/Fastenal%20Co_%20logo%20and%20chart-by%20T_Schneider%20via%20Shutterstock.jpg)

Minnesota-based Fastenal Company (FAST) provides wholesale distribution of industrial and construction supplies. Valued at a market cap of $54.3 billion, the company serves customers across manufacturing, construction, transportation, and government sectors.

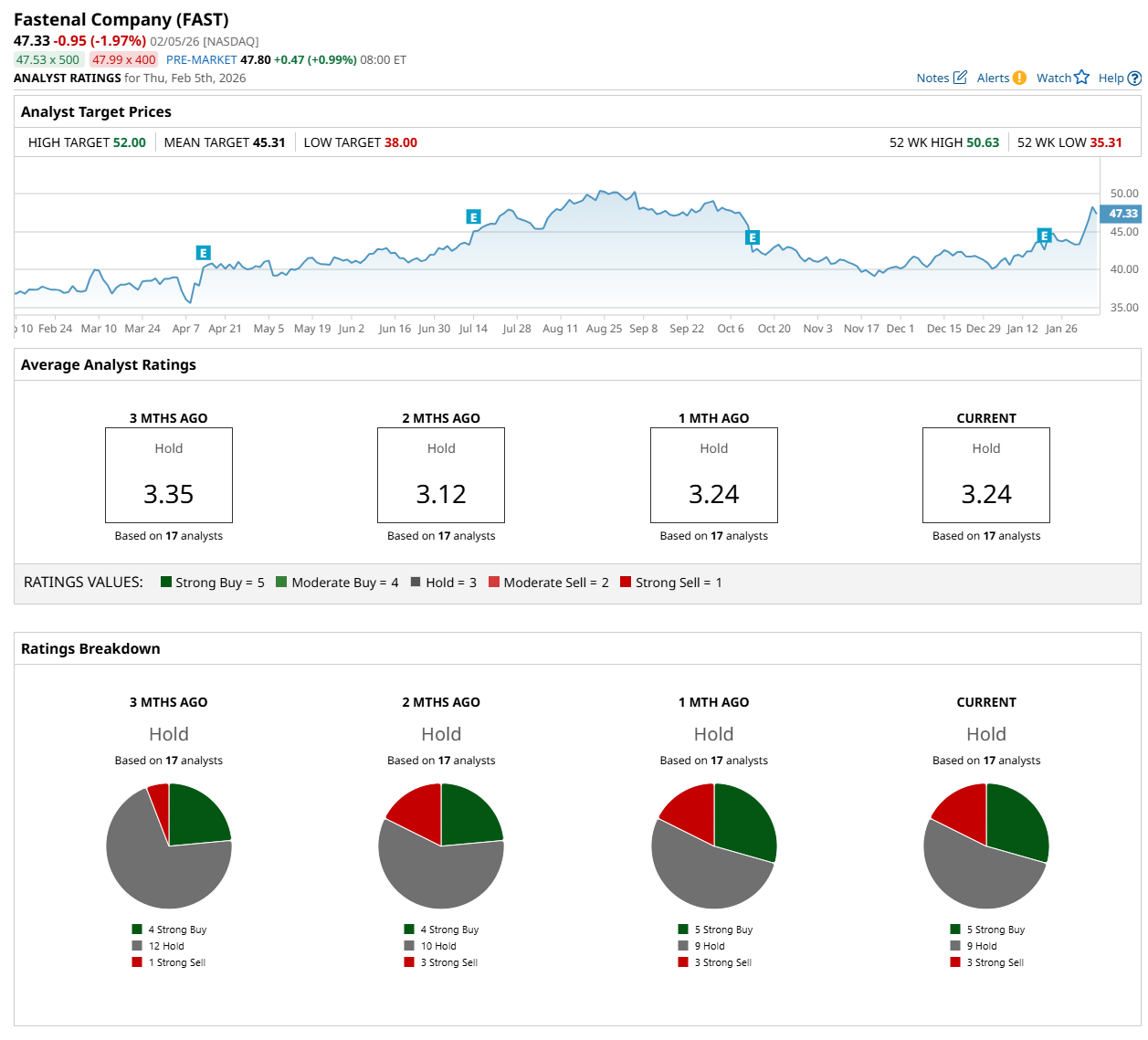

This industrial company has outperformed the broader market over the past 52 weeks. Shares of FAST have soared 28.7% over this time frame, while the broader S&P 500 Index ($SPX) has gained 12.2%. Moreover, on a YTD basis, the stock is up 17.9%, compared to SPX’s slight drop.

Zooming in further, FAST has also outperformed the State Street Industrial Select Sector SPDR ETF (XLI), which rallied 22.8% over the past 52 weeks and 8.5% on a YTD basis.

On Jan. 20, shares of FAST plunged 2.6% after delivering its Q4 earnings results. The company’s net sales increased 11.1% year-over-year to $2 billion, while its EPS advanced 13% from the year-ago quarter to $0.26, both coming in line with analyst estimates. Performance during the quarter was supported by higher unit sales, driven by an increase in the number of customers spending $10,000 or more per month. However, ongoing weakness in industrial production appeared to weigh on investor sentiment, leading to the stock’s decline.

For fiscal 2026, ending in December, analysts expect FAST’s EPS to grow 12.8% year over year to $1.23. The company’s earnings surprise history is mixed. It met or exceeded the consensus estimates in three of the last four quarters, while missing on another occasion.

Among the 17 analysts covering the stock, the consensus rating is a "Hold,” which is based on five “Strong Buy,” nine "Hold,” and three “Strong Sell” ratings.

The configuration is more bullish than two months ago, with four analysts suggesting a “Strong Buy” rating.

On Jan. 21, Barclays PLC (BCS) maintained an “Equal Weight” rating on FAST but lowered its price target to $43.

While the company is trading above its mean price target of $45.31, its Street-high price target of $52 suggests a 9.9% potential upside from the current levels.