Tesla shares edged higher in early Friday trading, extending a two-month gain for the stock that has added more than $100 billion in value, after investors voted to support two key proposals that effectively allow CEO Elon Musk to strengthen his grip on the carmaker.

Tesla (TSLA) shareholders voted overwhelmingly to support the long-delayed compensation package, agreed in 2018 but rejected by a Delaware judge last year, that will pay Musk around $55.8 billion.

Investors also backed Musk's plans to reincorporate the group in Texas, where it moved its headquarters in 2021, and abandon its registration in Delaware.

Related: Analyst predicts Tesla's Elon Musk may create Apple rival

"Hot damn, I love you guys," Musk told investors during a meeting in Austin that followed yesterday's vote tally. "We have the most awesome shareholder base!"

The move gives Musk more leverage in his broader effort to seize further control of the carmaker, which he has said is crucial to developing his AI ambitions. Without that support, and without the ability to own around 25% of Tesla shares, Musk has said he would look to expand his AI plans outside the Tesla structure.

"We think the news takes a potentially disastrous scenario off the table, in which Musk could have potentially left Tesla and opted to dedicate more time to his other (non-public) companies," said CFRA analyst Garrett Nelson. Such a circumstance "could have triggered a 'brain drain' of top talent and had massive implications for the future of the company and Tesla’s stock price."

Tesla's Musk has Texas on his mind

The vote doesn't automatically reinstate Musk's compensation deal, however, as the company plans to appeal Delaware Chancery Judge Kathaleen McCormick's ruling, in which she called the pay package an "unfathomable sum." The company must convince her that shareholders were fully informed of its details and impact.

Related: Analyst unveils Tesla stock price target before Q2 deliveries

"If that appeal were to fail, then moving the company’s legal home to Texas would allow the board to reintroduce the pay package in more-favorable courts," said Cantor Fitzgerald analyst Andres Sheppard.

Wedbush analyst Dan Ives, a longtime Tesla bull, says the shareholder vote "removes a $20 to $25 overhang on the stock" since Judge McCormick's decision but nonetheless puts the group's self-driving and autonomous-vehicle production plans in focus.

"Musk has been very optimistic at the shareholder meeting so far around autonomous and new models coming and it appears validation around Musk's strategic vision with FSD and Optimus [robots] is starting to take hold with some early positive signs," Ives said.

"We believe the August 8 robotaxi day will be a key historical moment for the Tesla story that we see as a near-term catalyst," he added.

Musk, in fact, told investors last night that the group's autonomous-driving technology is developing quickly. He said that weekly Cybertruck production was running at around 1,300 units.

Robotaxi event in focus

"We continue to believe that Tesla benefits from future upside from its Full Self-Driving software (plus upcoming robotaxi segment), the introduction of lower-priced models, a global manufacturing footprint with economies of scale, and the industry's largest charging infrastructure," said Cantor Fitzgerald's Sheppard.

"More specifically, we see future revenues from FSD and robotaxi to be fundamental to Tesla's bull thesis over the long term," added Sheppard, who carries an overweight rating and $230 price target on Tesla stock.

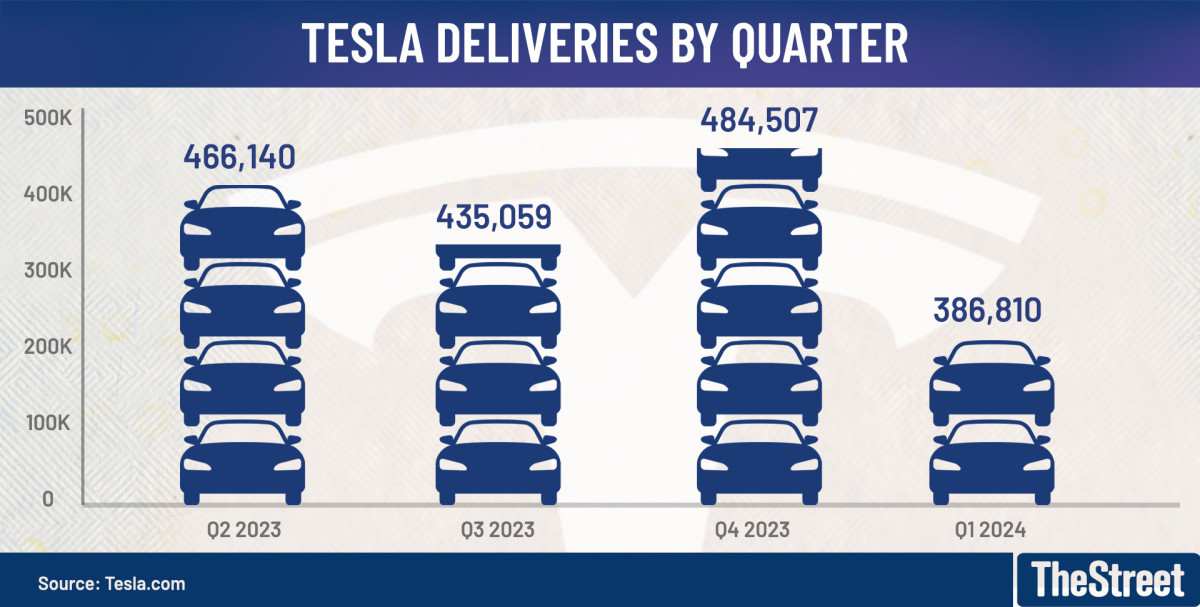

Tesla, which last month dropped its reference to a goal of handing over 20 million vehicles a year to new customers by the end of the decade, will publish its second-quarter delivery figures in around two weeks' time.

More Tesla:

- Tesla rival misses payment, Chapter 11 bankruptcy possible

- Hertz sells off Tesla fleet at discount as EV sales slump

- Analyst unveils Tesla stock price target before Q2 deliveries

Canaccord Genuity analyst George Gianarikas sees that figure coming in at 429,000 units, a 7% reduction from its prior forecast and well shy of the current Wall Street consensus of 445,000 units.

Tesla.com

Ives at Wedbush, who carries an outperform rating and $275 price target, says the bull case for Tesla could see a $350 share price, and a $1 trillion valuation, over the next 12 to 18 months. ["We] believe the next chapter in the Tesla growth story around autonomous and FSD is now on the near-term horizon."

Tesla shares were marked 1.4% higher in premarket trading to indicate an opening bell price of $185.02 each.

Related: Wall Street veteran analyst picks Palantir stock for the long-term