A fall on Wall Street has sent Australian stocks lower, while oil prices fall to their lowest since January.

We brought you the latest on what was happening on the markets throughout the day in our live blog.

Disclaimer: This blog is not intended as investment advice.

Key events

To leave a comment on the blog, please log in or sign up for an ABC account.

Live updates

Market snapshot

By Samuel Yang

This is where the market finished up at the close of local trade shortly after 4:00pm AEDT.

- ASX 200: Down 0.8 per cent to 7,176

- All Ords: Down 0.7 per cent to 7,369

- Aussie dollar: 67.14 US cents

- NZ 50: Up 0.1 per cent to 11,617

- On Wall Street: Dow flat, S&P down 0.2 per cent, Nasdaq down 0.5 per cent.

- In Europe: Stoxx 50 down 0.5 per cent, FTSE down 0.4 per cent, DAX down 0.5 per cent

- Spot gold: Down 0.2 per cent to $US1783.09 an ounce

- Brent crude: Up 0.9 per cent to $US77.86 a barrel

- Bitcoin: Down 0.1 per cent to $US16817.00

ASX falls for the third day in a row

By Samuel Yang

The Australian share market has closed with moderate losses, led by energy and financial sectors.

China reopening optimism subsides as traders focus on recession risks, which was weighing on the Australian dollar.

Downer EDI had the biggest decline on the ASX 200 index after launching an investigation into "historical misreporting of revenue and work in progress".

Gold miners were among the firms bucking the trend amid a jump in prices for the precious metal — Chalice Mining, West African Resources and Silver Lake Renounces were all among the top 10 gainers.

That's all from our live blog today, hopefully you can join us again for all of tomorrow's market action.

ACCC sues Queensland-based Qteq over 'cartel conduct'

By Samuel Yang

The ACCC has filed civil cartel proceedings in the Federal Court against mining equipment and technology services company Qteq and its executive chairman, Simon Ashton.

It is alleged that on seven instances between 2017 and 2019, Qteq contacted competing businesses working in the supply of services to the oil and gas service industry, in attempts to induce them to enter into cartel arrangements with them.

Specifically, Qteq is alleged to have attempted to enter, or attempted to induce four other suppliers to enter into, contracts, arrangements or understandings which contained cartel provisions, including provisions to not supply particular services to large oil and gas companies, to share markets and to rig a tender.

The ACCC also alleges that Mr Ashton was involved in attempting to induce competitors to enter into these cartel arrangements on six occasions.

"When businesses seek to allocate particular clients between them or agree not to bid on certain contracts, they distort competition, which can ultimately drive up prices to the detriment of other businesses and the wider economy," ACCC Commissioner Liza Carver said.

"Pursuing cartel conduct remains one of our enduring priorities. We carefully consider all allegations of attempted or actual cartel conduct received, including tip-offs from industry insiders and customers, as well as anonymous reports made via our cartel reporting portal.

"This case is a timely reminder for businesses, no matter what size, to ensure that their directors, senior managers and employees are aware of their obligations under the Competition and Consumer Act not to engage in cartel and other anti-competitive conduct, or they may face serious consequences."

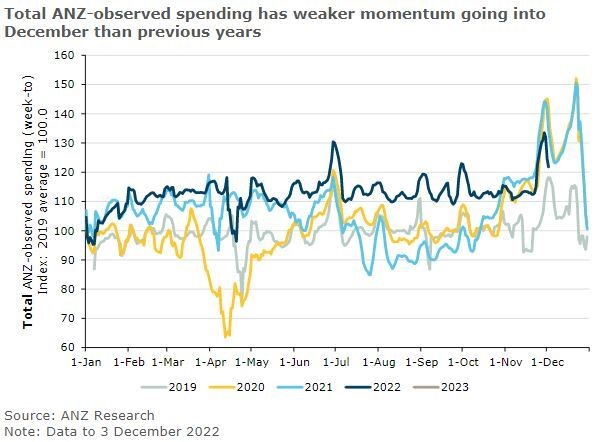

ANZ: Weaker spending momentum into December

By Samuel Yang

ANZ has released a report on consumer spending. It provides some indications about spending during the Black Friday weekend and what we can expect for the remainder of the year.

Here are some key findings from the report.

ANZ-observed spending data from the full Black Friday weekend, November 25–28, imply a weak start to the key holiday season.

Spending in the non-food retail sector over the weekend was 10 per cent lower than in 2019 and 20 per cent lower than the peak year of 2020.

Weaker Black Friday weekend sales may reflect the shift to services.

Third quarter GDP data showed that services consumption drove growth in total household consumption.

A shift to services spending may have dulled the spending impact of the Black Friday weekend, particularly when compared with 2020 and 2021, when international travel and other movement-related spending was not available.

December spending will be key to understanding spending caution into 2023.

November shopping sales were weak and may signal the beginning of a slowdown in household spending. Though the extent to which it is a slowdown, rather than a shift to services away from the retail sector, is still unclear.

If December spending is weak, it will add to the evidence of a slowdown in household spending ahead of 2023.

Forrest's Squadron Energy buys CWP Renewables

By Samuel Yang

Forrest's Squadron Energy buys CWP Renewables

Billionaire Andrew "Twiggy" Forrest's Squadron Energy has bought clean energy developer CWP Renewables in a $4 billion deal.

He says CWP and Squadron's combined assets are a "glove fit".

Here is the interview on The Business.

Link ends takeover talks with Dye & Durham

By Samuel Yang

Link Administration said on Thursday it had ended talks with Canada's Dye & Durham to sell its corporate markets and banking and credit management businesses for$1.27 billion.

Cloud-based software firm Dye & Durham has been trying to buy Link Administration and parts of it since last December in a long-running takeover tussle.

In a statement to the Australian Securities Exchange (ASX), Link said Dye & Durham had proposed deferring part of its payment for the business for two years.

Dye & Durham lodged a bid for Link's business units in October after its earlier bid to acquire the full company fell through due to regulatory headwinds and global market volatility.

Link said, in its opinion, Dye & Durham had not been able to progress its bid and show it had committed financing after two months of negotiations. Dye & Durham did not immediately respond for a request for comment on whether its funding had been secured.

The Canadian group told Reuters its revised bid for the corporate markets business was reflective of its valuation.

"While we believe the business continues to have attractive characteristics and would establish a new, strategic growth vertical for Dye & Durham, we are not willing to do a deal at any price," the company said in an emailed statement.

The failed deal joins a growing number of Australian transactions not to go ahead in 2022, led by KKR $US13 billion bid for private hospitals group Ramsay Health Care.

Over the past two years Link has received multiple buyout offers, including those from global investment firms Carlyle Group and KKR.

Link also reaffirmed its fiscal 2023 outlook on Thursday.

ASX at midday

By Samuel Yang

Energy stocks led losses, dropping 2.2 per cent as oil prices fell to its lowest level this year.

Oil and gas majors Woodside Energy and Santos fell 2.9 per cent and 1.9 per cent, respectively.

Miners slipped 0.9 per cent on weak iron ore prices after China's worse-than-expected trade data for November dampened enthusiasm about a major shift in Beijing's COVID containment policy.

Fortescue and Rio Tinto dropped over 1.5 per cent each.

Tech stocks slid 0.6 per cent, tracking overnight losses among its Wall Street peers. Block dropped 2.2 per cent.

Financials gave up 0.8 per cent with the big four banks down between 0.3 per cent and 1.7 per cent.

Strong bullion prices led gold stocks to advance 2.1 per cent. The country's largest gold miner Newcrest Mining added 2.2 per cent.

Share registry firm Link Administration declined 4.3 per cent and was among the top losers on the benchmark, after it ended discussions with Canada's Dye & Durham to sell Link's corporate markets and banking and credit management businesses for $1.27 billion.

Glencore pulls out of $1.5 billion Valeria coal mine project

By Samuel Yang

Mining company Glencore has withdrawn its plans for a major coal project in central Queensland.

In a statement, the company said it would remove itself from the approvals process and put the Valeria project under review due to "increased global uncertainty".

The proposal was for an open-cut metallurgical and thermal coal mine 27 kilometres north-west of Emerald, with construction initially planned to begin in 2024.

It would have created 1,400 construction jobs and 1,250 operational jobs.

Click through to read the story from ABC Capricornia's Jasmine Hines.

Downer EDI plunges 21pc after profit downgrade

By Samuel Yang

Engineering firm Downer EDI has admitted it's been overstating earnings since 2019.

The company said its FY23 guidance is now unlikely to be met and has identified certain accounting irregularities in its Australian utilities business.

It now expects underlying FY23 net profit after tax to be between $210 to $230 million.

Detailed investigation has been initiated.

Adjustments appear to relate to the period between September 2019 and November 2022.

Irregularities estimated to result in historical overstatement of pre-tax earnings in order of $30 million to $40 million at the end of November 2022.

Canada continues aggressive rate rises

By Michael Janda

Good morning, here's a little guest commentary from me on an important interest rate development overseas.

The Bank of Canada continued with its series of aggressive rate rises, lifting its benchmark interest rate by 0.5 of a percentage point to 4.25 per cent.

The bank has raised its official rate by 4 percentage points since it started moving in March, although the 0.5 of a percentage point rise is lower than 1 percentage point rise in July and 0.75 of a percentage point hike in September.

The bank's official post-meeting media release also offered borrowers some glimmer of hope, implying that rates might have reached their peak:

"Looking ahead, Governing Council will be considering whether the policy interest rate needs to rise further to bring supply and demand back into balance and return inflation to target."

Contrast this with the Reserve Bank of Australia governor's latest statement:

"The Board expects to increase interest rates further over the period ahead, but it is not on a pre-set course."

In Canada, the central bank is considering whether rates need to go any higher, in Australia it expects they will.

Then again, interest rates in Canada are 1.15 percentage points higher than they are here, yet the inflation rate of 6.9 per cent is exactly the same as Australia's latest reading.

So perhaps it's no wonder the RBA feels like it still might have some catching up to do, even after this week's rate hike.

ASX opens lower

By Samuel Yang

The ASX 200 has started the day lower in tandem with global market moves as a stronger-than-expected US worker productivity data further muddied a debate on how far and how fast US interest rates will rise.

The benchmark index dropped 11 points or 0.2 per cent, to 7,218 at 10:15am AEDT.

Energy (-0.8 per cent) and mining (-0.5 per cent) sectors were leading the losses.

Here are some of the top and bottom movers at open.

'Unit prices held firmer than house prices': Domain

By Samuel Yang

Domain has released its End of Year Wrap Report. Here are some key highlights.

- Australia's property market saw highs and lows with property prices at a record early in the year then quickly turning to the fastest quarterly decline

- The unit market showed resilience in the smaller capitals with prices in Brisbane, Adelaide and Canberra reaching new peaks

- Across the combined capitals, unit prices also held firmer than house prices

- The smaller capitals and some regional areas rose to new heights with the number of property sales soaring in these areas above the decade average

- 2022 was the third-busiest year on record for Australia's auction market with auction volumes 19 per cent higher than the five-year average.

- Keyword searches on Domain showed that lifestyle additions and location were high on wish lists, with 'pool', 'waterfront', 'beach' and 'view' taking out some of the top spots

You can read the full report here.

Warns of a 'domino effect' in WA building industry

By Samuel Yang

The fall of Perth builder Clough into voluntary administration after more than a century in business adds to a string of local builders striking troubled waters.

Having been responsible for major Perth projects like the Narrows Bridge, Graham Farmer Tunnel and many others across the state and world, their legacy now hangs in the balance.

But with an eighth consecutive interest rate rise, and growing economic pressures, the expectation is that this is just the tip of the iceberg.

For more, read the story by Keane Bourke.

Wall Street closed down

By Samuel Yang

Wall Street's main indices have ended broadly lower overnight, after a choppy session where investors struggled to grasp a clear direction as they weighed how the Federal Reserve's monetary policy tightening might feed through into corporate America.

The benchmark S&P 500 fell for the fifth straight session, while the Nasdaq finished down for the fourth time in a row.

The Nasdaq was dragged down by a drop in Apple on Morgan Stanley's iPhone shipment target cut and a fall in Tesla over production loss worries.

Markets have also been rattled by downbeat comments from top executives at Goldman Sachs, JPMorgan and Bank of America on Tuesday that a mild to more pronounced recession was likely ahead.

Fears that the US central bank might stick to a longer rate-hike cycle have intensified recently in the wake of strong jobs and service-sector reports.

More economic data, including weekly jobless claims, producer price index and the University of Michigan's consumer sentiment survey this week, will be on the watch list for clues on what to expect from the Fed on December 14.

"It feels like we're in this very uncertain period where investors are trying to ascertain what's more important, as policymakers are slowing down on rates but the data is not playing ball," said Craig Erlam, senior market analyst at OANDA.

"The market is trying to balance the headwinds and the tailwinds and this is causing some confusion."

ICYMI: Economy slows after eight interest rate hikes

By Samuel Yang

What's happening with our economy at the moment? Watch this short video by ABC business reporter Rhiana Whitson to find out.

Court documents reveal SkyCity Adelaide casino accepted bags of 'soiled' cash

By Samuel Yang

Cash that was dirty and appeared to have been buried, and money kept in plastic bags, was used in large transactions at the SkyCity Adelaide (SCA) casino, according to court documents.

Court documents outline customers with links to organised crime, loan sharking, human trafficking and sex slavery.

One customer listed as a "meatpacker" recorded a turnover at the casino of more than $85 million.

The allegations are part of civil proceedings against SkyCity Adeaide by Australia's financial crimes watchdog.

In a statement to the ASX, SkyCity said it had been informed of AUSTRAC's court proceedings and "will give the allegations … careful consideration before responding".

AUSTRAC has launched a similar prosecution against Star Entertainment, which owns casinos in New South Wales and Queensland.

For more details, read the story from state political reporter Leah MacLennan.

Copper shortage could hurt global green transition

By Samuel Yang

There are well known hurdles to the transition to renewable energy technologies, like Australia's political landscape.

But there are less known problems too, such as issues with the supply of copper, which is essential in many renewable energy technologies.

Analysts are concerned about the supply of copper, along with the actions being taken around the world to increase stocks.

So, how a lack of copper could slow the transition to renewable energy? Read more on this story from ABC RN's The Money by Sam Nichols and Kate MacDonald.

Treasurer warns of economic pain as growth slows, rates bite

By Samuel Yang

The third quarter GDP data came in slightly below expectations yesterday, growing by 0.6 per cent over the period of July to September and 5.9 per cent through the year.

In an interview with The Business, Treasurer Jim Chalmers warns of tough times ahead after GDP growth figures showed the economy is slowing amid rising interest rates.

You can read more by clicking the link below.

Good morning

By Samuel Yang

Welcome to our markets live blog, where we'll bring you the latest price action and news on the ASX and beyond.

A fall on Wall Street overnight sets the tone for local market action today.

The Dow Jones index dropped 0.1 per cent, the S&P 500 lost 0.2 per cent and the Nasdaq Composite down 0.5 per cent, at 7:04am AEDT.

At the same time, ASX futures were down 21 points or 0.3 per cent, to 7,225.

The Australian dollar was up 0.5 per cent to 67.31 US cents.

Brent crude oil was down 2.3 per cent, trading at $US77.50 a barrel.

Spot gold rose 1.1 per cent to $US1,789.56.

Iron ore dropped 2.1 per cent to $US107.45 a tonne.