/Everest%20Group%20Ltd%20logo%20and%20website-by%20T_Schneider%20via%20Shutterstock.jpg)

Hamilton, Bermuda-based Everest Group, Ltd. (EG) operates through its subsidiaries, provides reinsurance and insurance products in the United States, Europe, and internationally. With a market cap of $13.1 billion, Everest operates through the Insurance and Reinsurance segments.

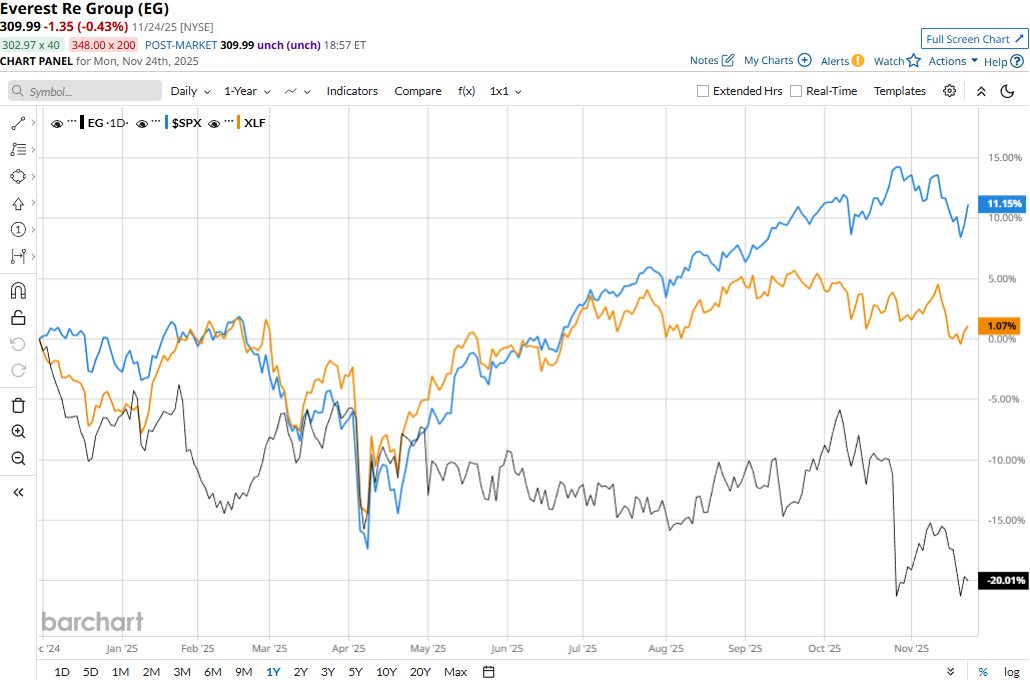

The insurance major has significantly underperformed the broader market over the past year. EG stock prices have plunged 20.3% over the past 52 weeks and 14.5% on a YTD basis, compared to the S&P 500 Index’s ($SPX) 12% returns over the past year and 14% surge in 2025.

Narrowing the focus, Everest has also underperformed the sector-focused Financial Select Sector SPDR Fund’s (XLF) 2.3% uptick over the past 52 weeks and 7.4% gains on a YTD basis.

Everest Group’s stock prices tanked 11.4% in a single trading session following the release of its disappointing Q3 results on Oct. 27. Due to a drop in premiums earned and muted growth in net investment income, the company’s overall topline for the quarter inched up by a modest 79 bps year-over-year to $4.3 billion, missing the Street’s expectations by 2.9%. Meanwhile, its net operating income per share plummeted 48.4% year-over-year to $7.54, missing the consensus estimates by a staggering 43.7%.

For the full fiscal 2025, ending in December, analysts expect EG to deliver an adjusted EPS of $45.02, up 50.9% year-over-year. However, the company has a lackluster earnings surprise history. Although it has surpassed the Street’s bottom-line estimates once over the past four quarters, it missed the projections on three other occasions.

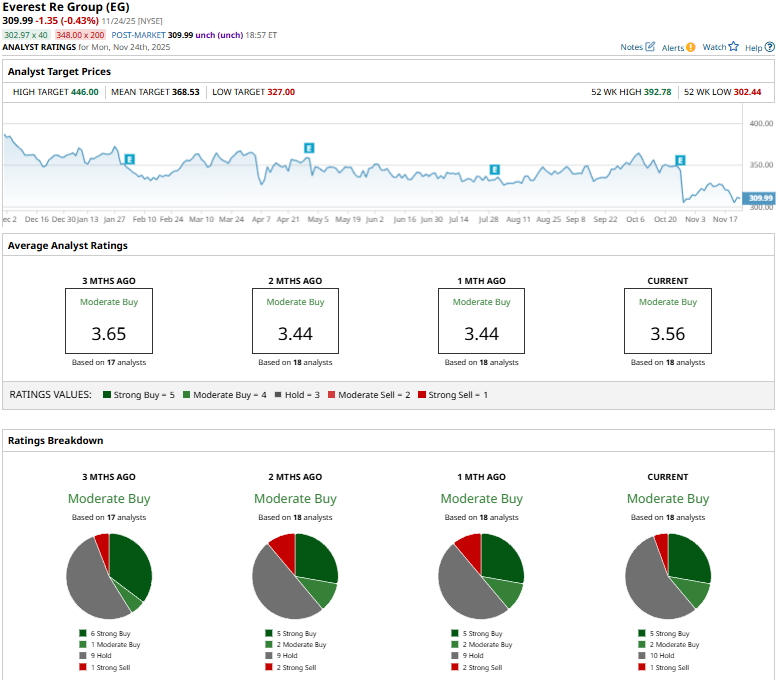

Among the 18 analysts covering the EG stock, the consensus rating is a “Moderate Buy.” That’s based on five “Strong Buys,” two “Moderate Buys,” 10 “Holds,” and one “Strong Sell.”

This configuration is slightly more optimistic than a month ago, when two analysts gave “Strong Sell” recommendations.

On Oct. 24, Keefe, Bruyette & Woods analyst Meyer Shields maintained an “Outperform” rating on EG, but lowered the price target from $424 to $400.

As of writing, Everest Group’s mean price target of $368.53 represents an 18.9% premium to current price levels. Meanwhile, the street-high target of $446 suggests a 43.9% upside potential.