Ares Management Corporation (ARES) is a prominent global alternative investment manager headquartered in Los Angeles, California. The firm provides a broad range of investment solutions across credit, private equity, real estate, and infrastructure asset classes, serving institutional investors worldwide. Ares Management has a market cap of $42.7 billion.

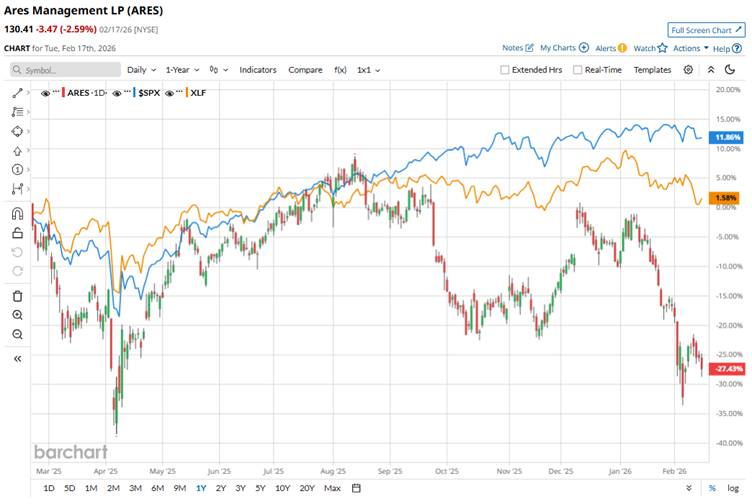

Shares of this company have underperformed the broader market over the past year. ARES has slumped almost 30% over this time frame, while the broader S&P 500 Index ($SPX) has rallied 11.9%. Plus, in 2026, the stock is down 19.3%, lagging behind the SPX’s marginal fall on a YTD basis.

Narrowing the focus, ARES’ underperformance is apparent compared to the State Street Financial Select Sector SPDR ETF (XLF). The exchange-traded fund has gained marginally over the past year but declined 4.7% this year.

Ares Management’s share price has fallen largely lately due to investor disappointment from weaker-than-expected quarterly results. Ares Management Corporation reported its Q4 2025 financial results on Feb. 5, 2026, showing EPS of $1.45, which increased from $1.23 in Q4 2024 but missed the consensus estimate.

Additionally, broader sector-wide headwinds affecting alternative asset managers, including market volatility and concerns around private credit and technology exposure, have weighed on sentiment toward asset management stocks.

For the current fiscal year, ending in December, analysts expect ARES’ EPS to grow 37.2% to $6.53 on a diluted basis. The company’s earnings surprise history is mixed. It missed the consensus estimate in two of the last four quarters while beating the forecast on two other occasions.

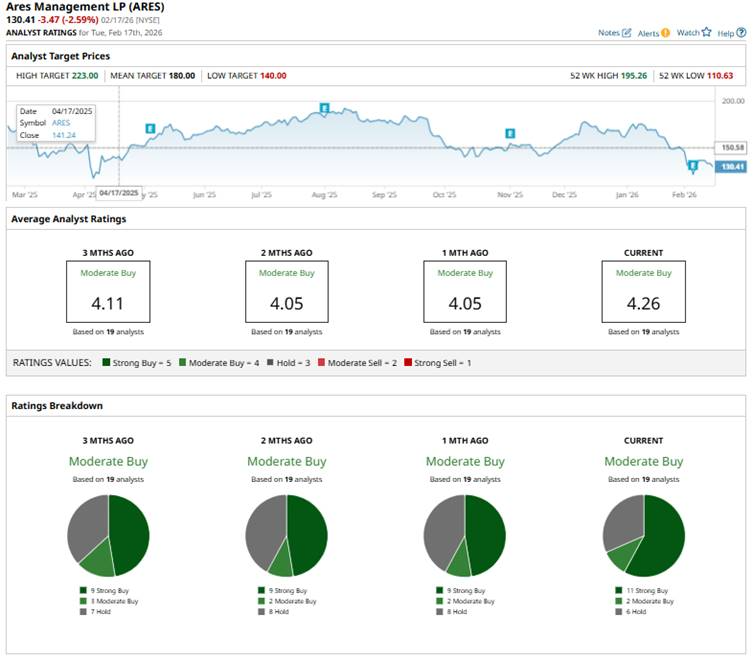

Among the 19 analysts covering ARES stock, the consensus is a “Moderate Buy.” That’s based on 11 “Strong Buy” ratings, two “Moderate Buys,” and six “Holds.”

This configuration is slightly more bullish than one month ago, when there were nine “Strong Buy” ratings.

Recently, Raymond James upgraded Ares Management from “Market Perform” to “Strong Buy,” setting a $157 price target, citing Ares’ strong growth outlook.

The mean price target of $180 represents a 38% premium to ARES’ current price levels. The Street-high price target of $223 suggests an upside potential of 71%.