.1K | 475 |

| AFRM | CALL | SWEEP | BEARISH | 12/06/24 | $13.45 | $13.05 | $13.05 | $56.00 | $36.5K | 242 | 0 |

About Affirm Holdings

Affirm Holdings Inc offers a platform for digital and mobile-first commerce. It comprises a point-of-sale payment solution for consumers, merchant commerce solutions, and a consumer-focused app. The firm generates its revenue from merchant networks, and through virtual card networks among others. Geographically, it generates a majority share of its revenue from the United States.

Present Market Standing of Affirm Holdings

- With a volume of 1,002,987, the price of AFRM is up 2.84% at $70.33.

- RSI indicators hint that the underlying stock may be overbought.

- Next earnings are expected to be released in 65 days.

What Analysts Are Saying About Affirm Holdings

In the last month, 5 experts released ratings on this stock with an average target price of $68.8.

Turn $1000 into $1270 in just 20 days?

20-year pro options trader reveals his one-line chart technique that shows when to buy and sell. Copy his trades, which have had averaged a 27% profit every 20 days. Click here for access. * An analyst from Barclays has decided to maintain their Overweight rating on Affirm Holdings, which currently sits at a price target of $64. * Consistent in their evaluation, an analyst from B of A Securities keeps a Buy rating on Affirm Holdings with a target price of $74. * An analyst from JP Morgan persists with their Overweight rating on Affirm Holdings, maintaining a target price of $74. * Consistent in their evaluation, an analyst from Susquehanna keeps a Positive rating on Affirm Holdings with a target price of $57. * An analyst from Barclays has decided to maintain their Overweight rating on Affirm Holdings, which currently sits at a price target of $75.

Trading options involves greater risks but also offers the potential for higher profits. Savvy traders mitigate these risks through ongoing education, strategic trade adjustments, utilizing various indicators, and staying attuned to market dynamics. Keep up with the latest options trades for Affirm Holdings with Benzinga Pro for real-time alerts.