/Universal%20Health%20Services%2C%20Inc_%20magnified-%20by%20Casimiro%20PT%20via%20Shutterstock.jpg)

With a market cap of $14.3 billion, Universal Health Services, Inc. (UHS) is one of the largest hospital and behavioral healthcare operators in the U.S., running a broad network of acute care hospitals, outpatient centers, and behavioral health facilities. The King of Prussia, Pennsylvania-based company focuses on delivering inpatient and outpatient medical services, mental health treatment, and specialty care, supported by a mix of government and commercial payors.

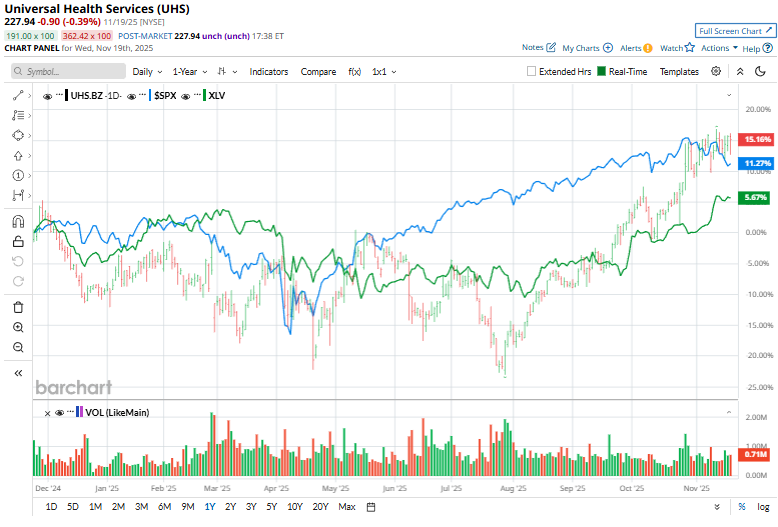

Shares of the company have outperformed the broader market over the past 52 weeks. UHS stock has climbed 15.8% over this time frame, while the broader S&P 500 Index ($SPX) has gained 12.3%. In addition, shares of the company have risen 27% on a YTD basis, compared to SPX's 12.9% increase.

Moreover, the hospital and health facility operator stock has also surpassed the Health Care Select Sector SPDR Fund's (XLV) 7.9% rise over the past 52 weeks and 10.7% rally in 2025.

UHS shares popped 1.6% after the company announced its third-quarter earnings on Oct. 27. The healthcare operator delivered 13.4% year-over-year revenue growth to $4.50 billion, thanks to robust performance across both its acute care and behavioral health segments. Profitability strengthened sharply as adjusted EPS rose to $5.69. The company boosted its full-year guidance for both revenue and earnings and expanded its share-repurchase authorization by $1.5 billion, moves that reinforced management’s confidence and helped drive the stock’s post-earnings bounce.

For the fiscal year ending in December 2025, analysts expect UHS’ adjusted EPS to grow 31.6% year-over-year to $21.85. The company's earnings surprise history is solid. It topped the consensus estimates in all of the last four quarters.

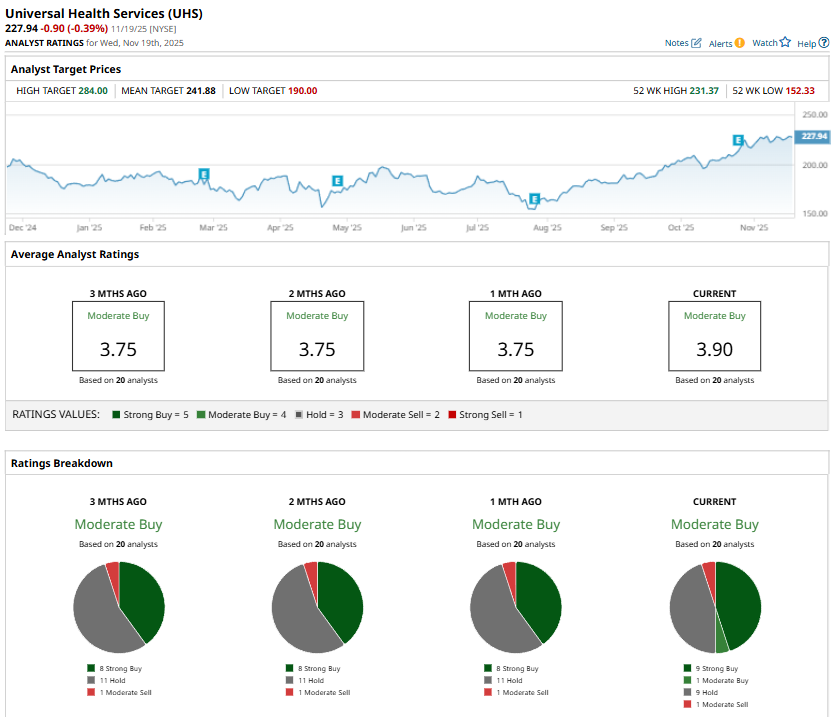

Among the 20 analysts covering the stock, the consensus rating is a “Moderate Buy.” That’s based on nine “Strong Buy” ratings, one “Moderate Buy,” nine “Holds,” and one “Moderate Sell.”

The current consensus is bullish than a month ago, when the stock had eight “Strong Buy” suggestions.

On Oct. 10, Barclays analyst Andrew Mok maintained his “Buy” rating on Universal Health Services and set a price target of $250.

The mean price target of $241.88 represents a 6.2% premium to UHS’ current price levels. The Street-high price target of $284 suggests a 24.6% potential upside.