With a market cap of $128.7 billion, Robinhood Markets, Inc. (HOOD) is a U.S.-based fintech platform best known for pioneering commission-free stock and crypto trading for retail investors. The company offers trading in stocks, ETFs, options, and cryptocurrencies, as well as investing and cash management tools.

Robinhood has been on a breakout run, delivering eye-popping gains that leave the broader market in the dust. HOOD stock has surged 389.4% over the past 52 weeks and 279.6% on a YTD basis, dwarfing the S&P 500 Index’s ($SPX) 17.4% rise over the past year and 16% return in 2025.

Narrowing the focus, Robinhood has also outpaced the SPDR S&P Capital Markets ETF’s (KCE) 8.9% gain over the past year and 5.9% rally this year.

On Oct. 27, Robinhood climbed 5.4% benefiting from a broader market rally driven by optimism around a potential U.S.–China trade truce and expectations of upcoming Fed rate cuts.

Moreover, HOOD shares popped 6.3% on Oct. 23, after Cathie Wood’s Ark Invest bought about $21.3 million worth of shares across two ETFs, signaling renewed institutional confidence.

For fiscal 2025, ending in December, analysts expect HOOD to report a 64.2% year-over-year growth in adjusted EPS to $1.79. Moreover, the company has surpassed the Street’s bottom-line estimates in three of the past four quarters, while missing on another quarter.

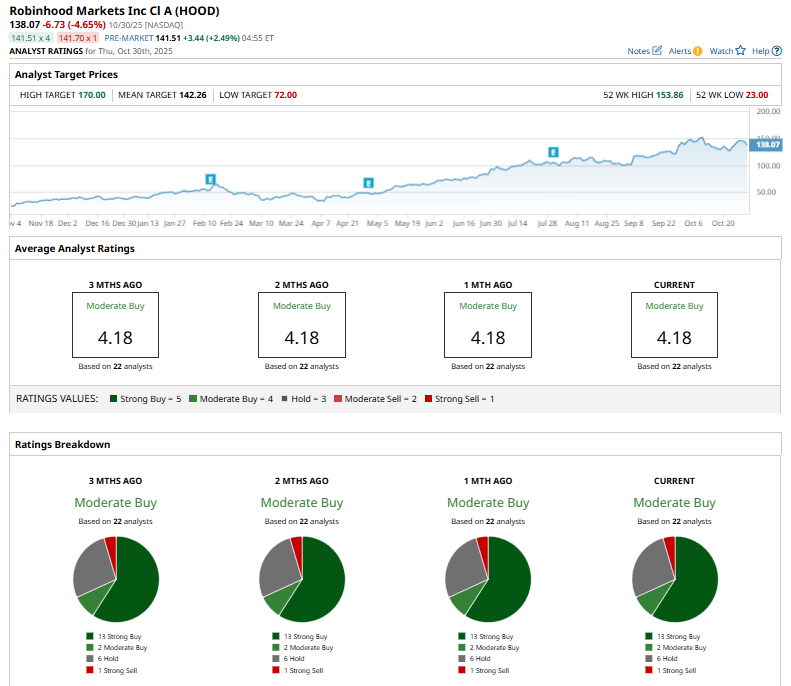

The stock has a consensus “Moderate Buy” rating overall. Of the 22 analysts covering the stock, opinions include 13 “Strong Buys,” two “Moderate Buys,” six “Holds,” and one “Strong Sell.”

This configuration has been fairly stable over the past couple of months.

On Oct. 9, JMP Securities analyst Devin Ryan raised his price target on Robinhood to $170, which is also the Street-high target, and reiterated an “Outperform” rating, citing a strong rebound in market activity and renewed strength in capital markets and fintech stocks driven by institutional trading and wealth-management inflows.

HOOD’s mean price target of $142.26 implies a 3% premium to current price levels.