/Aon%20plc_%20bilboard-%20by%20monticello%20via%20Shutterstock.jpg)

Valued at a market cap of $66.7 billion, Aon plc (AON) provides a range of risk and human capital solutions. The Dublin, Ireland-based company helps clients navigate uncertainty through data-driven insights and advisory services.

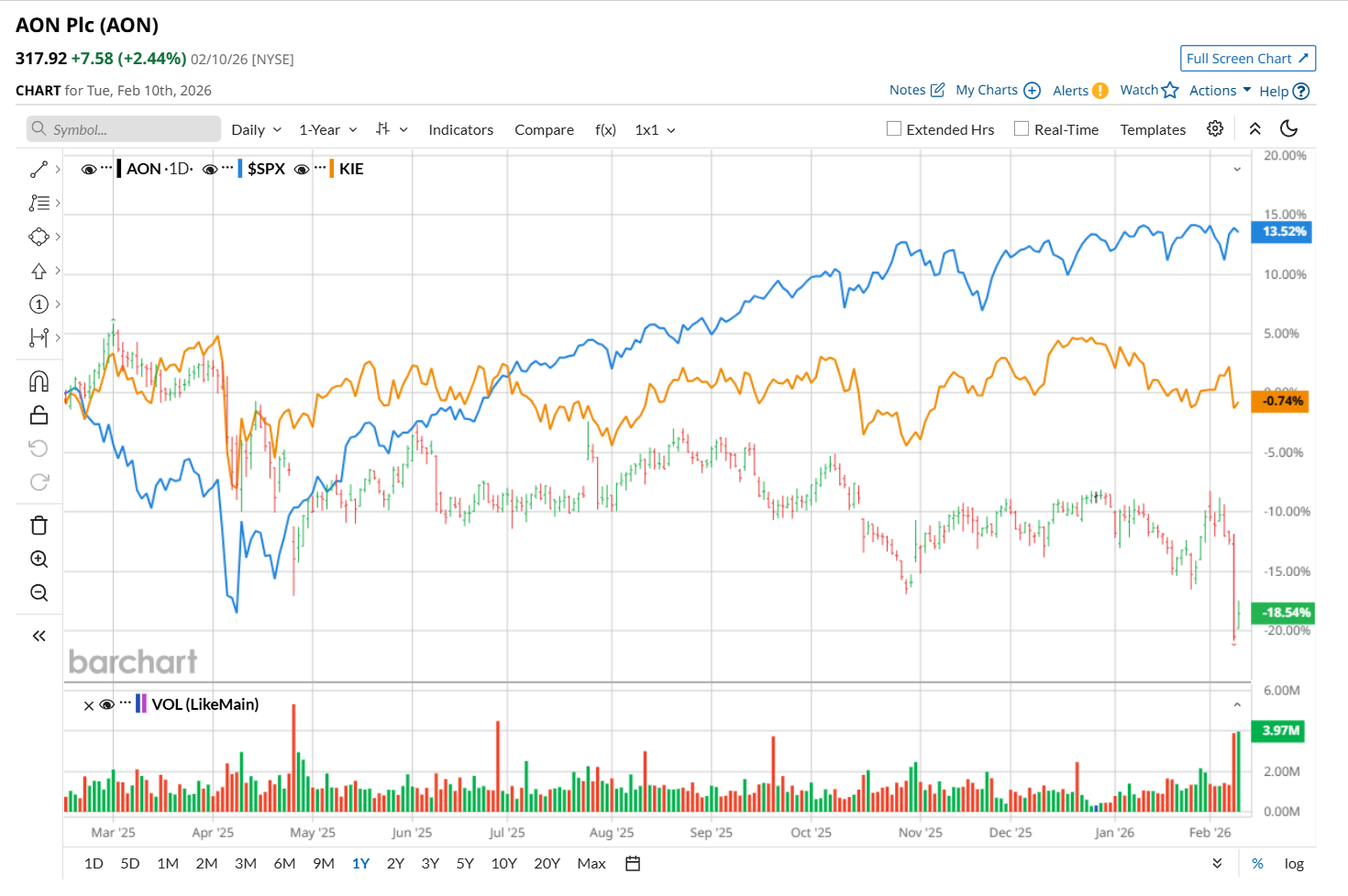

This financial company has considerably lagged behind the broader market over the past 52 weeks. Shares of AON have declined 17.6% over this time frame, while the broader S&P 500 Index ($SPX) has soared 14.4%. Moreover, on a YTD basis, the stock is down 9.9%, compared to SPX’s 1.4% return.

Narrowing the focus, AON has also underperformed the State Street SPDR S&P Insurance ETF (KIE), which declined marginally over the past 52 weeks and 3.8% on a YTD basis.

On Jan. 30, shares of AON surged nearly 2% after its mixed Q4 earnings release. While the company’s total revenue increased 3.7% year-over-year to $4.3 billion, it missed consensus expectations by 1.8%. Nonetheless, on the earnings front, its adjusted EPS improved 1.9% from the year-ago quarter to $4.85, topping analyst estimates of $4.76. Moreover, AON paid down $1.9 billion in debt in 2025 and successfully met its leverage objective in the fourth quarter, further bolstering investor confidence.

For fiscal 2026, ending in December, analysts expect AON’s EPS to grow 11.7% year over year to $19.07. The company’s earnings surprise history is mixed. It exceeded the consensus estimates in three of the last four quarters, while missing on another occasion.

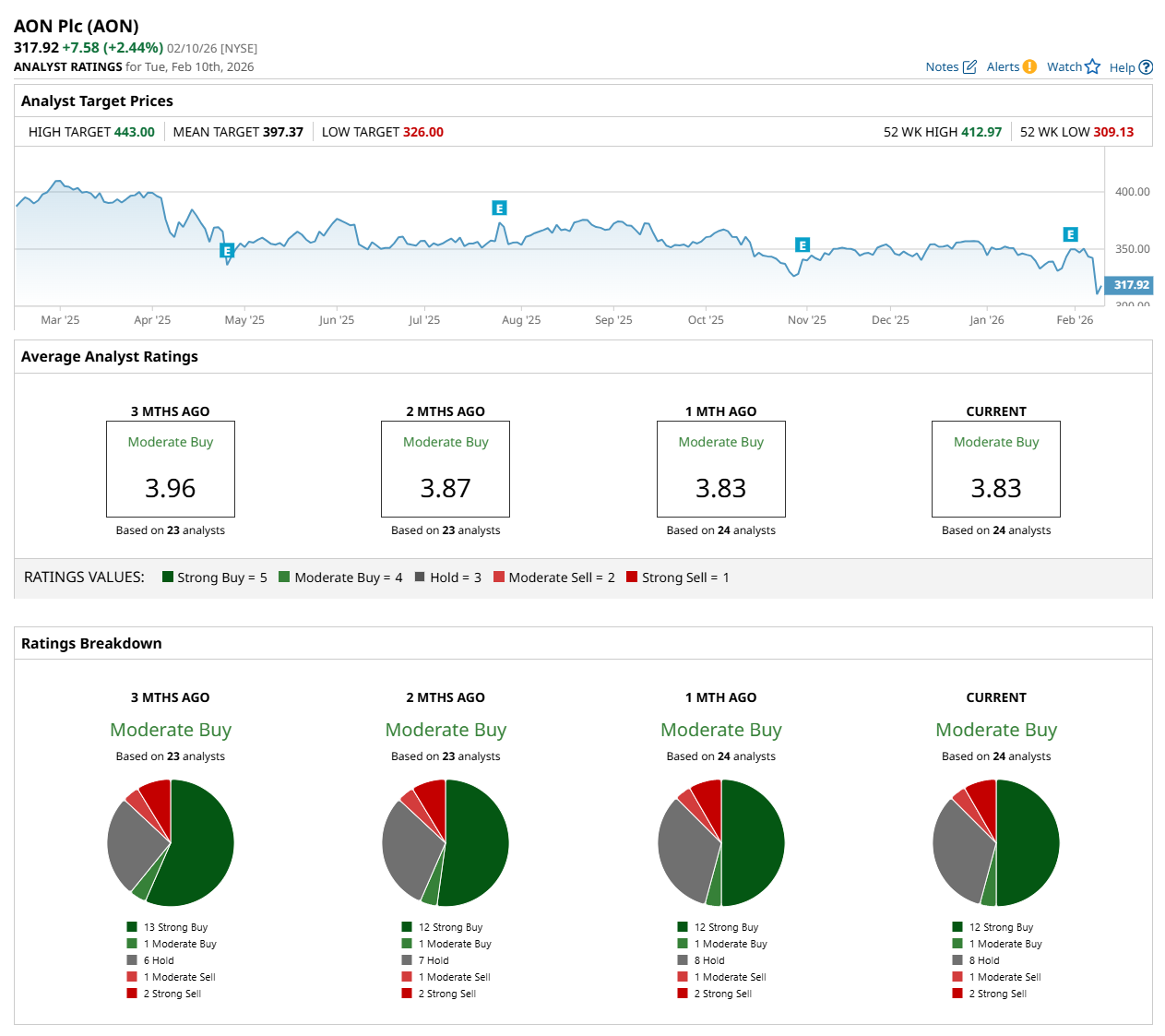

Among the 24 analysts covering the stock, the consensus rating is a "Moderate Buy,” which is based on 12 “Strong Buy,” one "Moderate Buy,” eight “Hold,” one "Moderate Sell,” and two “Strong Sell” ratings.

The configuration is less bullish than three months ago, with 13 analysts suggesting a “Strong Buy” rating.

On Feb. 3, Mizuho Financial Group, Inc. (MFG) analyst Yaron Kinar maintained a “Neutral" rating on AON and raised its price target to $398, indicating a 25.2% potential upside from the current levels.

The mean price target of $397.37 represents a 25% premium to its current price levels, while its Street-high price target of $443 suggests a 39.3% potential upside from the current levels.