Back in the first few months of 2012, signs of trouble were starting to pop up for U.S. agriculture. High temperatures in Chicago on St. Patrick’s Day hit 82 degrees Fahrenheit, the warmest for the day in 141 years. Unusual heat and dryness persisted through the spring, and by midsummer, severe heat and drought gripped much of the Midwest, sending market volatility and grain prices soaring.

A decade later, the risk factors American farmers must navigate throughout a crop year have multiplied, with 2022 featuring drought or excess rain in several key U.S. growing areas joined by soaring inflation, rising interest rates, high fertilizer costs, war in Ukraine and a potential recession.

In May 2012, CME Group launched Short-Dated New Crop (SDNC) options on corn, soybean and wheat futures, aiming to offer farmers and others in the agriculture supply chain greater flexibility to manage risks, such as drought, during the growing season. By coincidence, the product became available at the onset of a major drought.

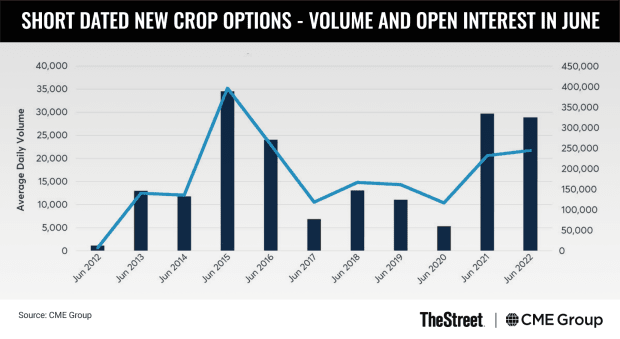

They have since proven to be well-suited for uncertain times. Volume and open interest were at record levels as of early July, illustrating the industry’s increasing embrace of flexible hedging tools that can be tailored around expected news (such a USDA reports), as well as the unexpected.

Short-Dated New Crop options open interest – the number of outstanding contracts – reached 244,942 contracts in June, while June average daily trading volume in 2021 and 2022 marked the most active months for the contract since 2015.

Extreme Events Require 'Bigger Menu of Choices' for Producers

The 2012-13 drought, one of the worst in U.S. history, covered 81% of the contiguous U.S. at its peak and caused an estimated $30 to $40 billion in losses in the Midwest as production of corn and soybeans was slashed. In September that year, soybean futures surged to a record just under $18 a bushel.

“Extreme, volatility-generating events such as droughts were among the real-world scenarios CME envisioned when it was designing the short-dated options,” said Tim Andriesen, CME Group’s managing director, agricultural commodities, said. The options were inspired in part by Andriesen’s previous experience in the over-the-counter options markets, where traders took out “strips” and other positions that were tied to futures but had shorter durations.

Read more about short-dated new crop options

“In the OTC world, you don’t have to go by convention, where a December option expires in November,” Andriesen said. “We were looking at a product that helped agricultural producers, who are super-sensitive to premium prices. To buy a corn or soybean option in the month of January at a premium of 30 cents, for example, that’s a hard sell for a farmer. So, we looked at our products and said, let’s try to give producers a bigger menu of choices.”

Corn and soybean options traditionally used to hedge production for the U.S. growing season expire in November or December, which in many cases is too long a time frame for farmers contemplating planting decisions and break-even grain prices during the winter and early spring. Short-dated options, by contrast, expire sooner than standard counterparts, enabling greater flexibility for farmers seeking to hedge production before or early in the growing season.

USDA Acreage, Stocks Reports Carry Surprise Potential

Short-dated new-crop corn and soybean options provide a potential solution for supply disruptions such as drought in South America or the war in Ukraine, where there could be a disconnect between old-crop and new-crop futures. They enable producers to secure some protection at favorable prices while still leaving open the possibility of capturing benefits from an extended rally.

“Critical USDA reports, such as the agency’s widely anticipated Acreage and quarterly Grain Stocks reports released June 30, also carry potential surprises that can send grain prices swinging higher or lower, another scenario where short-dated options flexibility can apply,” noted Brian Burke, president of John Stewart and Associates.

“When I’m advising clients, I ask them, which move on this report is going to cause you to lose sleep?” Burke said. “And then I typically go to some short-term options, whether August short-dated new-crop options or the July weekly options, which are short in the time frame and advise on protecting that risk against that short-term surprise that would work against them. This is often a very successful and effective way of managing risk.”

Global grains and oilseeds stocks as a percent of global demand “are amongst the tightest in over a decade,” Burke added. “When you combine this very tight global balance sheet with the fact the Ukraine… will have severely limited supply for several months or longer, you really gain some perspective on how critical the supply in the U.S. is for grains and oilseeds this fall.”

Farmers Increasingly Like Flexibility – 'Have to Have the Bushels Before the Price'

For farmers such as Betsy Leager of Leager Farms, 2022’s geopolitical turmoil and weather extremes underscores the importance of nimble hedging and marketing strategies that account for fast-shifting risks.

Leager, who farms in the Delmarva area of eastern Maryland, says she started to add short-dated options to bring some certainty to their operations. They previously leveraged forward contracting or locking in basis levels but figured their risk management needed to be more precise since it’s hard to predict the size of the harvest months ahead of time.

Leager, who manages the books for the farm, said with input costs rising she was looking for ways to protect the profits they saw this year when grain prices rallied. Compared to forward contracting, short-dated options allow more participation in higher prices while protecting against downside risk during the growing season.

“You have to have the bushels before you have the price,” Leager said earlier this year. Using short-dated options “gives us a sense of where our profit margin will be before the crops are in the ground.”

A Powerful Tool to Gauge Volatility

Another twist for producers and others in agriculture: one market’s volatility is not like the others. This is where the CME Group Volatility Index (CVOL) index can come in handy.

CVOL is “a very easy way to look at and compare historical volatility,” Andriesen said. “At its base, it makes understanding volatility very simple, providing a constant measure of volatility producers can track over time. At its simplest, it’s a nice, clear measure, and it can be a much more powerful tool for producers to gauge volatility.”

Looking ahead to the rest of 2022 and beyond, uncertainties likely will remain elevated for agriculture and the world in general, meaning producers will continue to seek ways to better manage their risks and protect their bottom lines.

“Over the last two years, we’ve seen significant spikes in volatility” in ag markets, Andriesen said. “People clearly see a need for options when you have an environment like this. Short-dated new-crop options have really helped manage risk in the current environment. Producers want the upside price opportunities using options, but they don’t want to do that when we have high prices and high volatility.”