Last week we were on high alert about the potential for a new bear market emerging as the S&P 500 (SPY) violently broke below the 200 day moving average on 3/10. That led me to write the following commentary:

Has the Next Bear Market Already Arrived?

Here we are a week later with a modest bounce from bottom...but still well below the 200 day moving average @ 5,747.

What does that mean for our stock market outlook?

We will answer that in the commentary that follows...

Market Outlook

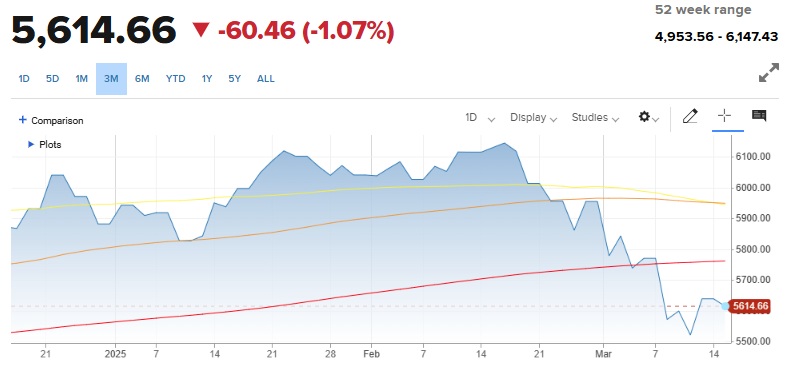

Let’s start with the current chart of the S&P 500 which remains below the long term trend line of the 200 day moving average:

(Yellow = 50 Day Moving Average / Orange = 100 Day MA / Red = 200 Day MA)

Staying below the 200 day for this long is not good news...but not necessarily bad news either.

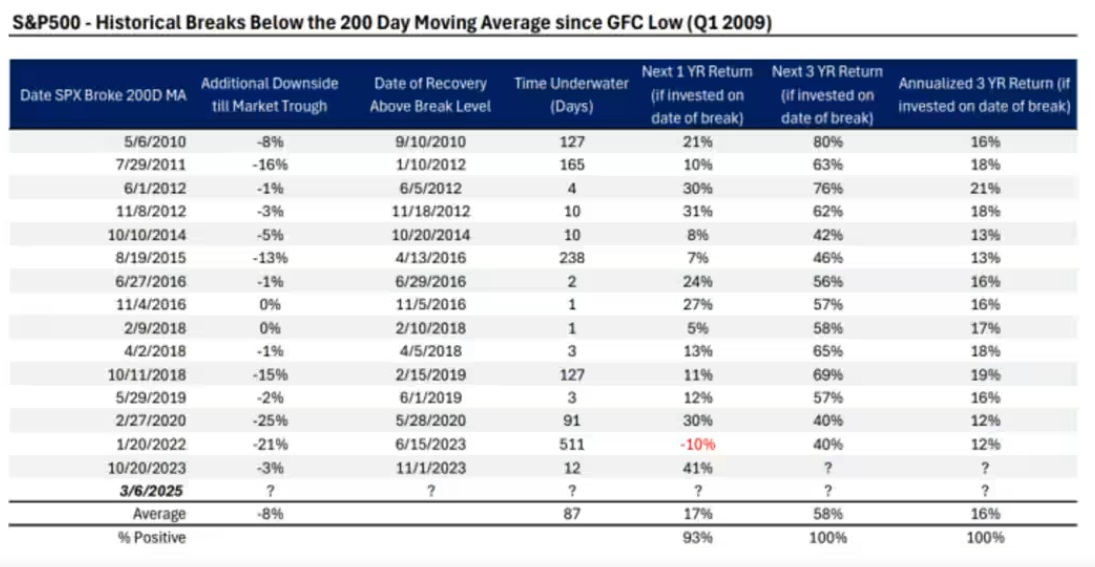

As you peruse this chart below about past breaks under the 200 day, shared in last week’s commentary, you will see that the key to not descending further into a bear market abyss is hopefully to break back above the 200 day moving average within 3 weeks (data in the middle column).

Why 3 weeks?

Because the longest we have been below without the market going much, much lower is 12 market days from the break below that happened on 11/1/2023.

I say 3 weeks because history does not repeat itself perfectly. So giving a few more days past 12 market days in the neighborhood of 15 days seems like ample leeway for the market to correct. If not, then odds of much more downside (and potential bear market) greatly increases.

More specifically, I am saying we want to bounce back above the 200 day moving average by Monday 3/31 which equates to three weeks after the break below on 3/10.

There is some good news out there to increase the odds of this positive outcome. That starts with the CPI report on 3/12 followed by the PPI on 3/13. Both were lower than expected after a long period of inflation being plateaued at too high of a level.

This sounds like good news given that the majority of the time the last 2 years we have been focused on inflation and what the Fed will do with rates.

HOWEVER...the recent weakening of inflation may have something to do with the weakening of the economy. Like the dramatic fall of the Q1 GDPNow reading from +2.2% to -2.8% by early March. That has improved marginally to -1.8% as of Tuesday of this week.

No doubt this economic weakness has the odds of recession on the rise. Couple that with confusion over tariffs would easily lead to a weakening in demand which tamps down inflation.

The silver lining in that is that with inflation coming down...and signs of a weakening economy, the Fed will be much more likely to lower rates to support the economy to help insure maximum employment (part of their dual mandate).

Right now the odds of that happening at their next meeting on Wednesday March 19th is a shockingly low 1%. That only increases to 17% for the May 7th meeting.

I agree that 3/19 is likely too soon for the next cut. But I would put the May meeting at about 50/50 given a likely increased fear of economic weakness on the way.

Again, Fed policy is not a miracle elixir. It generally takes 6+ months to see any real impact in the economy. Thus, to stave off any serious harm to the economy, especially to employment, then they would be wise to start cutting fairly soon.

Now that I say that out loud it would be really cool for them to do that on 3/19 as a true surprise cut. That move alone could quickly reverse any current negative market sentiment helping stocks break back above the 200 day moving average. And that move would have positive ripple effects to corporate executives who are very tuned into the stock market as a barometer of how they feel about future business outlook.

The better they feel about the stock market > better they feel about business outlook > more likely to make new investments in the business which then bolsters the economy

Yes, that is a positive reinforcing cycle. Unfortunately the opposite is also true:

The worse they feel about the stock market > worse they feel about business outlook > less likely to make new investments in the business which then weakens the economy

It is not the Fed’s job to prop up the stock market, but quite often they know that lowering rates makes stocks look like a better investment which kicks this positive chain reaction into motion that helps with their mandate to maximize employment.

That was certainly true with massive rate cuts in 2008/2009 to end the Great Recession.

That was also certainly true in the Spring of 2000 to end the Covid bear market.

So not so crazy to think they could do the same now. If not in March...then certainly in May.

Our investment gameplan very much hinges on what happens next.

Break back above 200 day moving average thus decreasing odds of descending into bear market = put 30% cash position to work in new Risk On stocks ready to bolt higher.

Stay below 200 day moving average past 3/31 greatly increasing the odds of more pain on the way = sell more of our Risk On positions to get to 50% long or even more defensive.

The more likely it seems a bear market is in the offing...the more likely we raise cash and/or buy inverse ETFs to profit from the downside.

Those who have followed me for a number of years may see more caution in my market timing approach than the past. That’s because the modern market acts differently than the past. That has a lot to do with the increase in computer based trading versus humans making the decisions.

Thus, many of the lessons of history are from periods before computer based trading...and thus past patterns do not necessarily play out the same as the past.

Meaning we are almost driving without a map which makes it harder to reach our destination.

Acknowledgement of the more difficult landscape has me approaching market timing in a more cautious fashion.

This is not 2008 when the financial system nearly collapsed and it was obvious that the only direction for stocks was down.

This is not 2020 with a worldwide Pandemic crushing the economy where down was the only possible direction for stocks.

This is more like 2022 when odds of something bad happening have increased...but not a sure thing. Even that bear market many look back on as just an overripe correction since no recession unfolded and thus the depth of the sell off was in many ways unnecessary.

Back to the point...its tricky out there. And our game plan is built with a firm understanding of that point.

Or to put it in Fed speak “our decisions will be data dependent”.

So as we get new data, we will adjust our plans accordingly.

What To Do Next?

Check out my portfolio with hand selected picks for the current market environment:

- 8 stocks to buy

- 1 stock to short

- 1 ETF to buy

All the stocks have been selected using the proven outperformance that comes from our POWR Ratings stock selection model which has done 4X better than the S&P 500 since 1999.

Now add in my 44 years of investing experience seeing bull markets...bear markets...and everything between. This helps me pick the right stocks for the current environment.

If you are curious to learn more, and want to see my current 10 recommendations, then please click the link below to get started now.

Steve Reitmeister’s Trading Plan & Top 10 Recommendations >

Wishing you a world of investment success!

SPY shares fell $0.67 (-0.12%) in after-hours trading Tuesday. Year-to-date, SPY has declined -4.28%, versus a % rise in the benchmark S&P 500 index during the same period.

About the Author: Steve Reitmeister

Steve is better known to the StockNews audience as “Reity”. Not only is he the CEO of the firm, but he also shares his 40 years of investment experience in the Reitmeister Total Return portfolio. Learn more about Reity’s background, along with links to his most recent articles and stock picks.

Bear Market Watch: Week 2 StockNews.com