Rachel Reeves announced £40 billion a year in extra taxes as she increased Government borrowing and spending to “rebuild Britain”.

The Chancellor’s plans will see the tax burden reach an historic high, while borrowing increases by an average £32.3 billion a year as spending increases by around £70 billion annually over the next five years.

Ms Reeves said the measures were necessary to address the “black hole” in the public finances left by the Tories while pumping billions into schools and hospitals.

She confirmed plans to hike employers’ national insurance contributions and increase capital gains tax, while also making changes to inheritance tax and stamp duty.

And changing the way government debt is measured allowed her greater flexibility to borrow, resulting in what the Office for Budget Responsibility called “one of the largest fiscal loosenings of any fiscal event in recent decades”.

Here are the main points from Chancellor Rachel Reeves’ Budget:

– The Chancellor has raised taxes by £40 billion. “Any chancellor standing here today would face this reality, and any responsible chancellor would take action,” Ms Reeves said.

– Among the measures are a 1.2 percentage point increase for employers’ national insurance contributions to 15% in April 2025. The threshold for paying them will fall from £9,100 per year to £5,000.

– The headline rates of capital gains tax will increase, with the lower rate rising from 10% to 18% and the higher rate from 20% to 24%.

– The stamp duty land tax surcharge for second homes will increase by two percentage points to 5%, and will come into effect from Thursday, the Chancellor added.

– She also confirmed changes to inheritance tax. This includes bringing pension pots within the with tax from April 2027 and reforms to agricultural and business property reliefs, raising a total of £2 billion a year.

– On personal taxes, the Government will not extend the freeze on income tax and national insurance thresholds beyond 2027/28, saying it would “hurt working people” to keep thresholds frozen.

– The Chancellor said that national insurance, VAT or income tax will not increase for working people in this Budget. “I say to working people: I will not increase your national insurance, your VAT, or your income tax,” Ms Reeves said.

– The national minimum wage will rise by 6.7% to £12.21 an hour after asking the Low Pay Commission to take the “cost of living” into account. The Government will move to a single level of the minimum wage, the Chancellor said, which will mean a flat rate for those 18 and above.

– A “flat rate duty” on vaping liquid will be introduced from October 2026. Taxes will also increase on tobacco. Meanwhile draught duty on alcoholic drinks will fall by 1.7%, meaning “a penny off a pint in the pub”.

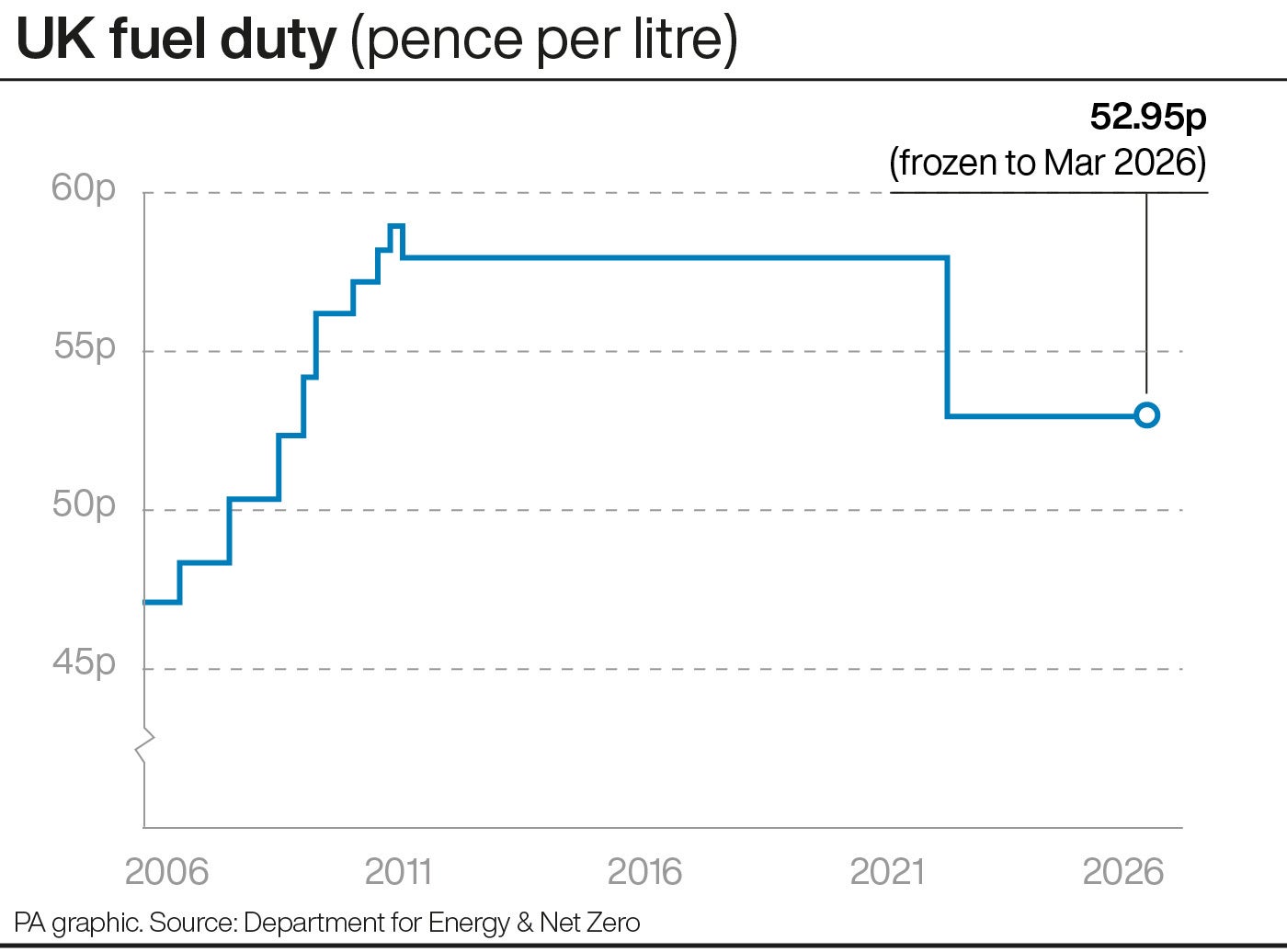

– The 5p cut to fuel duty will be kept into next year, with Ms Reeves saying it would be the “wrong choice” to increase it. She said keeping the cut and freezing it again will cost £3 billion.

– Ms Reeves reiterated the Government’s commitment to the pension triple lock, telling the Commons the basic and new state pension will rise by 4.1% in 2025-26.

– The weekly earnings limit for carers allowance will rise to the equivalent of 16 hours a week at the national living wage, the largest increase since the allowance was introduced.

– The Government will set aside £11.8 billion to compensate those affected by the infected blood scandal and £1.8 billion to compensate victims of the Post Office Horizon scandal.

– On public services, the Chancellor said there will be “no return to austerity”.

– Ms Reeves announced a £22.6 billion increase in the day-to-day health budget as well as a £3.1 billion increase in the capital budget, which she called the “largest real-terms growth in day-to-day NHS spending outside of Covid since 2010”.

– Defence spending will rise by £2.9 billion next year, and provide £3 billion of support to Ukraine each year.

– The Chancellor has announced £1.4 billion to rebuild more than 500 schools as part of a 19% real-terms increase in the Department for Education’s capital budget, along with £2.1 billion for school maintenance.

– The core schools budget will rise by £2.3 billion next year, with an extra £1 billion funding increase to special educational needs provision. Investment in breakfast clubs will be tripled, Ms Reeves added.

– HS2 will be brought to Euston Station in London, Ms Reeves confirmed. She said she would commit “the funding required” to begin tunnelling work.

– Rail links will be upgraded between York, Leeds, Huddersfield and Manchester.

– Local government will get an “significant real-terms funding increase”, with £1.3 billion of extra grant funding next year to deliver “essential services,” Ms Reeves announced.

– The Government will invest more than £5 billion in housebuilding, and £1 billion of funding to remove dangerous cladding next year.

– Ms Reeves said she is setting a “2% productivity, efficiency and savings target” for all Government departments next year.

– The Government hopes to raise £6.5 billion by giving HMRC new technology and hiring extra staff to crack down on £6.5 billion in unpaid taxes.

– The Chancellor went on to say she will reduce fraud in the welfare system by hiring new members of the Department for Work and Pensions counter-fraud teams. It will save £4.3 billion a year by 2029.

– Regions in Scotland and Northern Ireland will get new growth deals, and devolved nations will get the largest real-terms funding amount since devolution. Scotland will get an extra £3.4 billion, Wales will get £1.7 billion, and £1.5 billion for Stormont in Northern Ireland.

– On inflation, ministers will maintain the MPC’s (Bank of England’s Monetary Policy Committee) target of 2%, as measured by the 12-month increase in the Consumer Prices Index.

– Ms Reeves said the OBR has forecast that CPI inflation will average 2.5% this year, 2.6% in 2025, then 2.3% in 2026, 2.1% in 2027, 2.1% in 2028 and 2% in 2029.

– The Chancellor said Government borrowing for this year is expected to reach £127 billion.

– Public sector net borrowing will be £105.6 billion in 2025-26 and drop each year to £70.6 billion in 2029-30.

– She added the current budget will be in deficit by £26.2 billion in 2025-26 and £5.2 billion in 2026-27, before moving into surplus of £10.9 billion in 2027-28, £9.3 billion in 2028-29 and £9.9 billion in 2029-30, meeting the Government’s “stability rule” two years early.