AstraZeneca Plc's (NASDAQ:AZN) total revenue jumped 63% Y/Y to $12.01 billion in Q4 FY21 on a constant-currency basis, beating the consensus of $10.96 billion.

- Core earnings per share (EPS) came in at $1.67, topping estimates of $0.73.

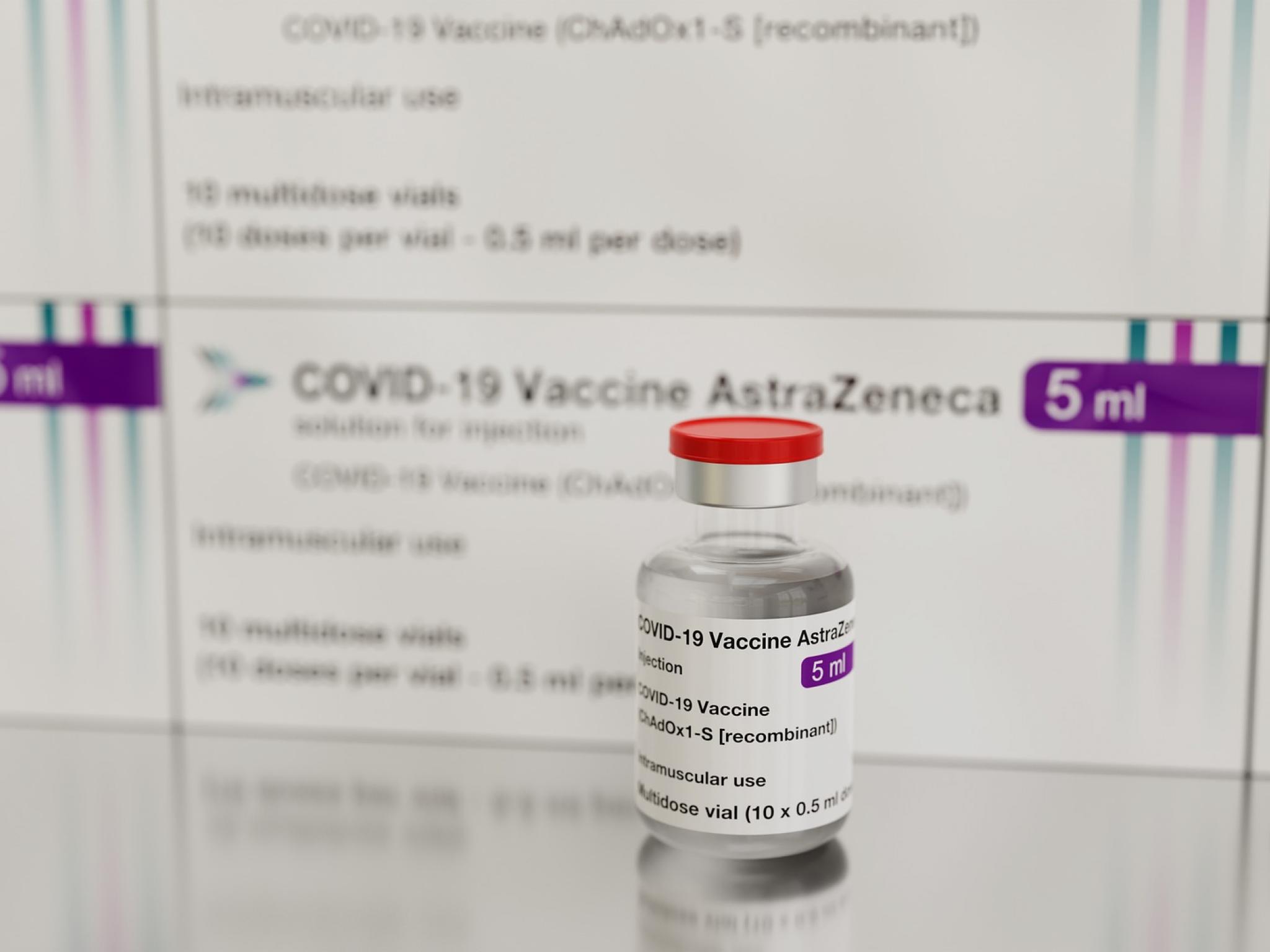

- In Q4, sales of the COVID-19 vaccine, Vaxzevria, were $1.76 billion, the best-selling product for AstraZeneca, lung cancer drug Tagrisso, racked up $1.3 billion in revenues.

- The Company posted a Q4 FY21 net loss of $(346) million, despite a 63% jump in net sales. Its gains were wiped out by costs associated with its $39 billion Alexion Pharmaceuticals deal and new drug research.

- "AstraZeneca continued on its strong growth trajectory in 2021 with ... five of our medicines crossing (the) blockbuster threshold," Chief Executive Pascal Soriot said.

- Dividend: AstraZeneca also said it would raise its annualized dividend by $0.10 to $2.90 per share.

- Guidance: AstraZeneca expects overall 2022 revenue to increase by a high teens percentage, with core earnings growing by a mid-to-high 20s percentage.

- However, the Company said sales of COVID-19 products were expected to decline by a low-to-mid 20s percentage this year and that the gross profit margins from those products would be lower than the company average.

- An expected decline in sales of the vaccine is likely to be only partially offset by growth in sales of the antibody-drug, Evusheld, with the majority of vaccine revenue in 2022 expected to come from initial contracts.

- Price Action: AZN shares are up 2.33% at $58.53 during the premarket session on the last check Thursday.

- Photo by Paul McManus from Pixabay