It's another week, and a new Tesla bull is emerging from the woodwork; Bank of America analysts have a dismal report on consumer spending, and a move at Ford has Morgan Stanley worried.

Ich sprechen kein deutsch. Ich sprechen sie Tesla

Deutsche Bank has a new face covering auto stocks, and he seems very bullish about Tesla.

This week, analyst Edison Yu initiated his coverage of automotive stocks for the Frankfurt-based bank, handing out 'Buy' ratings with caution. In his note, he wrote that he isn't very optimistic about future earnings as the air around the greater auto industry starts to normalize.

“We see the U.S. auto industry in the later innings of a cycle that is already showing signs of normalization after a post-pandemic surge,” Yu wrote.

Though his wording sounds like doom-and-gloom, Yu reassured that historically, "the American consumer has proven to be highly resilient.”

But as he sat at his computer and began to type, the reality was that American consumers were facing high interest rates that made car payments too high, inflated car prices, and a drop in used car prices, which would eventually lead to a drop in new car pricing.

Related: Analysts weigh in on Chinese EVs, make predictions on Tesla's Robotaxi event

As a result, Yu rated shares of Tesla rival Rivian (RIVN) , Ford (F) , General Motors (GM) and Polestar (PSNY) at Hold.

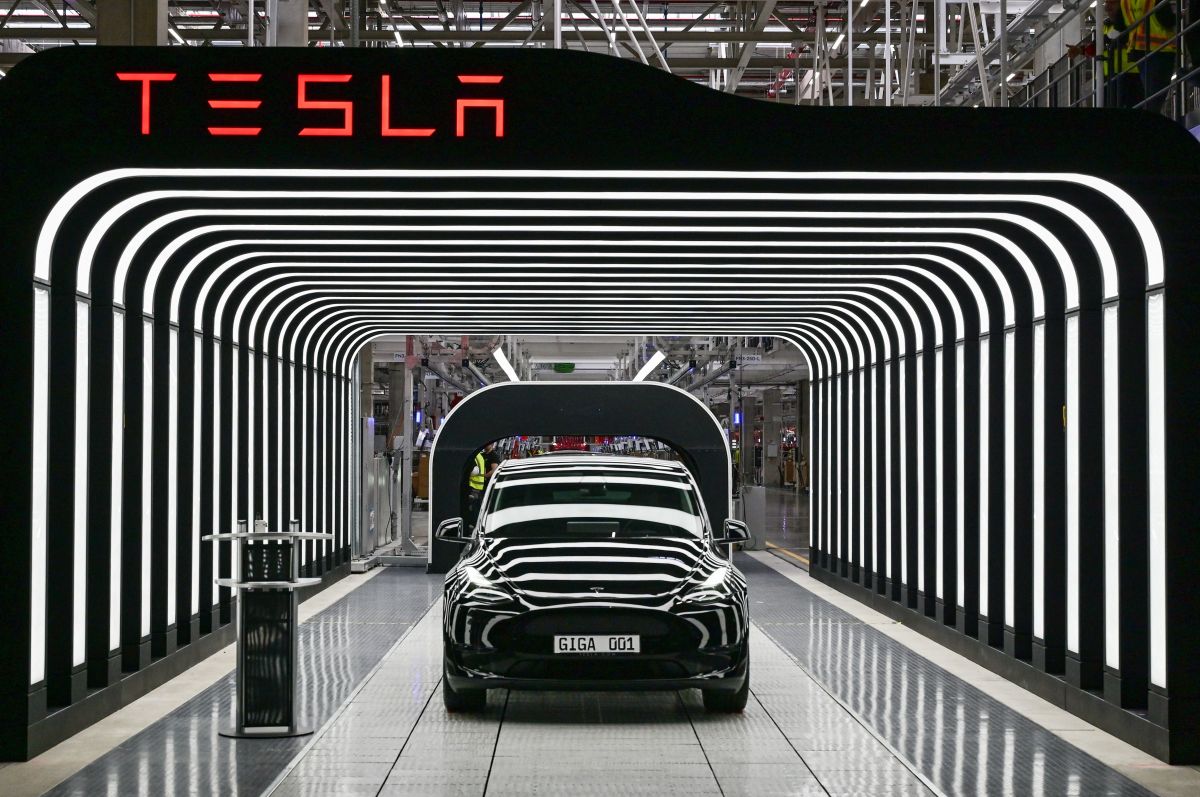

However, he does make one exception: Tesla (TSLA) itself. Like Tesla bulls like Wedbush's Dan Ives, he sees it as "more than a car company."

“We do not see Tesla as an auto maker but rather a technology platform attempting to reshape multiple industries, deserving of a unique type of valuation framework,” wrote Yu.

He also noted that the Elon Musk-led automaker is “in a league of its own and represents our highest conviction secular leader, poised to reshape multiple industries across auto, energy, mobility, and robotics.”

Edison Yu gave Tesla a Buy rating with a $295 price target.

More Automotive:

- The Toyota Crown is a masterclass in cheap, quiet luxury

- Ford making radical change that might anger loyal consumers

- Gavin Newsom's 'EV mandate' is under U.S. Supreme Court threat

BofA says consumers aren't consuming [enough]

Following the same sentiment as Deutsche Bank's Edison Yu, the automotive industry is pretty much worthless if there aren't people around to spend their hard-earned dollars, euros, yen, yuan, and pounds sterling on the metal boxes and four wheels that manufacturers spend billions to produce.

According to a new edition of the consumer survey conducted by Bank of America Global Research, big-ticket spending by consumers in the United States is down, including spending on homes, home renovations, home improvements, and, most importantly, new cars.

The research team found that the number of people expecting to buy a new car has been on a sequential decline since May this year, with 37.7% of those surveyed expecting to cough up, versus 38.5% in August 2024 and 39.8% in September 2023.

More worrying is that confidence in everyday spending, such as expenditures at bars, restaurants, and food delivery, is going down. The folks at BofA found that over the next three months, 18.67% of people surveyed are expecting to spend more eating and drinking out, and 14.80% said they'll order food more.

A missing pillar at Ford

While Ford's Model e electric vehicle division operates at a loss, one consistent money maker for the Blue Oval is its commercial vehicles division; known at the company as Ford Pro.

In the second quarter of 2024, Ford's Model e division had an EBIT loss of $1.1 billion, while Ford Pro had an EBIT of $2.6 billion. Ford credits this to sales of its gargantuan Super Duty heavy-duty pickup trucks and the Transit van and subscriptions to Ford Pro software.

In a statement, Ford CEO Jim Farley credits much of the success to commercial vehicle customers' openness to adopting new vehicle technologies like connected cars and EVs before individual consumers.

"The capabilities we’re developing in electric vehicles and software-enabled and physical services are wide competitive moats between Ford Pro and other companies," said Farley. "For customers, from small businesses to the largest enterprises, they’re bridges to transforming their organizations at the same time we’re remaking ours."

Related: Ford hands-free driving tech blamed for deadly DUI crash

On September 12, Ford announced that Ted Cannis, the CEO of Ford's Ford Pro division, will retire. The automaker credits him with turning the division into a "high-growth, high-margin business" that is "a vital productivity accelerator for millions of commercial customers."

“Ted’s energy and passion for customers has been instrumental in building Ford Pro into a business that’s tracking towards $70 billion in revenue this year – a Fortune 100-size company in its own right,” Ford CEO Jim Farley said in a statement.

Of those who will also miss Cannis is Morgan Stanley analyst Adam Jonas. He stated in an investment note on September 12 that his departure will be a "big loss" for the automaker, as he was “one of the most competent and well-respected leaders at Ford.”

Although Ford announced that Ford Blue president Andrew Frick also will lead Ford Pro on an interim basis until the company announces a new leader, Jonas stated that he expects Cannis' replacement to come from outside the Blue Oval, noting that “investors will look at unexpected departures of executives running highly successful business units and ask if there are any underlying fundamental implications at play."

Related: Veteran fund manager sees world of pain coming for stocks