/Pentair%20plc%20logo%20on%20phone-by%20nikkimeel%20via%20Shutterstock.jpg)

London, U.K.-based Pentair plc (PNR) is a global industrial company specializing in water treatment and fluid management solutions. With a market cap of $16.1 billion, Pentair operates its principal business in North America, Europe, Asia, and Latin America. The company’s products serve residential, commercial, municipal, and industrial customers who require efficient water filtration, pumping, and flow systems.

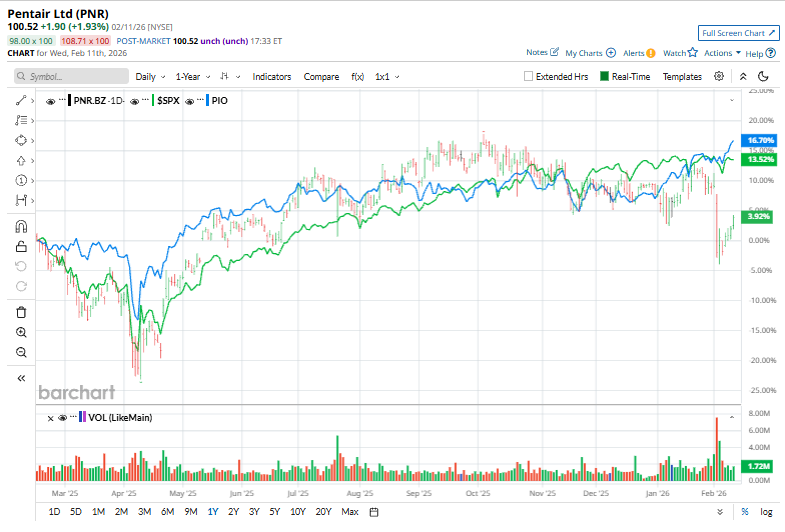

The water solutions titan has notably underperformed the broader market over the past year. PNR stock prices have gained nearly 1.3% over the past 52 weeks, compared to the S&P 500 Index’s ($SPX) 14.4% gains. In 2026, the stock has slumped 3.5%, trailing SPX’s 1.4% rise.

Narrowing the focus, Pentair has also underperformed the industry-focused Invesco Global Water ETF’s (PIO) 17.2% surge over the past 52 weeks and 9.1% on a YTD basis.

On Feb. 3, Pentair released its fiscal 2025 fourth-quarter earnings, and its shares dipped 10.2%. Sales rose 5% to $1 billion compared with about $973 million in Q4 2024. Adjusted earnings per share increased 9% to $1.18. Operating income for the quarter increased about 5% to $205 million. Segment performance varied, with the Flow and Pool businesses showing strong sales gains while Water Solutions declined. The quarter also contributed to a record free cash flow of $748.4 million, and management returned $225 million to shareholders through share repurchases.

For FY2026 ending in December, analysts expect Pentair to deliver an adjusted EPS to improve 8.5% year over year to $5.34. Further, the company has a robust earnings surprise history. It has surpassed the Street’s bottom-line estimates in each of the past four quarters.

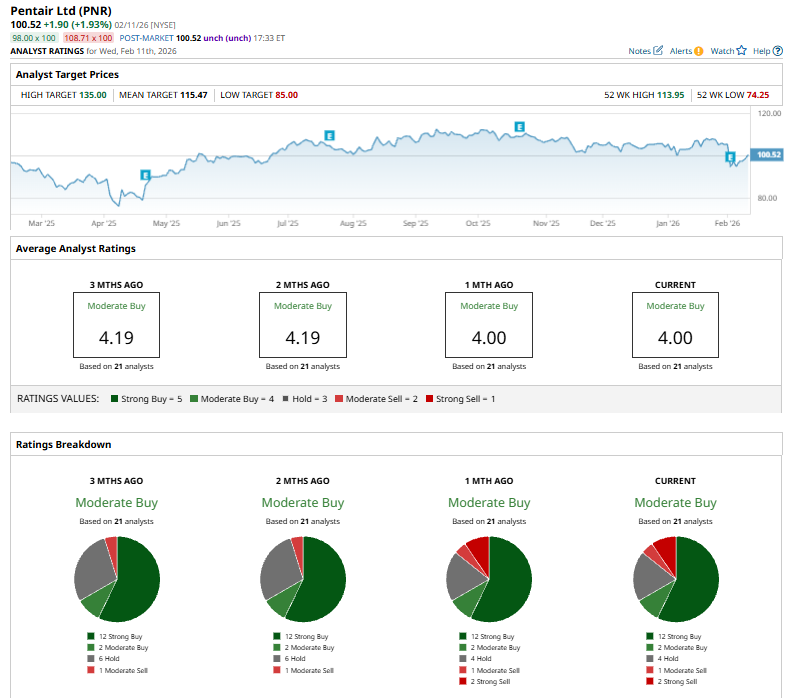

Among the 21 analysts covering the PNR stock, the consensus rating is a “Moderate Buy.” That’s based on 12 “Strong Buys,” two “Moderate Buys,” four “Holds,” one “Moderate Sell,” and two “Strong Sell” ratings.

This configuration has remained stable over the past three months.

On Feb. 4, Citigroup analyst Andrew Kaplowitz maintained a “Buy” rating on Pentair but lowered his price target to $120 from $126, reflecting a 4.76% reduction.

PNR’s mean price target of $115.47 represents a 14.9% premium to current price levels. Meanwhile, the street-high target of $135 suggests a notable 34.3% upside potential.