The Australian share market closed 1.1 per cent lower on Thursday.

KPMG writes an email to staff saying it 'can no longer sit by' after PwC tax leaks.

The Australian Energy Regulator announces a default price jump for residential and small business customers.

Follow the day's financial news and insights from our specialist business reporters on our live blog.

Disclaimer: this blog is not intended as investment advice.

Key events

To leave a comment on the blog, please log in or sign up for an ABC account.

Live updates

Market snapshot at 4.17pm AEST

By Nassim Khadem

ASX 200: -1.1% to 7138.2 at market close

All Ordinaries: -1% to 7,316.7 points

Australian dollar: 65 US cents

Nikkei: +0.39% to 30,801 points

Hang Seng: -2.41 to 18,655.9 points

Shanghai: -0.92% to 3,175 points

S&P 500: -7.3% to 4,115 points

Nasdaq: -0.61% to 12,484 points

FTSE: -1.75% to 7,627.1 points

EuroStoxx: -1.81% to 4,263.7 points

Spot gold: -0.16% to $US$1,956.85/ounce

Brent crude: +1.98% to $78.36/barrel

Iron ore: -4.52% to $US$95.46/tonne

Bitcoin: -0.31% to $US26,241

Thanks for being with us, until next time!

By Nassim Khadem

Some of you have given us feedback throughout the day that you love GIFs; that they lighten the mood at time when economic news can be quite depressing.

Some of you say they are annoying and childish. I get it. I've not always been a fan of them either.

But I have succumbed to the majority and have come to live with them. Give us more feedback so we can work out whether they stay or go, and what you enjoy or don't about our blog.

Thanks for being with us today, until next time!

Australian shares close lower; miners, banks down

By Nassim Khadem

Australian shares fell 1.1 per cent to 7138.2 at market close, dragged down by miners and a stock sell-off overnight on Wall Street and Europe.

BHP Group shares fell 1.6 per cent, Rio Tinto dropped 1.6 per cent and Fortescue Metals lost 3.6 per cent.

Treasury Wine Estate was the worst performing stock. Its shares fell by 7.8 per cent after its chief executive Tim Ford said sales would be down overall across the group by 2 to 3 per cent.

The big banks were also in the red. Commonwealth Bank shares were down 2.2 per cent, Westpac fell 1.6 per cent, ANZ lost 2.6 per cent and National Australia Bank dropped 2.1 per cent.

Update

By Nassim Khadem

Given that electricity prices are about to move up significantly how do you feel the energy stocks like origin and AGL are placed?

- tony orlando

Capital Markets analyst Gordon Ramsay has the perfect answer for you Tony.

He says it's a positive for AGL more than Origin.

Here's why according to Ramsay:

"AGL and Origin have large electricity generation portfolios underpinned by coal and gas-fired generators, which allows the two companies to retain a somewhat fixed (more fixed than competitors) wholesale generation cost.

"In a rising price environment this should allow the two companies to improve electricity gross margins. While Origin has a strong contracted gas book, AGL has a stronger coal supply position which allows AGL to provide some of the lowest cost base load electricity in the market. For this reason, we believe that AGL is positioned to capture more of a benefit in a rising electricity price environment versus Origin."

Hope that helps answer your question.

Thanks for your comments

By Michael Janda

They were very enlightening and generally quite positive, which is great.

The issue of gifs remains vexed: some love, some hate and a few are 'meh'.

I think we'll probably keep them because there were slightly more commenters who said they liked them to break up the blog with some colour, humour and images, but we'll use in moderation so as not to antogonise those who just find them annoying distractions.

I am off now, but Nassim will stay with you to bring you the market close numbers.

KPMG 'can no longer sit by' after PwC tax leaks

By Nassim Khadem

KPMG's management has sent an email to its staff in the light of the PwC tax leak scandal, reminding its partners and staff to act "ethically and in the public interest".

PwC used confidential information — collected from the government when the firm was advising it on developing international tax avoidance laws — to help global clients avoid tax.

"There has been significant exposure on this across the past few weeks," the pair wrote referring to the PwC matter.

"This latest news is an important development: we can no longer sit by and watch our profession be tarnished by the unethical actions of a few. The decision by Treasury underlines the gravity of the matter."

On Wednesday Treasury referred the leaking of confidential tax briefings by PwC and its former head of international tax Peter Collins to the Australian Federal Police.

In a statement, Treasury secretary Steven Kennedy said Mr Collins "improperly used confidential Commonwealth information", with emails tabled in parliament by the Tax Practitioners Board highlighting "the significant extent of the unauthorised disclosure of confidential Commonwealth information and the wide range of individuals within PwC who were directly and indirectly privy to the confidential information".

He said in light of these recent revelations and the seriousness of this misconduct, the Treasury referred the matter to the Australian Federal Police to consider commencement of a criminal investigation.

Speaking in parliament this morning, AFP national security deputy commissioner Ian McCartney revealed the investigation was currently into "an individual in relation to their activities" but warned if police "identify any further people we believe may have committed an offence" they may come under investigation.

Finance Department secretary Jenny Wilkinson has told Senate estimates hearings in Canberra she considers the PwC tax leak to be an abuse of confidence and trust with the federal government.

Parliament has heard 53 current and former PwC partners and staff received emails revealing confidential tax information.

PwC has now agreed to an order to "stand down" any staff who knew about Treasury tax leaks from working on any existing or future government contracts.

KPMG's email to its staff said they were often "trusted with confidential information" and "acknowledged that as a firm we have not got everything right", referencing the firm's cheating scandal and the behaviour of partners relating to a controversial NSW transport entity but said that they had worked to "put it right" in the aftermath of the issues.

"At our firm, we recognise it is a privilege to support our clients in a commercial capacity or advisory role," the pair wrote. "We are often trusted with confidential information as part of our interaction with clients. And with 10,000 people working on complex and high-profile projects, there may be cases where we fall short of what is expected."

They said when they learned of the TPB findings, they "fully appreciated the seriousness of these wrongdoings and the potential impact on all professional services firms".

Gainers and losers on the market

By Michael Janda

Market snapshots are useful. I like the format. Gifs are also a bit of fun personality. My only comment is on Tuesday, ZIP wasn't showing in the biggest gains/losses chart despite having a rise of 10%? Why the omission? The "biggest gainer" shown was only ~5% Thanks!

- Justin

Hi Justin, that is a good question and I've looked into it.

I am pretty sure that Zip has dropped out of the ASX 200 index, because of its price slump over the past 18 months.

We construct our winners and losers out of the ASX 200, otherwise the list would be dominated by the wild moves that often occur for smaller firms.

So Zip wasn't there because it's market capitalisation is no longer big enough to make it onto the ASX 200.

Australian shares down, SVB owner lays off nearly 500 staff

By Nassim Khadem

Australian shares fell 0.88 per cent, to 7,150 points, after noon, with miners continuing to record losses amid weaker iron ore prices.

BHP shares fell 1.18 per cent to $42.32 while Rio Tinto dropped 1.2 per cent.

Treasury Wine Estate shares fell 5.88 per cent after chief executive Tim Ford said sales would be down overall across the group by 2 to 3 per cent.

Silicon Valley Bank owner First Citizens Bank says it will cut 3 per cent of its workforce, after its collapse earlier this year.

The bank, which has been described as once "the hearts and lungs" of lending in Silicon Valley, was taken over by First Citizens, a North Carolina lender.

The bank was one of many US regional banks to face pressure and was left with big debts when the Federal Reserve raised interest rates earlier in the year.

However, the acquiring bank has now announced layoffs, with about 500 positions, or 3 per cent of its workforce, set to be eliminated.

First Citizens Bank chief executive Frank Holding said these job cuts would primarily affect 'select' corporate roles.

Market snapshot at 12:20 pm AEST

By Nassim Khadem

ASX 200: -0.2% to 7,289 points

All Ordinaries: -0.2% to 7,459 points

Australian dollar: Flat at 66.52 US cents

Nikkei: +0.9% to 31,077 points

Hang Seng: +1.3% to 19,700 points

Shanghai: +0.3% to 3,278 points

S&P 500: -0.1% to 4,192 points

Nasdaq: -0.2% to 12,658 points

FTSE: +0.2% to 7,757 points

EuroStoxx: +0.7% to 469 points

Spot gold: +0.2% to $US1,981/ounce

Brent crude: +0.1% to $US75.64/barrel

Iron ore: -1.7% to $US105.00/tonne

Bitcoin: -0.1% to $US26,799

Some useful feedback, keep it coming

By Michael Janda

Thanks to those readers who've left a comment so far, there's been some really useful feedback.

I had a feeling the topic of gifs would be divisive, and so it is proving.

Be great to have more feedback from a bigger number of readers to get a better weight of opinion on these matters of critical importance!

I'd also love some feedback about the market snapshot pinned posts.

Are they useful or do they just get in the way of getting to the other posts? Is the format OK? Are we missing anything important?

Bank of Korea hold rates steady, but rate cuts next?

By Nassim Khadem

Unlike most other central banks, South Korea's could be cutting rates soon.

The Bank of Korea board voted to keep its policy rate unchanged at 3.50 per cent, as both inflation and economic growth eased.

The central bank started raising interest rates in August 2021 to tame inflation, well before the world's other major central banks, and had raised them by a total of 300 basis points through January this year.

Capital Economics senior Asia economist Gareth Leather said: "we don't think it will be long before the [Korea's] central bank starts cutting interest rates".

"With inflation falling back, the economy struggling and the housing market downturn deepening, we think the BoK will start loosening monetary policy in August, earlier than when others are expecting. "

"The main reason we think the central bank will start loosening policy soon is the weakness of the economy. GDP grew by just 0.3 per cent in Q1 following a 0.4 per cent contraction in the final quarter of last year.

He said pressures were also continuing to ease.

"The headline rate has fallen from a peak of 6.3 per cent in July 2022 to 3.7 per cent in March, which is the lowest reading in over a year."

"Overall, we are expecting 75 basis points worth of rate cuts this year, with the first cut likely to be in August."

He noted that in contrast, most other analysts are expecting either very modest cuts, or for interest rates to be left unchanged this year.

ASX opens lower; Treasury Wine shares tumble

By Nassim Khadem

Australian shares opened lower, with the ASX down 0.67 per cent to 7,165.3 at 10.37am.

The lower opening in Australia followed market sell off across Europe and the US.

Treasury Wine Estate was the worst performing stock, its shares tumbled 5.3 per cent after chief executive Tim Ford said sales will be down overall across the group by 2 to 3 per cent.

The major banks also opened lower.

At 10.30am CBA was trading 0.6 per cent lower, Westpac lost 0.7 per cent, ANZ dropped 0.7 per cent and National Australia Bank fell 0.5 per cent.

The Australian dollar is down slightly fetching 65.42 US cents.

Treasury Wine Estates to cut costs amid revenue fall

By Nassim Khadem

In its latest trading update, Treasury Wines Estates says it expects group net sales revenue to decline 2 per cent to 3 per cent in FY 2023.

This reflects declines in Treasury Americas and Treasury Premium Brands being partly offset by growth for Penfolds.

In a statement, the company said category consumption trends for entry-level premium wine in the United States remained "challenging and have shown signs of further deterioration in recent months".

The company is expecting earnings before interest, tax, SGARA and material items (EBITS) to grow 11 per cent to 13 per cent year over year to between $580 million to $590 million.

Group EBITS margin will be about 23.5 per cent, compared to 21.1 per cent.

"We continually and proactively assess our business performance, our structure and our cost base to make sure we're in the best position to continue to deliver on our premiumisation and growth strategy," chief executive Tim Ford said in a statement.

"With changing consumer preferences and a tightening economic environment in most major markets, we're taking the opportunity to make changes in our business now, so we have increased flexibility in the future to continue to grow our Premium and Luxury portfolios."

TWE shares were trading almost 4 per cent lower at $12.28 at 10.15am Thursday.

PwC tax leaks now under AFP investigation — what happens next?

By Michael Janda

With news out late yesterday that the PwC tax leaks matter has been referred to the Australian Federal Police, as we had flagged earlier this week, what will that mean for the accounting firm/consultancy and its future?

The ABC's senior business correspondent Peter Ryan spoke to author Tom Ravlic, a specialist in the financial services sector.

More on the AFP referral from ABC political reporter Matt Doran.

To gif or not to gif? That is the question

By Michael Janda

We've had some early feedback that at least some readers don't like the gifs.

They are pretty common across ABC blogs, but maybe regular markets readers feel they don't work so well here?

Or maybe there is a silent group out there who love the gifs (or at least don't dislike them)?

Or maybe we're just using them to often?

Please make your voices heard via the comments.

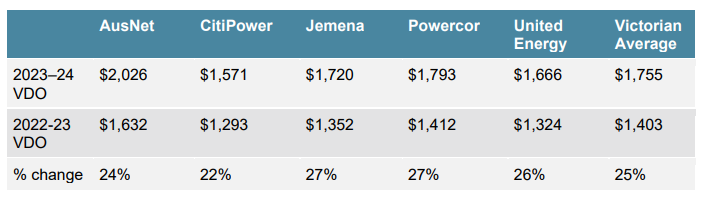

Victorian regulator lowers default offer from draft levels

By Michael Janda

When it released its draft determination a couple of months ago, Victoria's Essential Services Commission warned consumers to brace for electricity price increases of up to 30% next financial year.

Unlike the Australian Energy Regulator, where the final determination came in slightly above the draft, Victoria's price rises will be lower than previously flagged.

The average Victorian household and small business can expect their default standing market offer to rise by 25% from July 1.

Here's the full table for residential customers based on which transmission network you are covered by.

The biggest contributor to the price increase was a rise in wholesale electricity prices.

And while those prices have recently come back, they are still double what they were in 2021-22.

When will we see falling energy prices?

By Michael Janda

Morning Michael. Now inflation is starting to ease, is there any indication when energy prices will follow suit?

- David

Great question David.

It certainly feels like the laws of physics rarely apply to free market economics — when it comes to prices, what goes up frequently stays up.

According to the experts we've spoken to, there's a couple of factors as to why Australian electricity prices are still rising sharply in the coming financial year, even though the cost of the fossil fuels used to produce the majority of that energy have plunged in recent months.

Director of the Monash Energy Institute, Ariel Liebman, said electricity bills are comprised of several charges. The biggest components are wholesale prices, network and retail costs.

"Their [energy retailers'] net profits aren't particularly great. It's expensive to compete in a big market, attracting customers, marketing, and all the information systems," he explained.

So the whole cost of electricity — still mainly burning stuff to turn steam turbines — is only one part of our power bills.

And, while plunging coal and gas prices have lowered wholesale energy costs on the spot market, energy retailers tend to lock in longer-term contracts, to 'hedge' the risk of being stung by short-term price spikes.

"The strategy, known as hedge contracts, fixes the wholesale price retailers pay for electricity over a long period — up to several years," Mr Liebman said.

"The price set in hedge contracts struck over the past year or so was influenced by Australia's domestic gas crisis in 2022, which caused massive rises in wholesale electricity prices."

So that was before the $12 price cap on gas and caps on coal pricing.

Then add in to that that the gas price cap doesn't appear to be working, according to Bruce Robertson, an energy finance analyst for gas and LNG at the Institute for Energy Economics and Financial Analysis (IEEFA).

"Gas sets the price of electricity in the national electricity market. And the price we pay for gas is insanely high," Mr Robertson.

"They're laughing at the government over the gas price cap, because the gas price cap is $12. And [Tuesday] in Sydney, the gas price is $19. And in Victoria, it's $21.

"So there really isn't a cap at all. The gas industry is charging prices that aren't just high … they're obscenely high prices."

"We're talking about five to seven times the price of gas in the US today, we're talking prices higher than the importing countries of Europe, about 50-60 per cent higher.

"We actually produce gas in Australia. And this is a key point — it should be far cheaper here than it is in other countries. It should be more like the levels of the US, for example."

What do you like/not like about our markets live blog?

By Michael Janda

We've been running this markets blog for a bit over half a year now, and it'd be helpful to know what you think.

What do you like? What do we do well?

What do you not like? What's annoying? What would you like to see? What could we do better?

Use the comments button to send us your feedback.

Market snapshot at 8:30am AEST

By Michael Janda

-

ASX 200 futures: -0.4% to 7,196 points

- Australian dollar: -1% to 65.41 US cents

- S&P 500: -0.7% to 4,115 points

- Nasdaq: -0.6% to 12,484 points

- FTSE: -1.8% to 7,627 points

- EuroStoxx: -1.8% to 458 points

- Spot gold: -0.9% to $US1,957/ounce

- Brent crude: +2% to $US78.34/barrel

- Iron ore: -3.7% to $US96.30/tonne

- Bitcoin: -0.2% to $US26,349

Markets still focused on interest rates amid news from Fed, RBNZ and RBA

By Michael Janda

Following hot on the heels of the Reserve Bank of New Zealand effectively calling an end to its aggressive rate hike cycle with one last increase yesterday, we got minutes from the latest US Federal Reserve meeting.

The Fed seems very divided by those 'hawks' who believe rates need to keep going up until inflation falls back much closer to target and 'doves' who believe that the current level of rates will do that job, given some time.

This from ANZ research's morning note, compiled by John Bromhead:

"Fed officials were divided at the May meeting over whether further hikes would be needed.

"Some were concerned that inflation was not falling fast enough, warranting further hikes, while others noted the full effects of past tightening are yet to be felt and tighter credit conditions from recent banking sector stresses could be equivalent to one or two hikes.

"Officials stressed that future decisions will be dependent on the incoming data, supporting what has been said by Fed speakers in recent weeks. Markets are currently pricing in a 29% chance of a hike in June."

Meanwhile, a report from the AFR's political correspondent Phillip Coorey (paywalled) suggests another Philip, Lowe, is not done with raising interest rates in Australia.

Apparently, the RBA governor gave a very pessimistic private briefing to members of the House of Representatives economics committee, saying the odds of staying on the "narrow path" between avoiding recession and getting inflation down were not great.

He also reportedly said that he doesn't have any tolerance for inflation remaining high for a long time and will do what he believes needs to be done to get it back down.