Financial giants have made a conspicuous bullish move on ASML Holding. Our analysis of options history for ASML Holding (NASDAQ:ASML) revealed 82 unusual trades.

Delving into the details, we found 57% of traders were bullish, while 36% showed bearish tendencies. Out of all the trades we spotted, 29 were puts, with a value of $2,588,601, and 53 were calls, valued at $4,795,957.

Predicted Price Range

Taking into account the Volume and Open Interest on these contracts, it appears that whales have been targeting a price range from $580.0 to $800.0 for ASML Holding over the last 3 months.

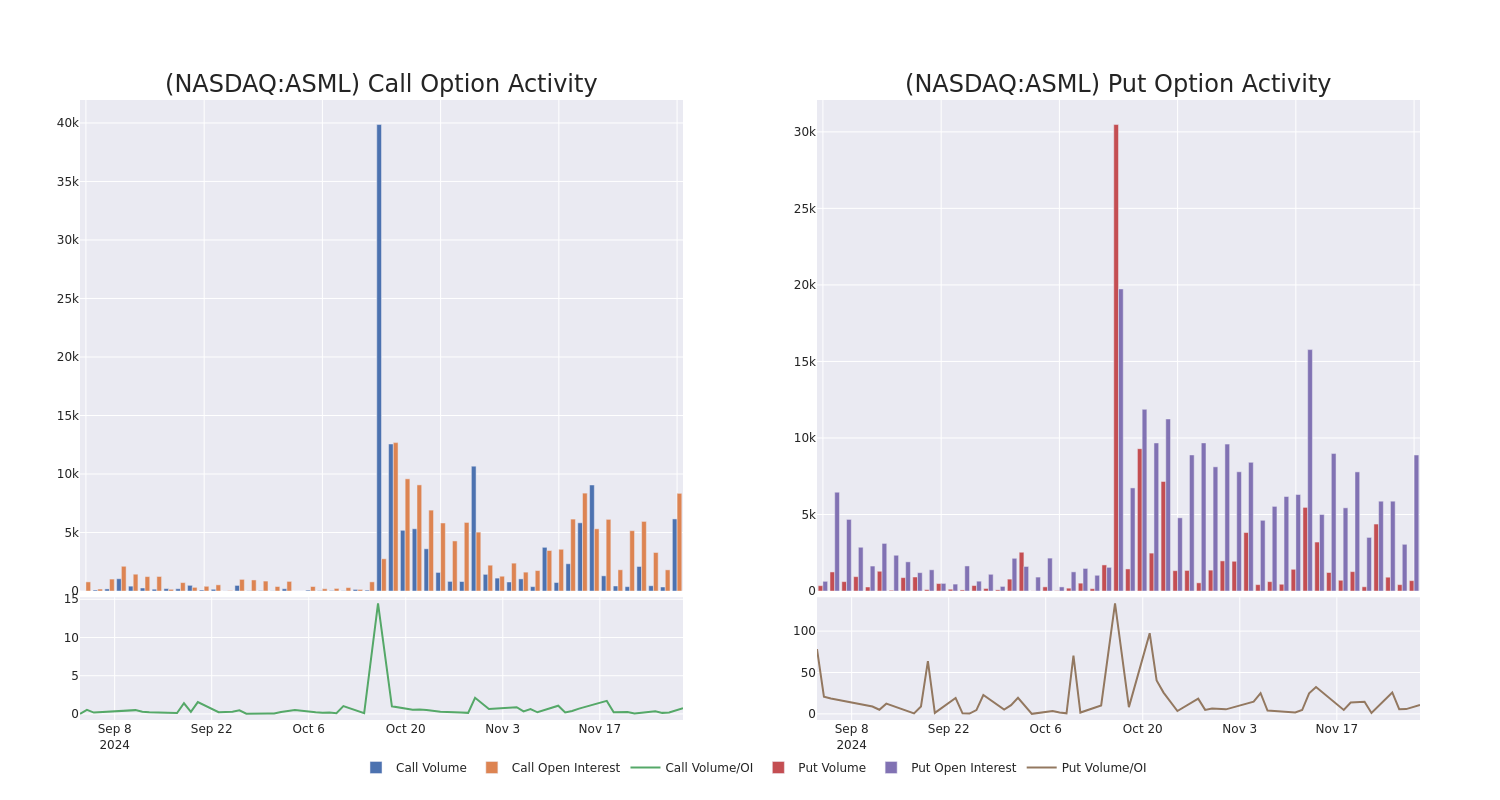

Insights into Volume & Open Interest

In today's trading context, the average open interest for options of ASML Holding stands at 313.4, with a total volume reaching 6,778.00. The accompanying chart delineates the progression of both call and put option volume and open interest for high-value trades in ASML Holding, situated within the strike price corridor from $580.0 to $800.0, throughout the last 30 days.

ASML Holding 30-Day Option Volume & Interest Snapshot

Noteworthy Options Activity:

| Symbol | PUT/CALL | Trade Type | Sentiment | Exp. Date | Ask | Bid | Price | Strike Price | Total Trade Price | Open Interest | Volume |

|---|---|---|---|---|---|---|---|---|---|---|---|

| ASML | PUT | TRADE | BULLISH | 02/21/25 | $87.7 | $86.9 | $86.9 | $760.00 | $191.1K | 231 | 22 |

| ASML | PUT | TRADE | BULLISH | 02/21/25 | $86.8 | $86.0 | $86.0 | $760.00 | $189.2K | 231 | 66 |

| ASML | PUT | TRADE | BULLISH | 02/21/25 | $86.3 | $85.5 | $85.5 | $750.00 | $188.1K | 37 | 66 |

| ASML | CALL | TRADE | BULLISH | 01/17/25 | $41.2 | $40.8 | $41.2 | $680.00 | $168.9K | 334 | 281 |

| ASML | CALL | TRADE | BULLISH | 12/20/24 | $21.7 | $20.9 | $21.5 | $690.00 | $150.5K | 347 | 75 |

About ASML Holding

ASML is the leader in photolithography systems used in the manufacturing of semiconductors. Photolithography is the process in which a light source is used to expose circuit patterns from a photo mask onto a semiconductor wafer. The latest technological advances in this segment allow chipmakers to continually increase the number of transistors on the same area of silicon, with lithography historically representing a high portion of the cost of making cutting-edge chips. ASML outsources the manufacturing of most of its parts, acting like an assembler. ASML's main clients are TSMC, Samsung, and Intel.

Following our analysis of the options activities associated with ASML Holding, we pivot to a closer look at the company's own performance.

ASML Holding's Current Market Status

- With a trading volume of 550,696, the price of ASML is up by 3.75%, reaching $695.64.

- Current RSI values indicate that the stock is may be approaching overbought.

- Next earnings report is scheduled for 61 days from now.

Professional Analyst Ratings for ASML Holding

Over the past month, 1 industry analysts have shared their insights on this stock, proposing an average target price of $767.0.

Turn $1000 into $1270 in just 20 days?

20-year pro options trader reveals his one-line chart technique that shows when to buy and sell. Copy his trades, which have had averaged a 27% profit every 20 days. Click here for access. * An analyst from Bernstein persists with their Outperform rating on ASML Holding, maintaining a target price of $767.

Options are a riskier asset compared to just trading the stock, but they have higher profit potential. Serious options traders manage this risk by educating themselves daily, scaling in and out of trades, following more than one indicator, and following the markets closely.

If you want to stay updated on the latest options trades for ASML Holding, Benzinga Pro gives you real-time options trades alerts.