/Applied%20Materials%20Inc_%20logo%20on%20phone-by%20sdx15%20via%20Shutterstock.jpg)

Valued at a market cap of $255.8 billion, Applied Materials, Inc. (AMAT) is a leading California-based supplier of equipment, software, and services used in the manufacturing of semiconductors and advanced electronic displays. Founded in 1967, the company plays a critical role in enabling chipmakers to produce smaller, faster, and more energy-efficient integrated circuits.

Over the past year, the tech titan has delivered a standout performance, leaving both the broader market and its sector peers in the dust. Shares of AMAT have surged 78.2% over this time frame, while the broader S&P 500 Index ($SPX) has gained 15.4%. Moreover, on a YTD basis, the stock is up 24%, compared to SPX’s 1.1% return.

Even within the high-performing semiconductor space, AMAT has shone, outpacing the Invesco Semiconductors ETF’s (PSI) 59.8% rise over the past 52 weeks and 19.1% rally in 2026.

Applied Materials has posted strong momentum, with its stock reaching new highs, driven largely by accelerating demand from artificial intelligence investments. As a leading supplier of wafer fabrication equipment, the company plays a critical role in producing chips for AI data centers, consumer electronics, autos, and industrial applications. Looking ahead to 2026, the company is well-positioned to benefit from rising demand for advanced logic, DRAM, and high-bandwidth memory equipment, though valuation concerns may temper near-term upside.

For the current fiscal year, which ends in October, analysts expect AMAT’s EPS to grow 2% year over year to $9.61. The company’s earnings surprise history is promising. It topped the consensus estimates in each of the last four quarters.

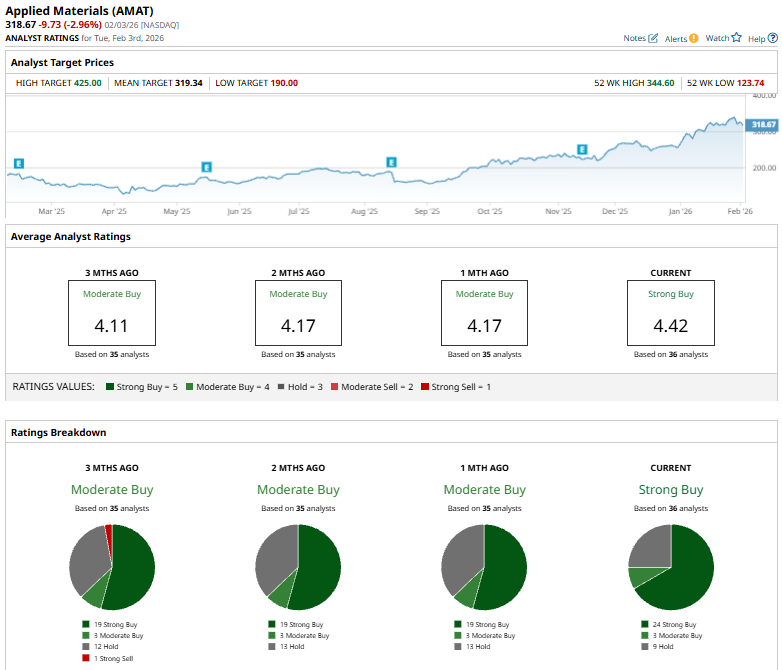

Among the 36 analysts covering the stock, the consensus rating is a "Strong Buy,” which is based on 24 “Strong Buy,” three “Moderate Buy,” and nine "Holds.”

This consensus is bullish than a month ago when the stock had an overall “Moderate Buy” rating.

Applied Materials is gaining strong momentum as an AI-focused stock, highlighted by Mizuho Securities analyst Vijay Rakesh upgrading it from “Neutral” to “Outperform” on Jan. 27 with a $370 price target. The firm expects AMAT, the world’s second-largest wafer fabrication equipment supplier, to benefit from rising chipmaking investments in the U.S., Taiwan, and Japan, forecasting global WFE spending growth of 13% in 2026 and 12% in 2027.

Its mean price target of $319.34 implies a marginal premium from the current market prices. Its Street-high price target of $425 suggests an upside potential of 33.4%.